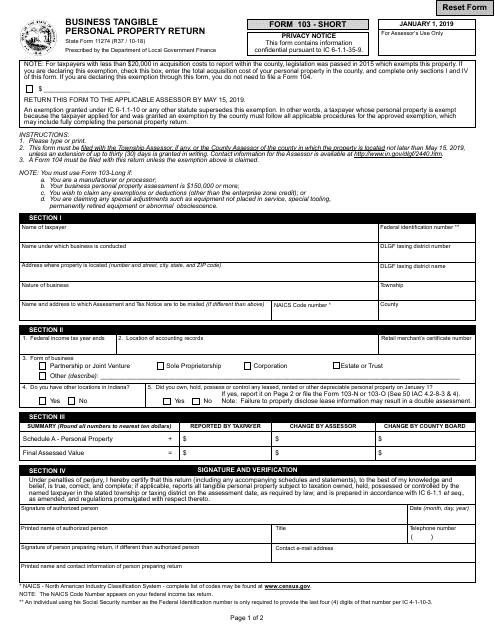

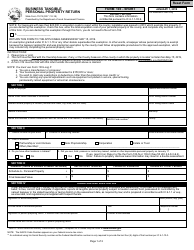

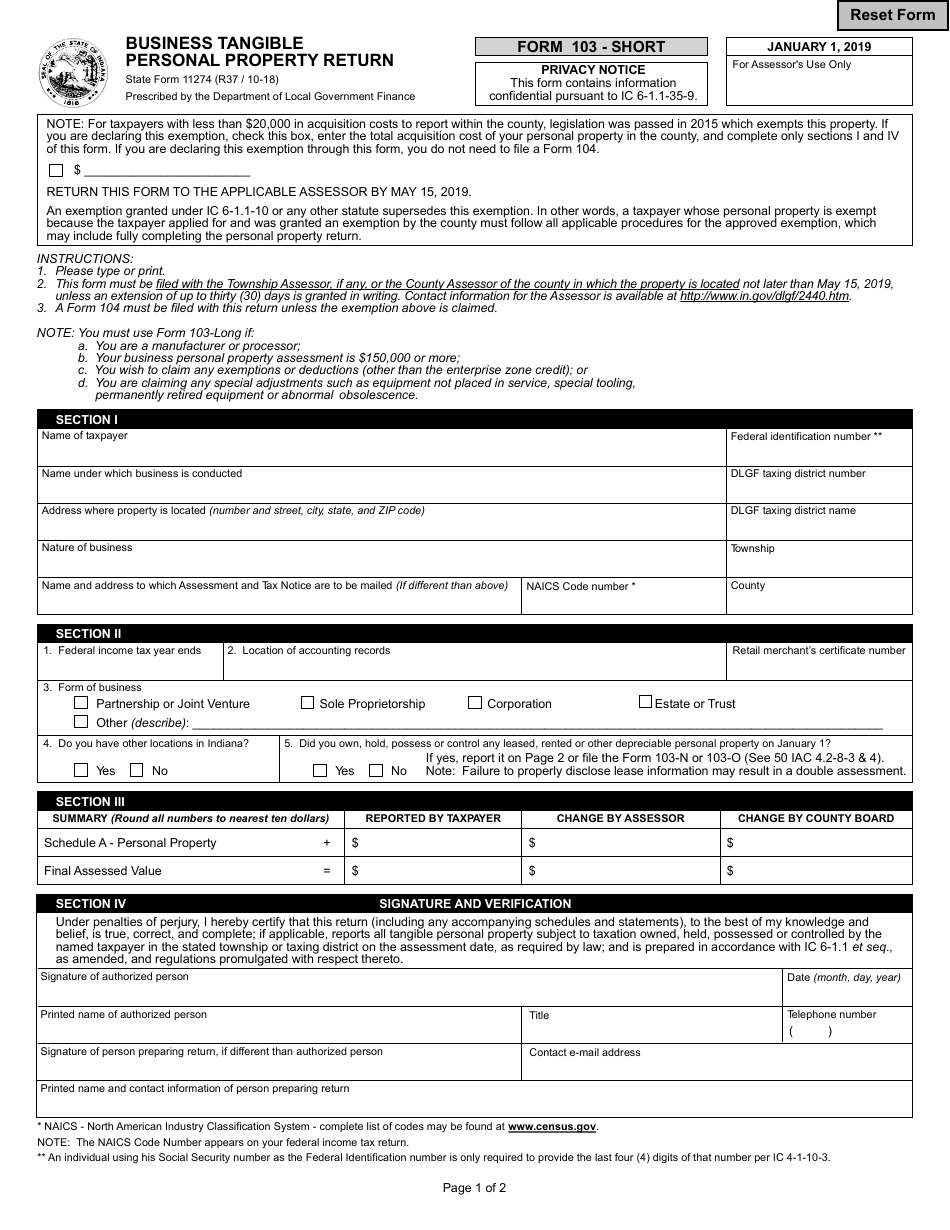

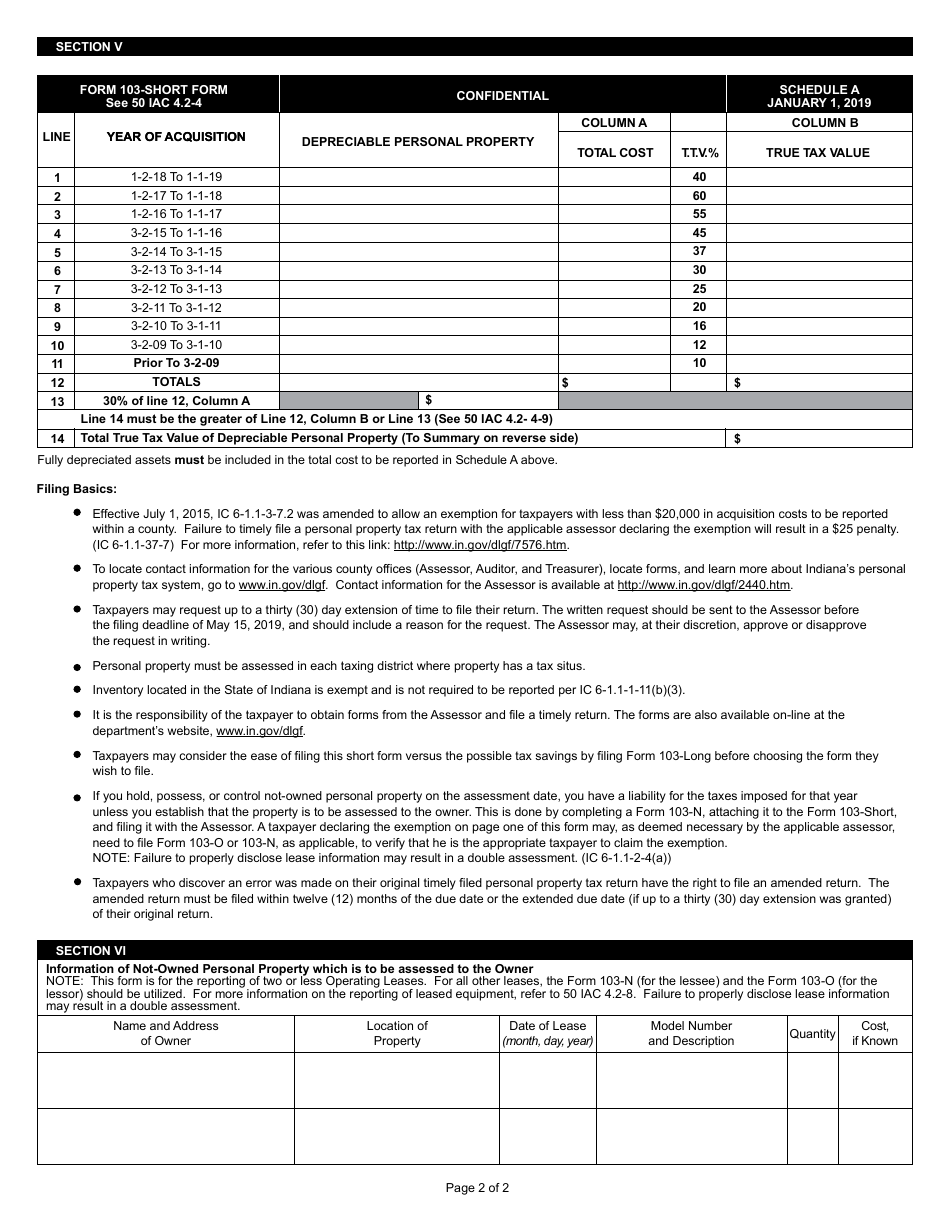

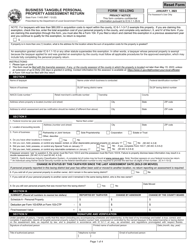

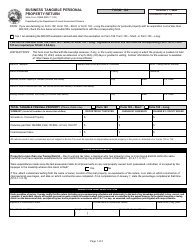

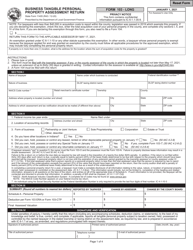

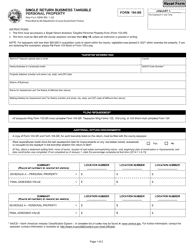

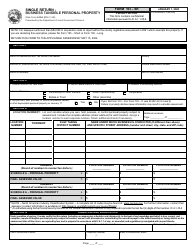

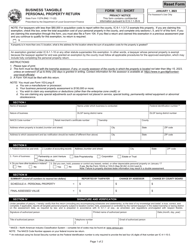

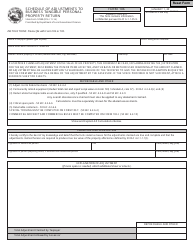

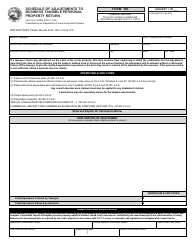

State Form 11274 (103-SHORT) Business Tangible Personal Property Return - Indiana

What Is State Form 11274 (103-SHORT)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 11274?

A: State Form 11274 is a Business Tangible Personal Property Return in Indiana.

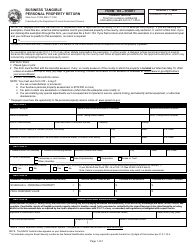

Q: Who needs to file State Form 11274?

A: Businesses in Indiana that own tangible personal property must file State Form 11274.

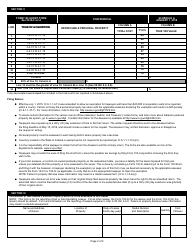

Q: What is considered tangible personal property?

A: Tangible personal property refers to physical assets like equipment, machinery, furniture, and inventory.

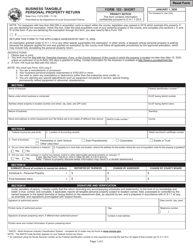

Q: When is the deadline to file State Form 11274?

A: The deadline to file State Form 11274 is typically May 15th.

Q: Are there any penalties for not filing State Form 11274?

A: Yes, failure to file or filing late can result in penalties and interest.

Q: Are there any exemptions for filing State Form 11274?

A: Yes, there are certain exemptions and deductions available. Please refer to the form instructions for more details.

Q: Do I need to include documentation with State Form 11274?

A: You may need to include supporting documentation, such as asset listings or depreciation schedules, depending on your situation. Check the form instructions for more information.

Q: What if I have questions or need assistance with State Form 11274?

A: If you have questions or need assistance, you can contact the Indiana Department of Revenue directly.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Indiana Department of Local Government Finance;

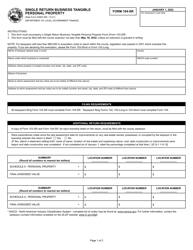

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 11274 (103-SHORT) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.