This version of the form is not currently in use and is provided for reference only. Download this version of

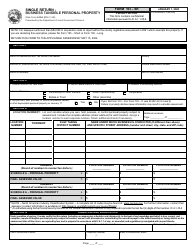

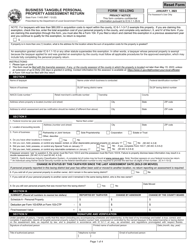

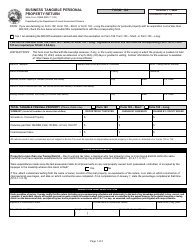

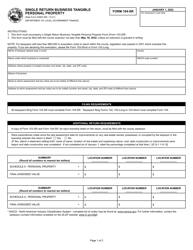

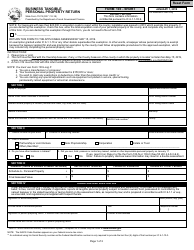

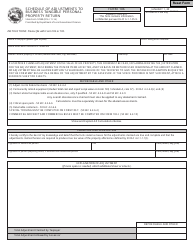

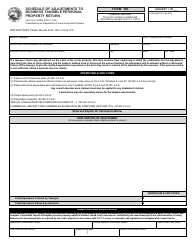

State Form 50006 (102)

for the current year.

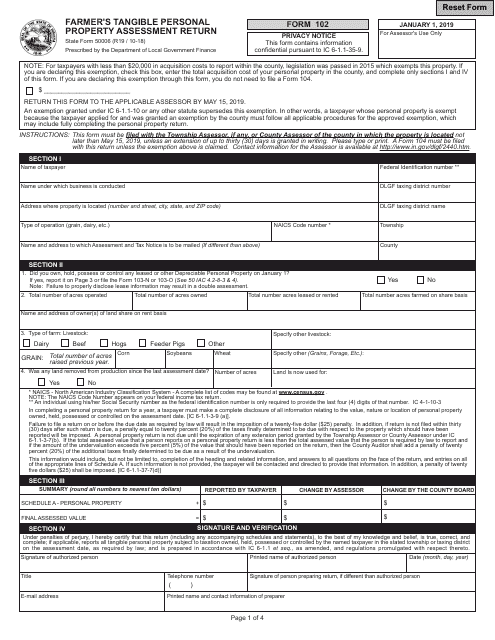

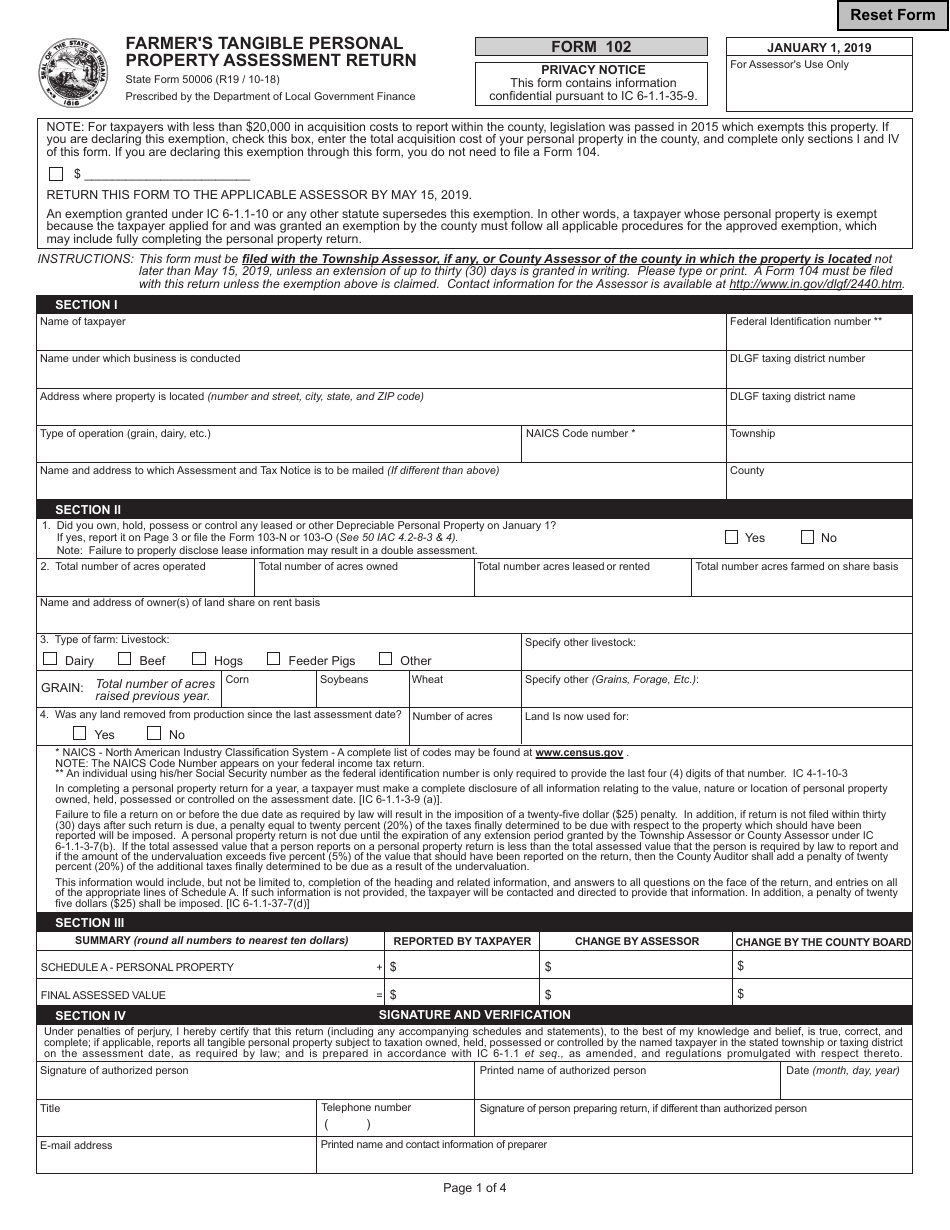

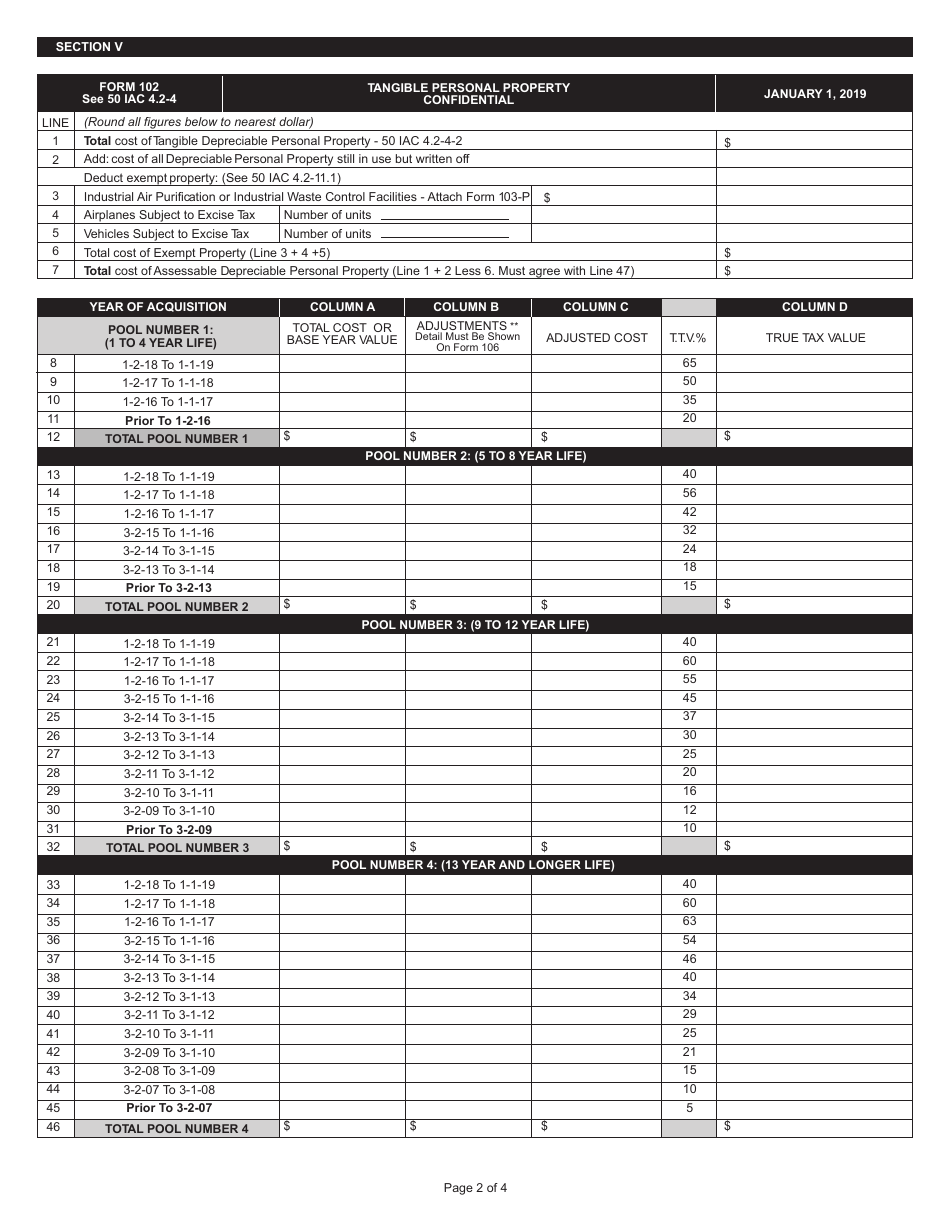

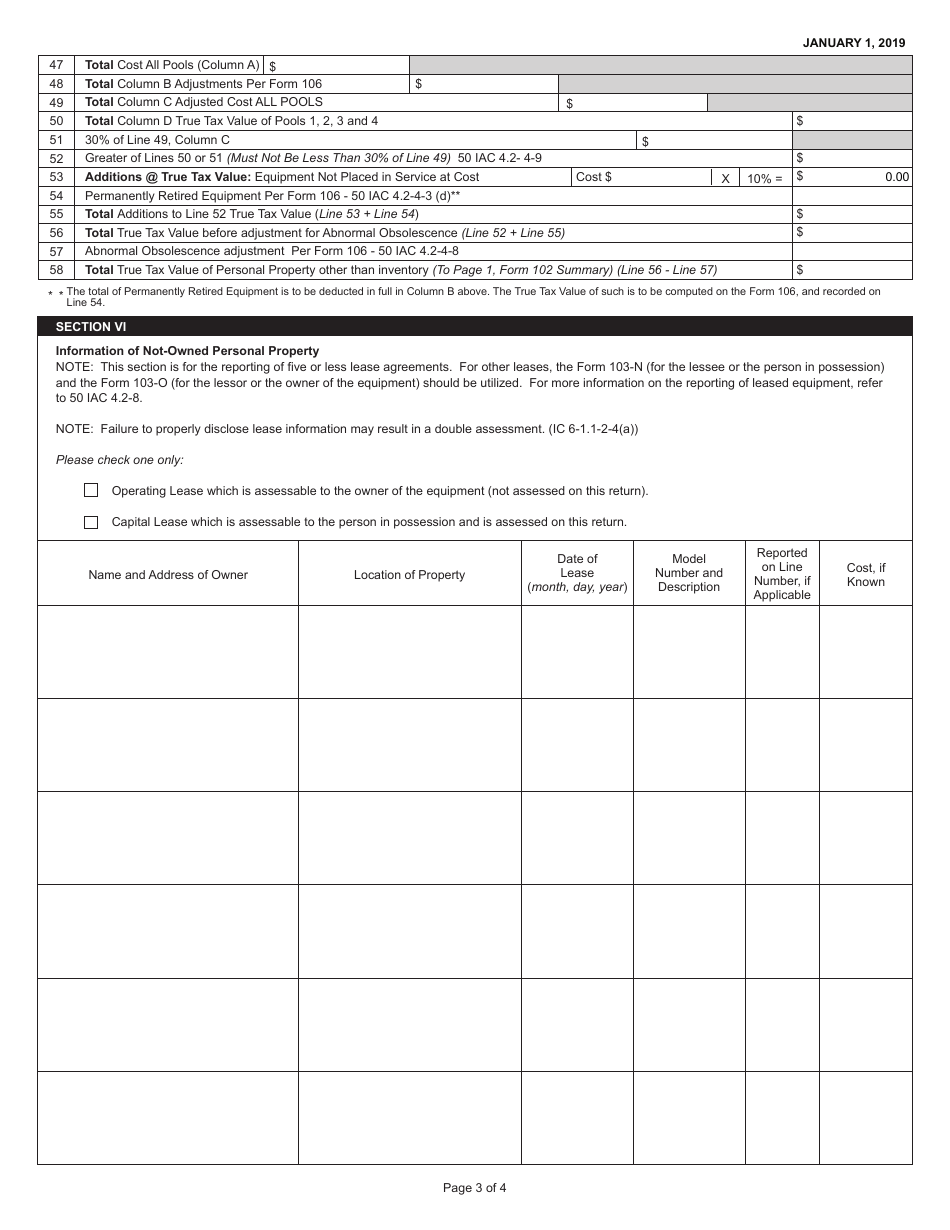

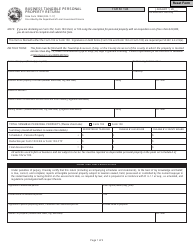

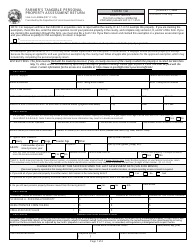

State Form 50006 (102) Farmer's Tangible Personal Property Assessment Return - Indiana

What Is State Form 50006 (102)?

This is a legal form that was released by the Indiana Department of Local Government Finance - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 50006 (102)?

A: State Form 50006 (102) is the Farmer's Tangible Personal Property Assessment Return in Indiana.

Q: Who needs to file State Form 50006 (102)?

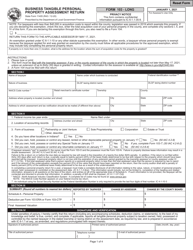

A: Farmers in Indiana who own tangible personal property need to file State Form 50006 (102).

Q: What is tangible personal property?

A: Tangible personal property refers to physical assets such as machinery, equipment, and livestock that are used for agricultural purposes.

Q: Why do farmers need to file this form?

A: Filing State Form 50006 (102) allows the local government to assess the value of a farmer's tangible personal property for tax purposes.

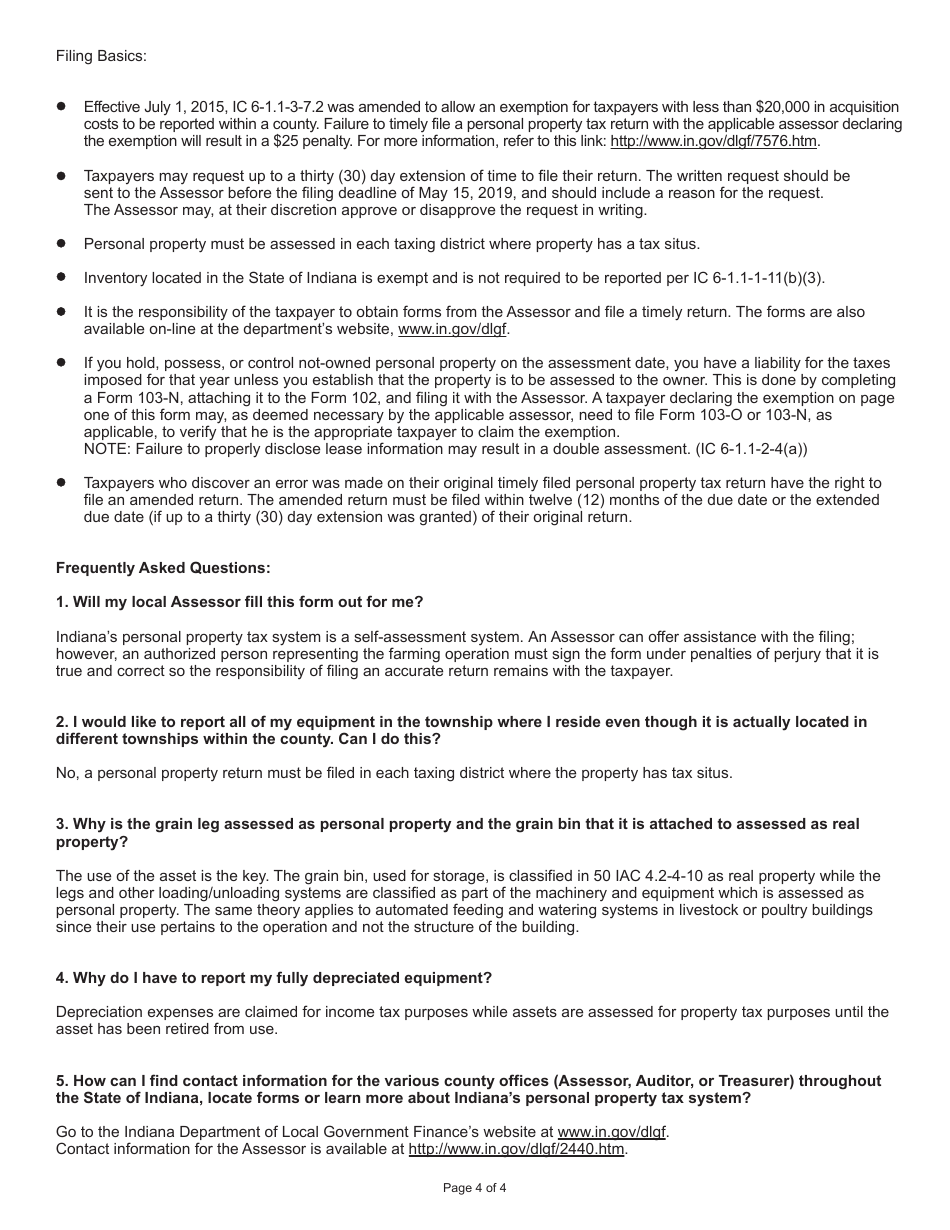

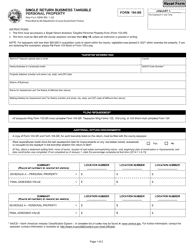

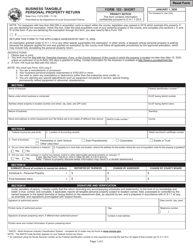

Q: When is the deadline to file State Form 50006 (102)?

A: The deadline to file State Form 50006 (102) varies by county in Indiana. Farmers should check with their local assessor's office for the specific deadline.

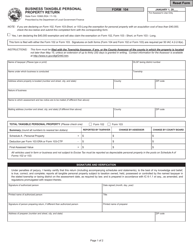

Q: Are there any exemptions or deductions available for farmers?

A: Yes, there are certain exemptions and deductions available for farmers in Indiana. These exemptions and deductions are detailed in the instructions provided with State Form 50006 (102).

Form Details:

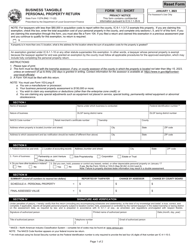

- Released on October 1, 2018;

- The latest edition provided by the Indiana Department of Local Government Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 50006 (102) by clicking the link below or browse more documents and templates provided by the Indiana Department of Local Government Finance.