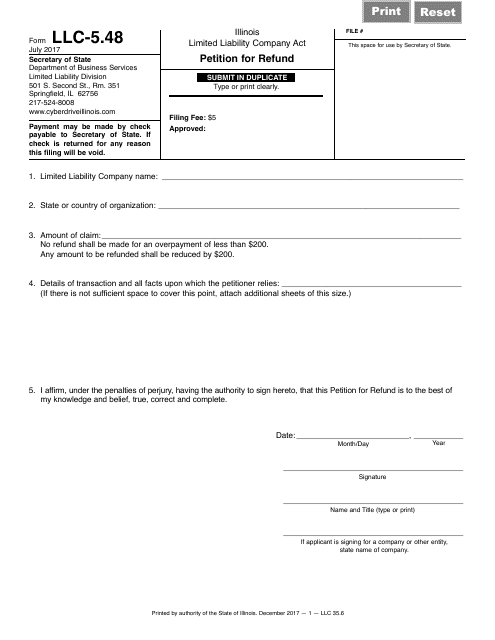

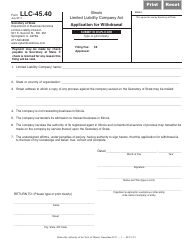

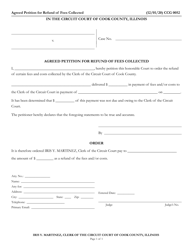

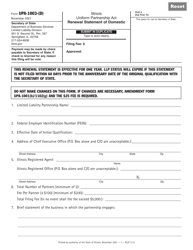

Form LLC-5.38 Petition for Refund - Illinois

What Is Form LLC-5.38?

This is a legal form that was released by the Illinois Secretary of State - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

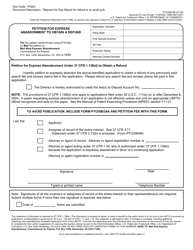

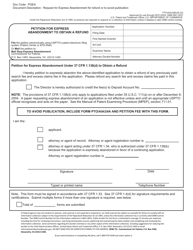

Q: What is the LLC-5.38 Petition for Refund?

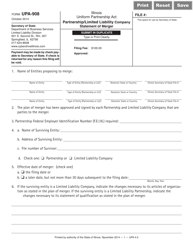

A: The LLC-5.38 Petition for Refund is a form used in Illinois to request a refund of overpaid fees or taxes relating to Limited Liability Companies (LLCs).

Q: Who can use the LLC-5.38 Petition for Refund?

A: The LLC-5.38 Petition for Refund can be used by individuals or entities that have overpaid fees or taxes directly related to an LLC in Illinois.

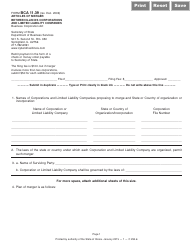

Q: What information is required on the LLC-5.38 Petition for Refund?

A: The LLC-5.38 Petition for Refund requires information such as the name and address of the LLC, the tax period or year, the reason for the refund request, and supporting documentation.

Q: How should I submit the LLC-5.38 Petition for Refund?

A: The LLC-5.38 Petition for Refund should be submitted either electronically or by mail, following the instructions provided by the Illinois Department of Revenue.

Q: Is there a deadline for filing the LLC-5.38 Petition for Refund?

A: Yes, there is a deadline for filing the LLC-5.38 Petition for Refund. Generally, it must be filed within 3 years from the date the fee or tax was paid, or within 1 year from the date of the final determination if there was an audit or assessment.

Q: What happens after I submit the LLC-5.38 Petition for Refund?

A: After submitting the LLC-5.38 Petition for Refund, the Illinois Department of Revenue will review the request and supporting documentation. If approved, a refund will be issued to the claimant.

Q: What should I do if my LLC-5.38 Petition for Refund is denied?

A: If your LLC-5.38 Petition for Refund is denied, you may have the option to appeal the decision. It is recommended to consult with a tax professional or attorney for guidance on the appeals process.

Q: Can I use the LLC-5.38 Petition for Refund for federal tax refunds?

A: No, the LLC-5.38 Petition for Refund is specific to requesting refunds of fees or taxes related to an LLC in Illinois. For federal tax refunds, you should follow the procedures outlined by the Internal Revenue Service (IRS).

Q: Are there any fees associated with filing the LLC-5.38 Petition for Refund?

A: There are no specific fees associated with filing the LLC-5.38 Petition for Refund. However, there may be costs involved in obtaining necessary supporting documentation or seeking professional assistance.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Illinois Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LLC-5.38 by clicking the link below or browse more documents and templates provided by the Illinois Secretary of State.