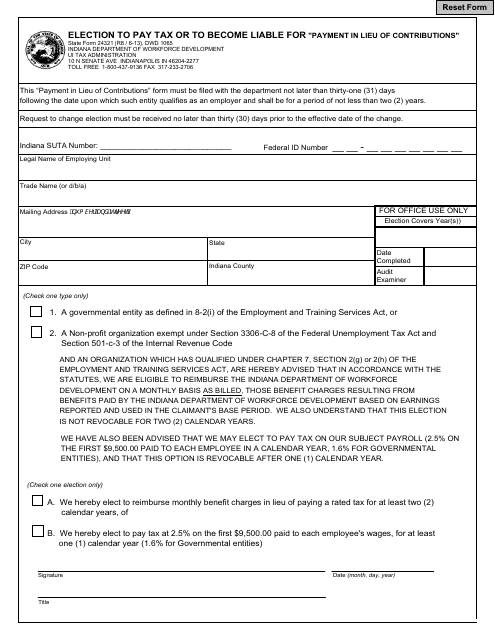

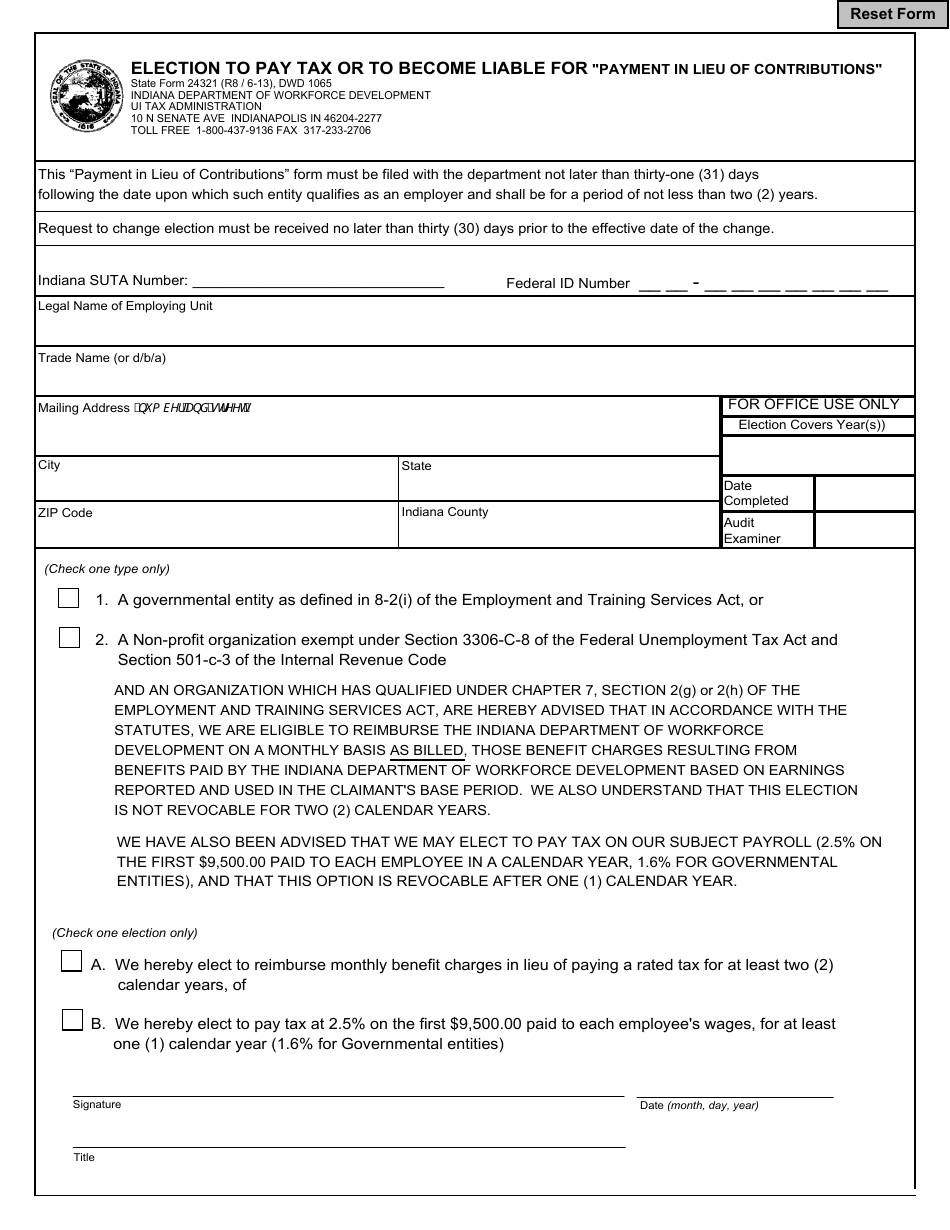

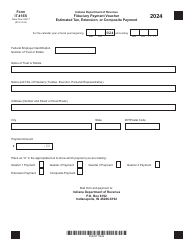

State Form 24321 (DWD1065) Election to Pay Tax or to Become Liable for Payment in Lieu of Contributions - Indiana

What Is State Form 24321 (DWD1065)?

This is a legal form that was released by the Indiana Department of Workforce Development - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is State Form 24321 (DWD1065)?

A: State Form 24321 (DWD1065) is the form used in Indiana to make an election to pay tax or become liable for payment in lieu of contributions.

Q: What is the purpose of State Form 24321 (DWD1065)?

A: The purpose of State Form 24321 (DWD1065) is to allow individuals or employers in Indiana to choose whether to pay unemployment tax or become liable for payment in lieu of contributions.

Q: Who needs to fill out State Form 24321 (DWD1065)?

A: Individuals or employers in Indiana who want to make an election regarding unemployment tax payments or payment in lieu of contributions need to fill out State Form 24321 (DWD1065).

Q: How do I submit State Form 24321 (DWD1065)?

A: State Form 24321 (DWD1065) can be submitted by mail or in person at the local DWD office. The form should be completed and signed before submission.

Q: Is there a deadline for submitting State Form 24321 (DWD1065)?

A: Yes, there is a deadline for submitting State Form 24321 (DWD1065). The form must be filed within 20 days of the date of mailing, personal delivery, or electronic transmission of the notice.

Q: What happens after I submit State Form 24321 (DWD1065)?

A: After submitting State Form 24321 (DWD1065), the Indiana Department of Workforce Development (DWD) will process the form and notify the individual or employer of their election status.

Q: Can I change my election after submitting State Form 24321 (DWD1065)?

A: Once State Form 24321 (DWD1065) is submitted, any changes to the election must be requested in writing and approved by the Indiana Department of Workforce Development (DWD).

Form Details:

- Released on June 1, 2013;

- The latest edition provided by the Indiana Department of Workforce Development;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of State Form 24321 (DWD1065) by clicking the link below or browse more documents and templates provided by the Indiana Department of Workforce Development.