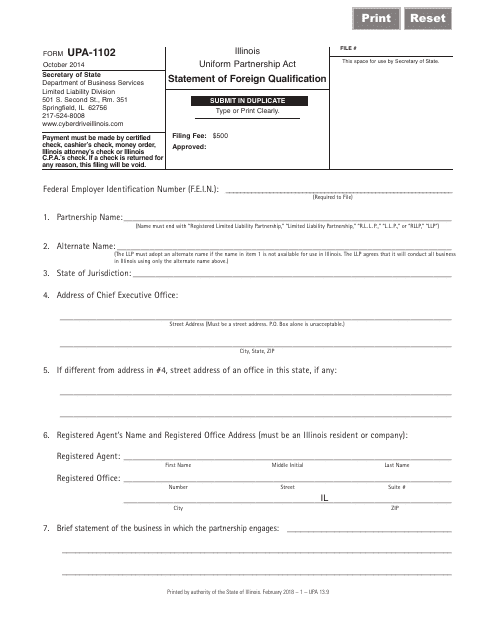

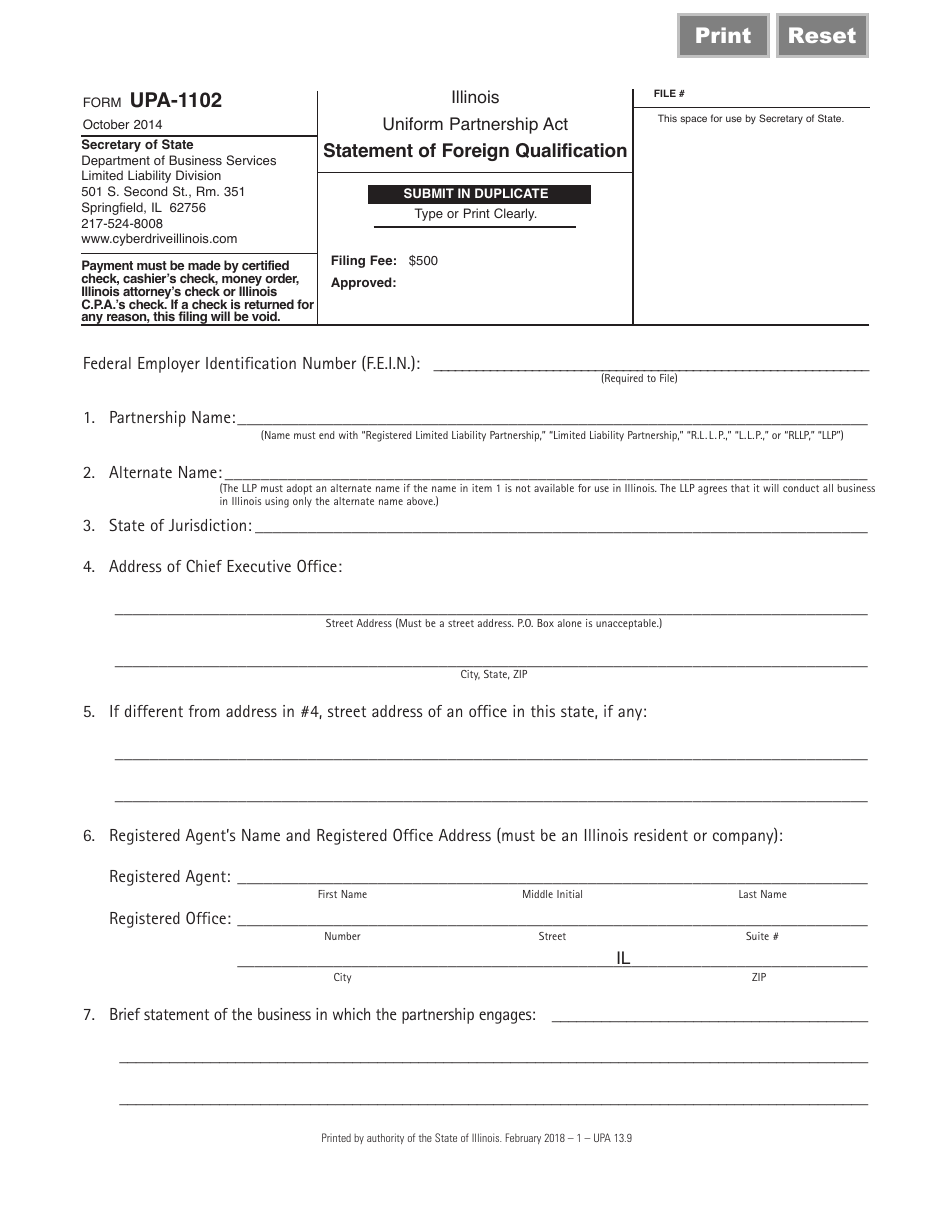

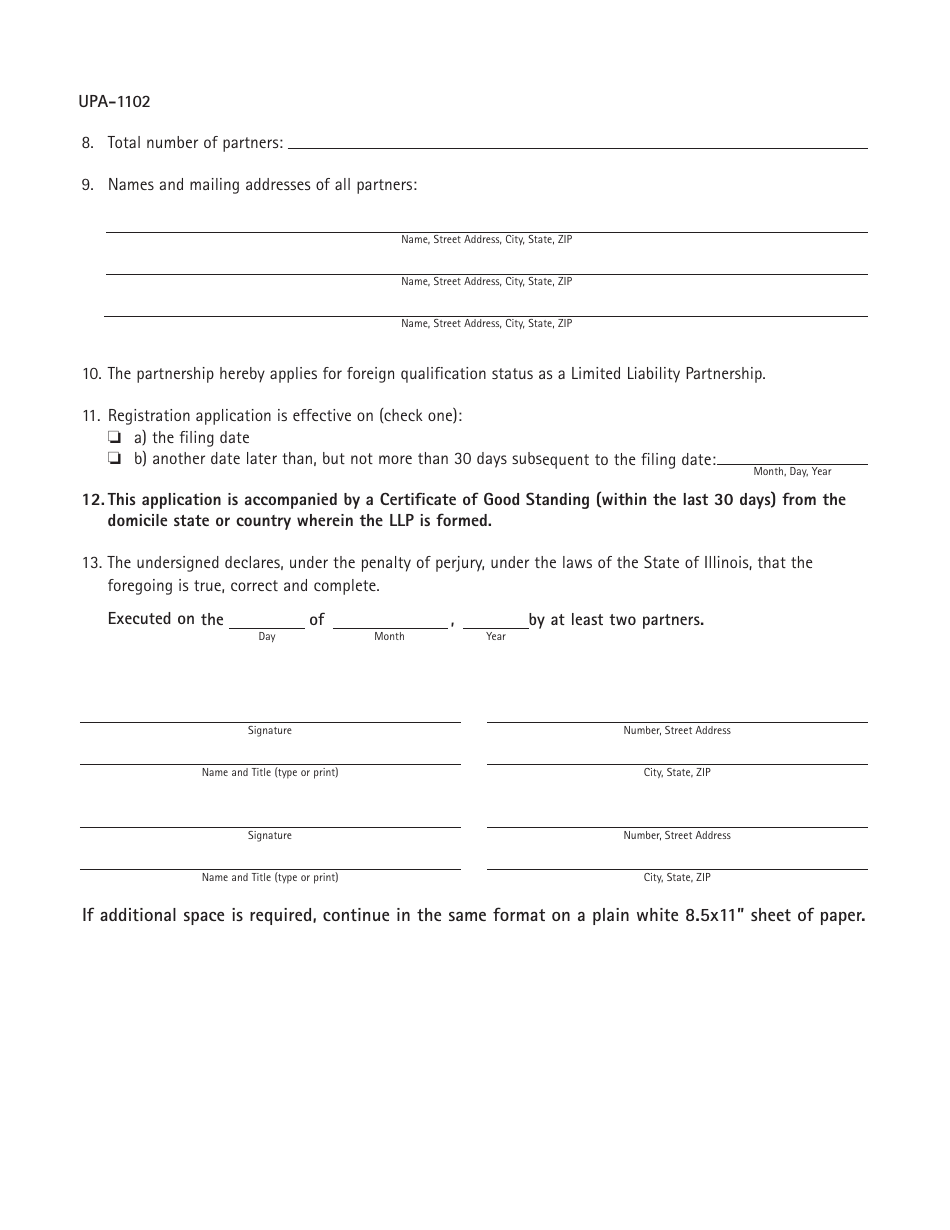

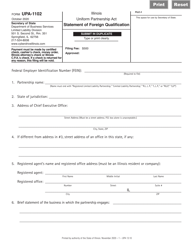

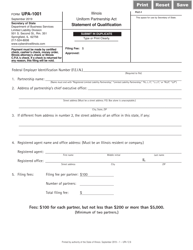

Form UPA-13.9 (UPA-1102) Statement of Foreign Qualification - Illinois

What Is Form UPA-13.9 (UPA-1102)?

This is a legal form that was released by the Illinois Secretary of State - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UPA-13.9 (UPA-1102)?

A: Form UPA-13.9 (UPA-1102) is a Statement of Foreign Qualification for the state of Illinois.

Q: What is the purpose of Form UPA-13.9?

A: The purpose of Form UPA-13.9 is to notify the Illinois Secretary of State that a foreign corporation or LLC wishes to conduct business in Illinois.

Q: Do I need to file Form UPA-13.9 if I am a domestic corporation?

A: No, Form UPA-13.9 is only required for foreign corporations or LLCs.

Q: What information is required on Form UPA-13.9?

A: Form UPA-13.9 requires information such as the name and address of the foreign corporation or LLC, the jurisdiction of formation, and the name and address of a registered agent in Illinois.

Q: Is there a filing fee for Form UPA-13.9?

A: Yes, there is a filing fee associated with filing Form UPA-13.9. The fee amount may vary, so it is best to check with the Illinois Secretary of State for the current fee schedule.

Q: What happens after I file Form UPA-13.9?

A: After filing Form UPA-13.9, the Illinois Secretary of State will review the information and, if everything is in order, issue a Certificate of Authority allowing the foreign corporation or LLC to conduct business in Illinois.

Q: Is Form UPA-13.9 required for all types of businesses?

A: No, Form UPA-13.9 is specifically for foreign corporations and LLCs. Other types of businesses may need to file different forms or follow different procedures.

Form Details:

- The latest edition provided by the Illinois Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UPA-13.9 (UPA-1102) by clicking the link below or browse more documents and templates provided by the Illinois Secretary of State.