This version of the form is not currently in use and is provided for reference only. Download this version of

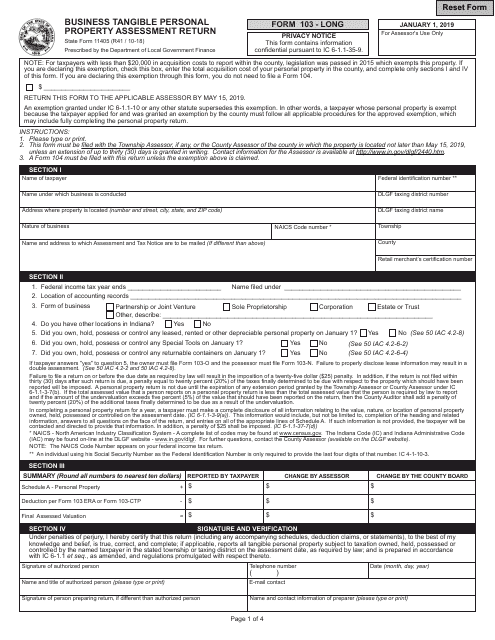

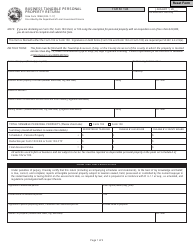

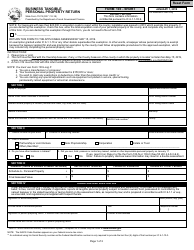

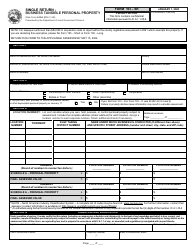

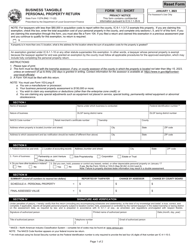

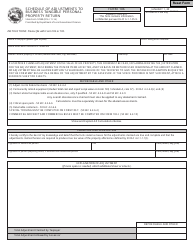

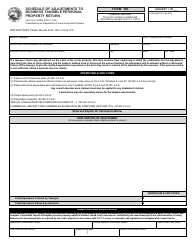

State Form 11405 (103-LONG)

for the current year.

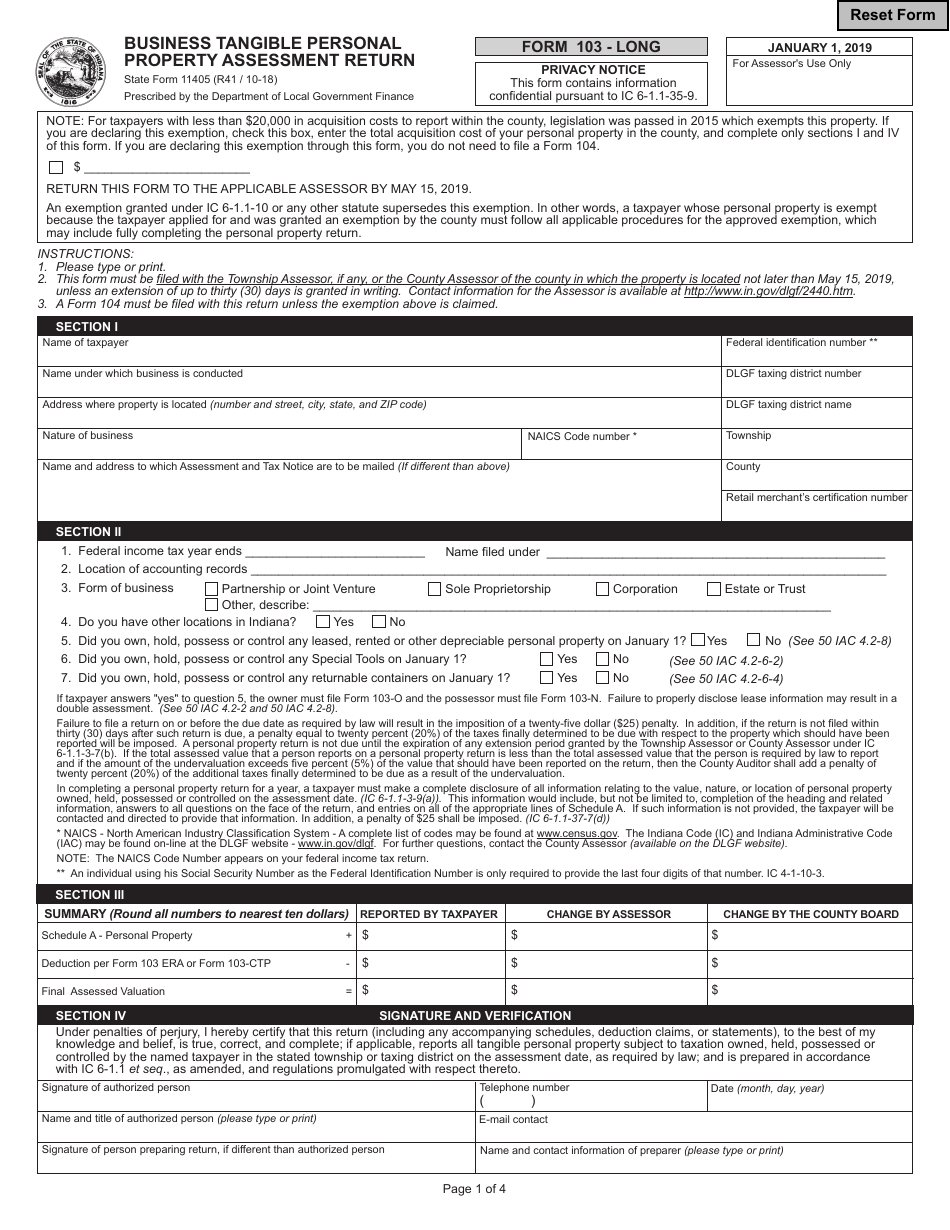

State Form 11405 (103-LONG) Business Tangible Personal Property Assessment Return - Indiana

What Is State Form 11405 (103-LONG)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 11405 (103-LONG)?

A: State Form 11405 (103-LONG) is the Business Tangible Personal Property Assessment Return form used in Indiana.

Q: What is the purpose of State Form 11405 (103-LONG)?

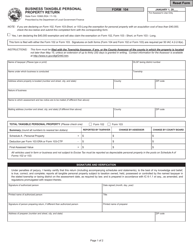

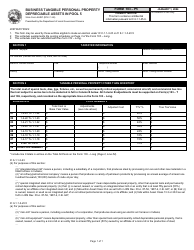

A: The purpose of State Form 11405 (103-LONG) is to report and assess the value of tangible personal property owned by a business in Indiana.

Q: Who needs to file State Form 11405 (103-LONG)?

A: Businesses in Indiana that own tangible personal property are required to file State Form 11405 (103-LONG).

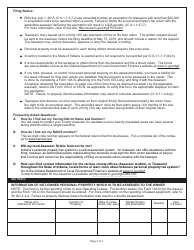

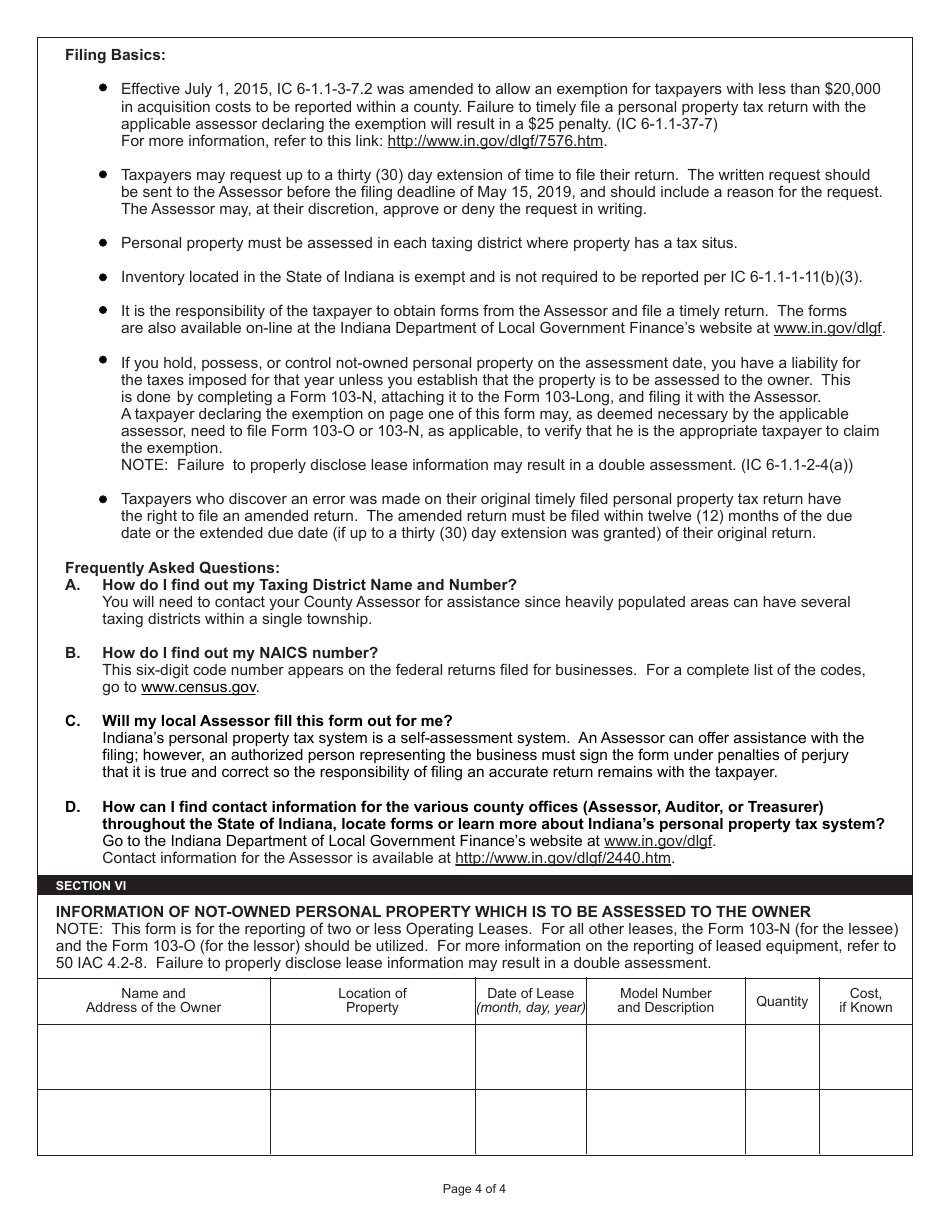

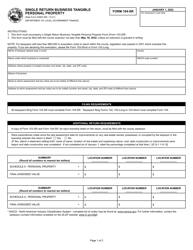

Q: When is State Form 11405 (103-LONG) due?

A: State Form 11405 (103-LONG) is typically due on May 15th of each year.

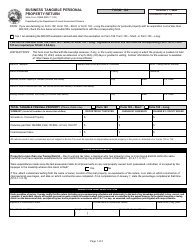

Q: Are there any penalties for late filing of State Form 11405 (103-LONG)?

A: Yes, there may be penalties for late filing of State Form 11405 (103-LONG) in Indiana. It is important to file the form by the due date to avoid any penalties.

Q: Is State Form 11405 (103-LONG) only for Indiana businesses?

A: Yes, State Form 11405 (103-LONG) is specifically for businesses located in Indiana.

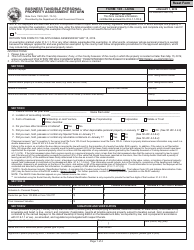

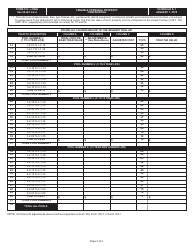

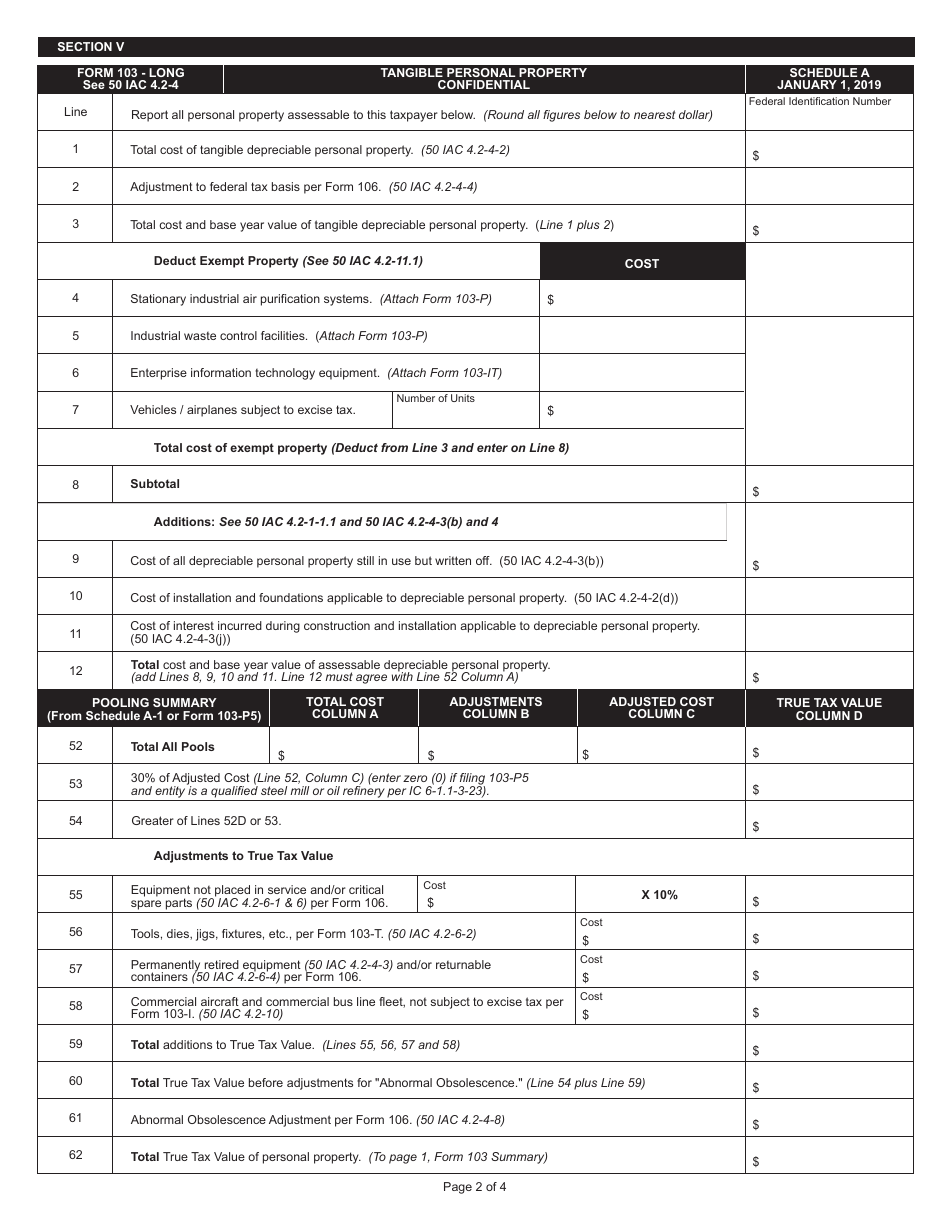

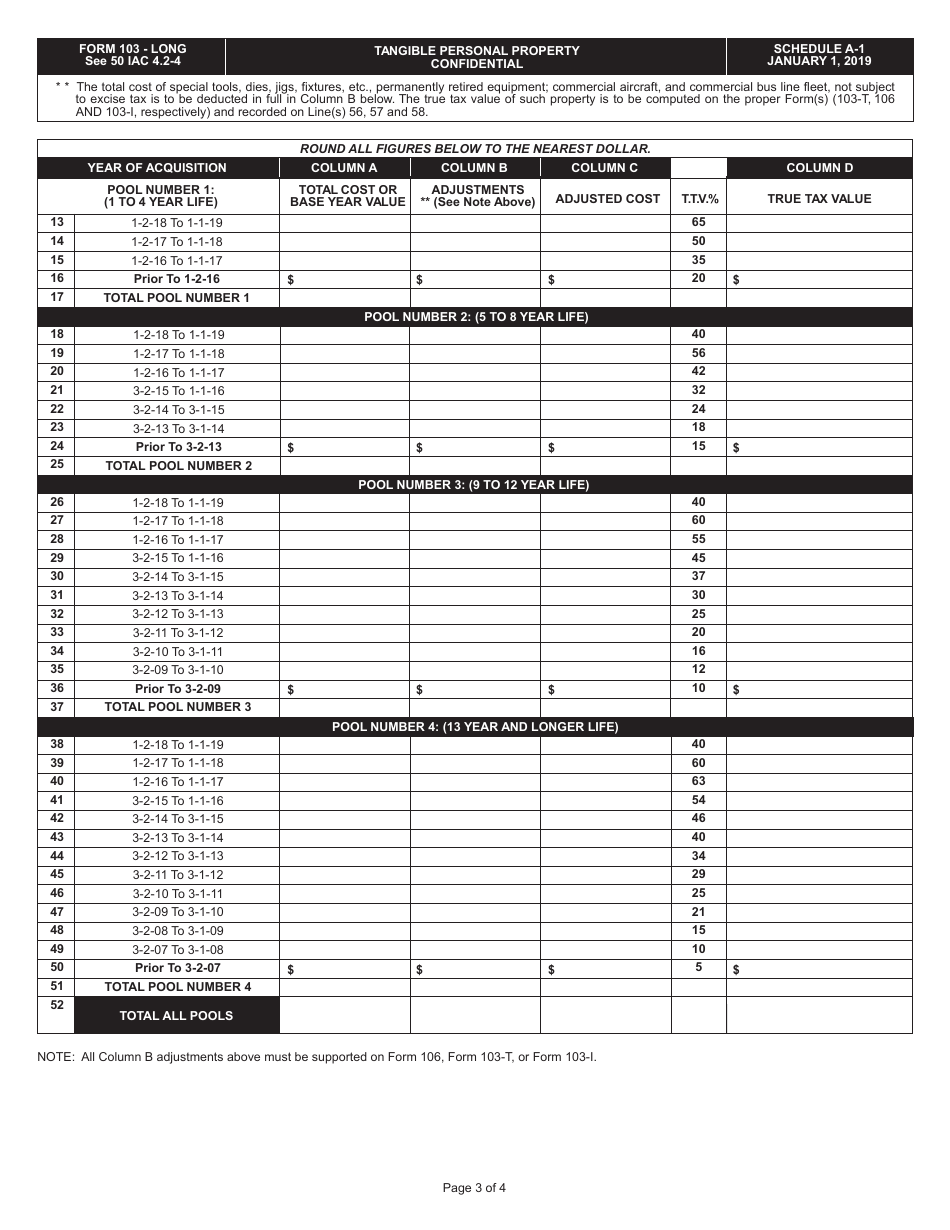

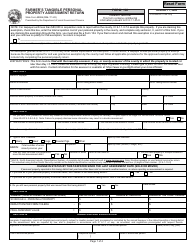

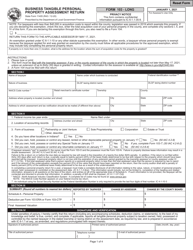

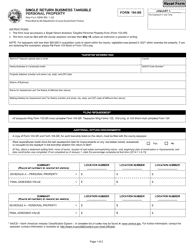

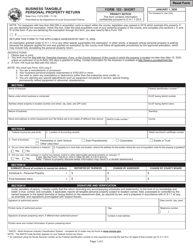

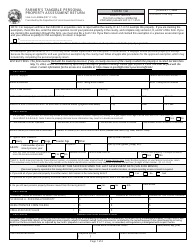

Q: What information is required on State Form 11405 (103-LONG)?

A: State Form 11405 (103-LONG) requires information about the business and details of the tangible personal property owned by the business in Indiana.

Q: Who should I contact for more information about State Form 11405 (103-LONG)?

A: For more information about State Form 11405 (103-LONG), you can contact the Indiana Department of Revenue directly.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 11405 (103-LONG) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.