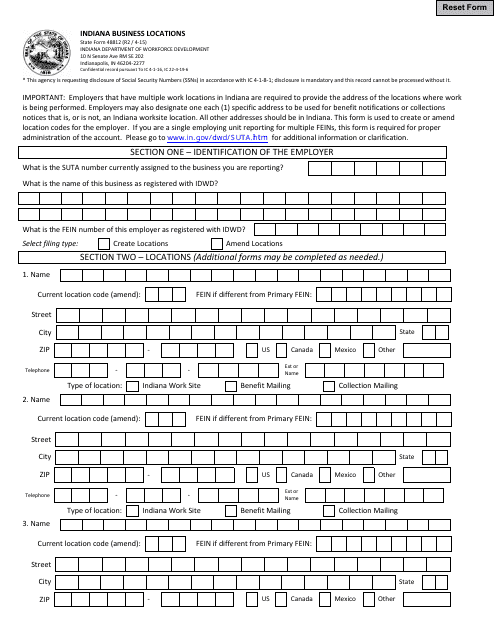

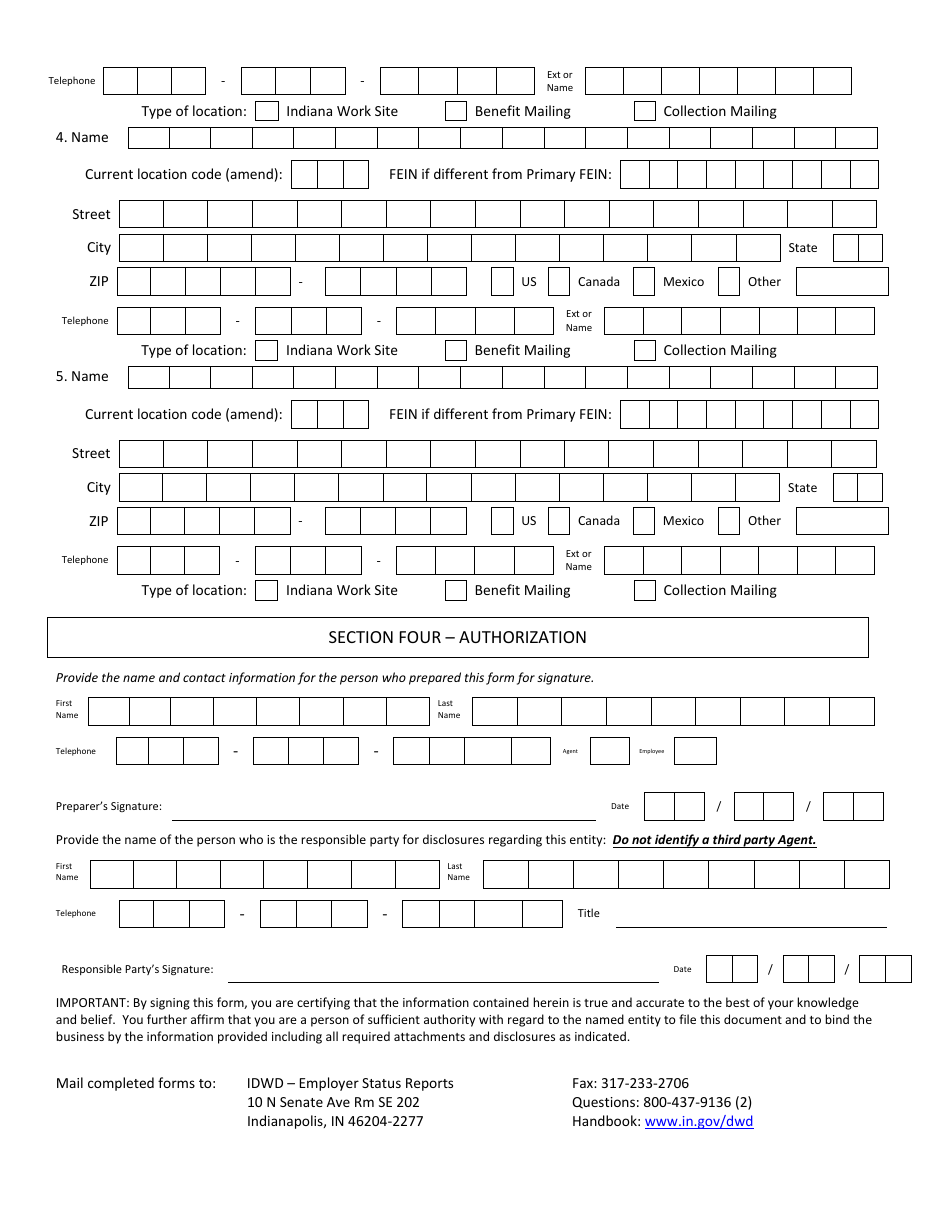

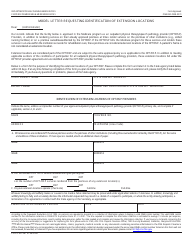

State Form 48812 Indiana Business Locations - Indiana

What Is State Form 48812?

This is a legal form that was released by the Indiana Department of Workforce Development - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 48812?

A: State Form 48812 is a form used for reporting Indiana business locations.

Q: Who uses State Form 48812?

A: Business owners in Indiana use State Form 48812.

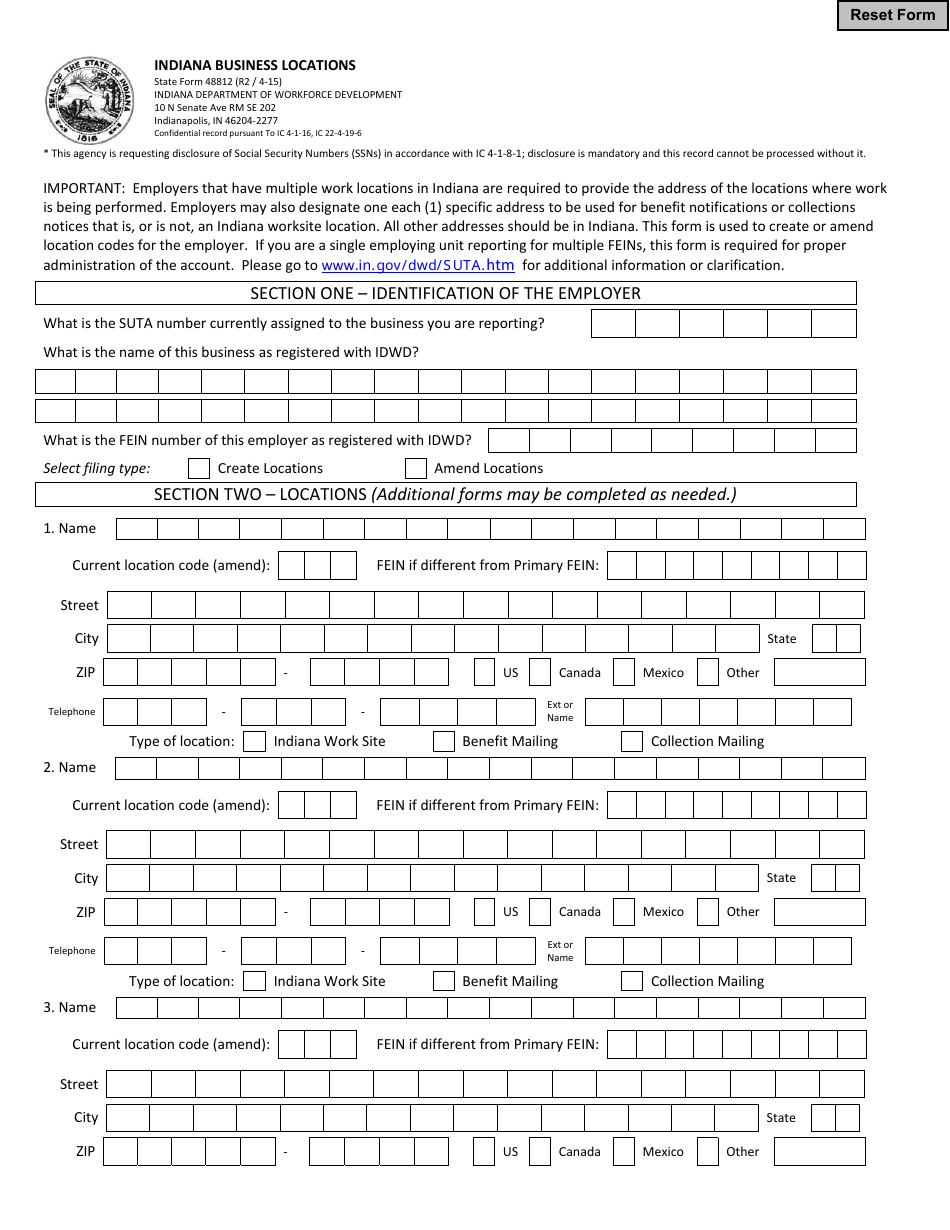

Q: What information is required on State Form 48812?

A: State Form 48812 requires information about the business location, including the address, contact information, and other details.

Q: Is there a filing fee for State Form 48812?

A: There is no filing fee for State Form 48812.

Q: When is the deadline for filing State Form 48812?

A: The deadline for filing State Form 48812 is typically determined by the Indiana Department of Revenue and may vary each year.

Q: What happens if I don't file State Form 48812?

A: Failure to file State Form 48812 may result in penalties or consequences imposed by the Indiana Department of Revenue.

Q: Are there any exemptions or exceptions to filing State Form 48812?

A: Specific exemptions or exceptions to filing State Form 48812 may be outlined by the Indiana Department of Revenue.

Q: Can I amend State Form 48812 if there are changes to my business location?

A: Yes, you can amend State Form 48812 if there are changes to your business location by filing an updated form with the Indiana Department of Revenue.

Form Details:

- Released on April 1, 2015;

- The latest edition provided by the Indiana Department of Workforce Development;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 48812 by clicking the link below or browse more documents and templates provided by the Indiana Department of Workforce Development.