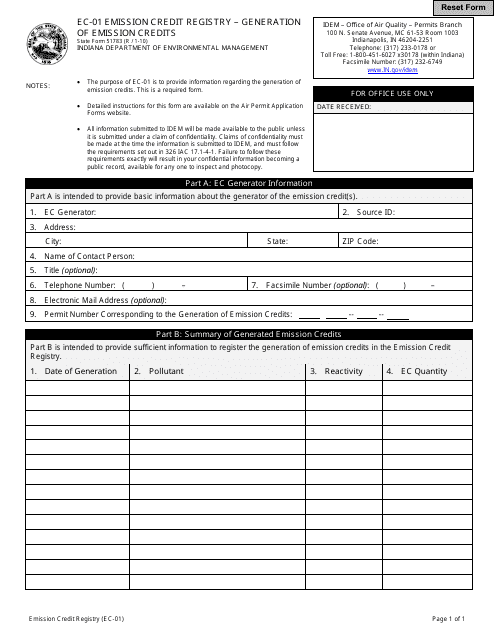

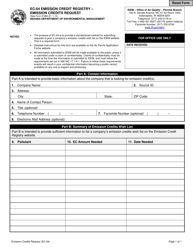

State Form 51783 (EC-01) Emission Credit Registry - Generation of Emission Credits - Indiana

What Is State Form 51783 (EC-01)?

This is a legal form that was released by the Indiana Department of Environmental Management - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 51783?

A: State Form 51783 is the form for the Emission Credit Registry in Indiana.

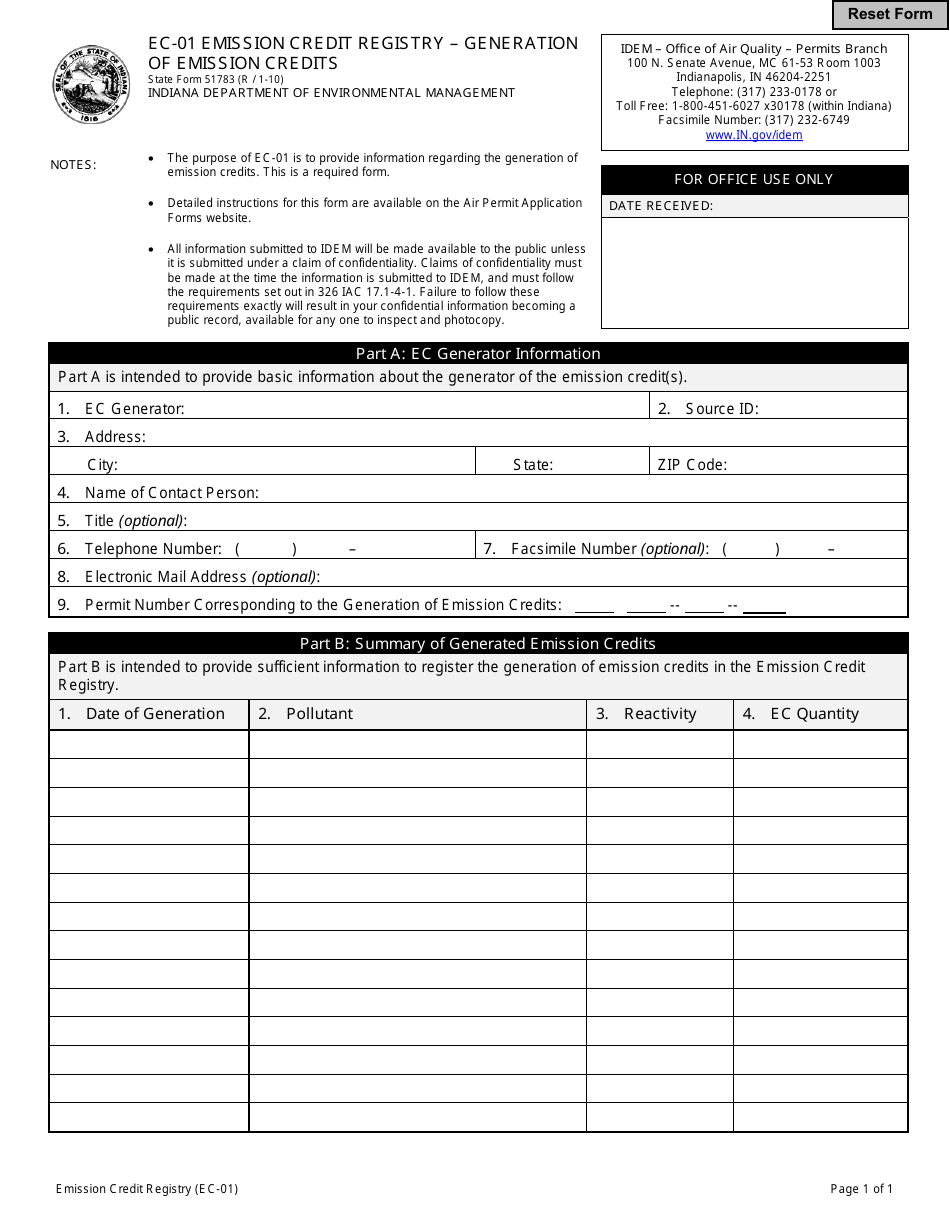

Q: What is the purpose of the Emission Credit Registry?

A: The purpose of the Emission Credit Registry is to track and manage the generation of emission credits in Indiana.

Q: Who needs to use State Form 51783?

A: Any entity generating emission credits in Indiana needs to use State Form 51783.

Q: What are emission credits?

A: Emission credits are a form of currency that can be used to offset pollution in Indiana.

Q: How do I generate emission credits?

A: To generate emission credits, you need to follow the guidelines and requirements set forth by the Emission Credit Registry.

Q: What are the benefits of using the Emission Credit Registry?

A: Using the Emission Credit Registry allows you to track and trade emission credits, which can be beneficial for environmental compliance and sustainability initiatives.

Q: Are there any fees associated with using the Emission Credit Registry?

A: Yes, there may be fees associated with using the Emission Credit Registry. It is best to check with IDEM for the current fee schedule.

Q: Is participation in the Emission Credit Registry mandatory?

A: No, participation in the Emission Credit Registry is not mandatory. However, it can be beneficial for entities generating emission credits to participate.

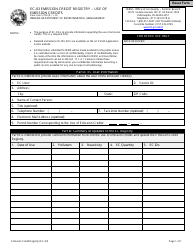

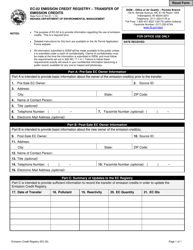

Q: Can I transfer my emission credits to another entity?

A: Yes, emission credits can typically be transferred to another entity through the Emission Credit Registry.

Form Details:

- Released on January 1, 2010;

- The latest edition provided by the Indiana Department of Environmental Management;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 51783 (EC-01) by clicking the link below or browse more documents and templates provided by the Indiana Department of Environmental Management.