This version of the form is not currently in use and is provided for reference only. Download this version of

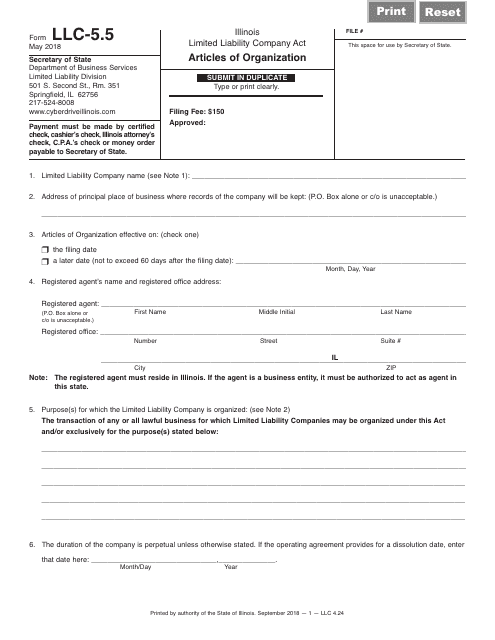

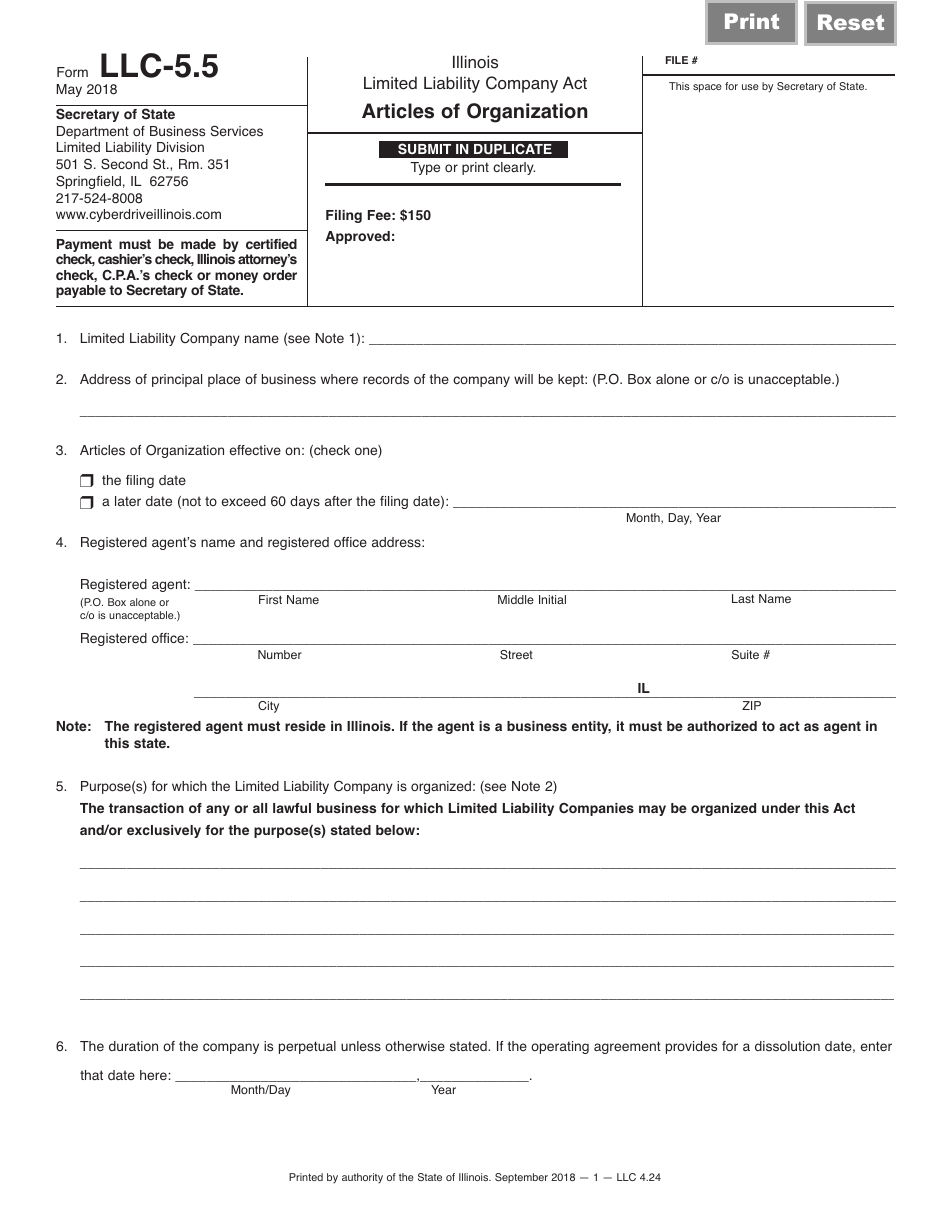

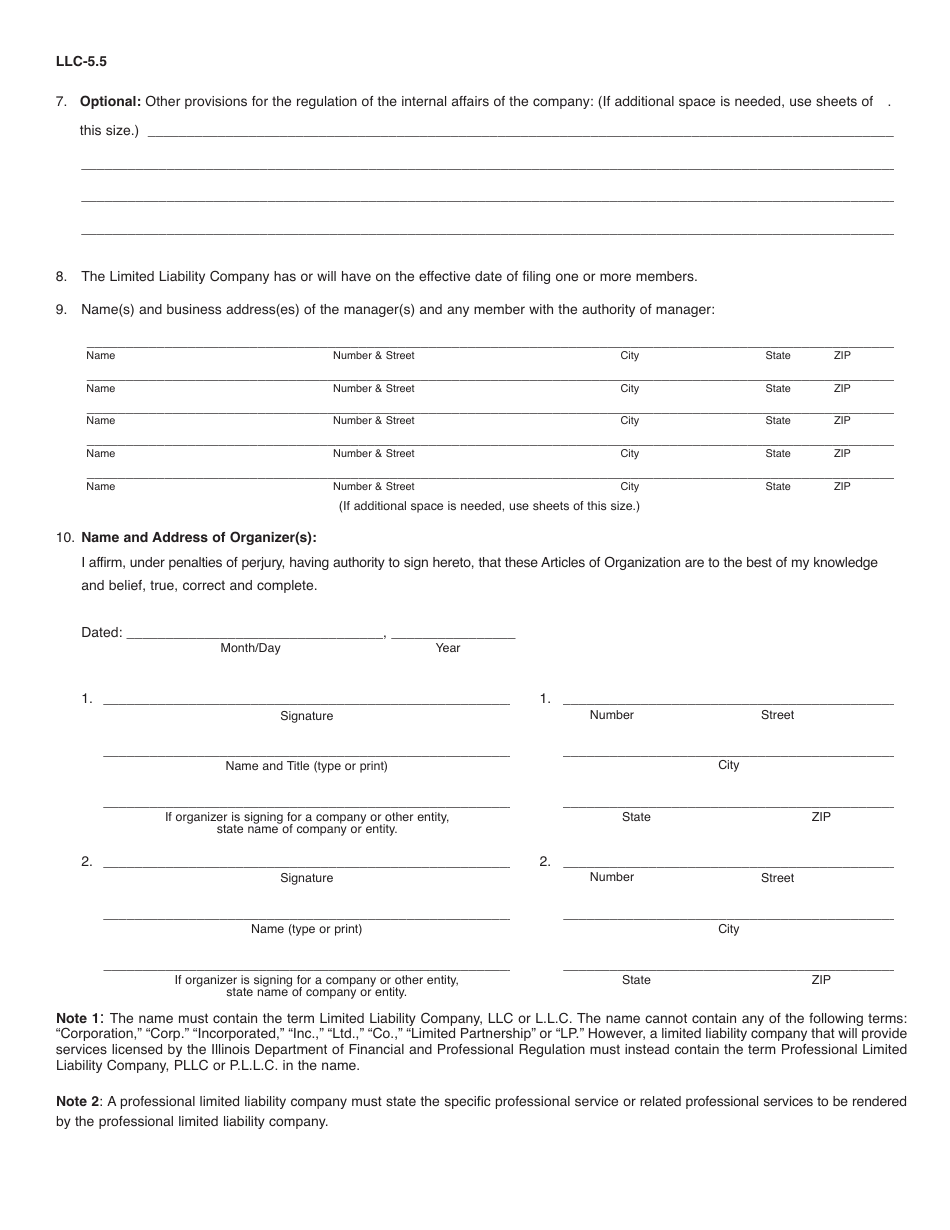

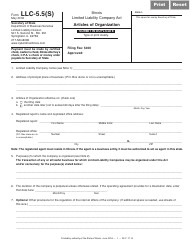

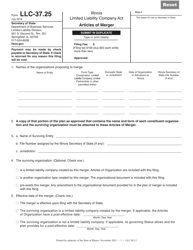

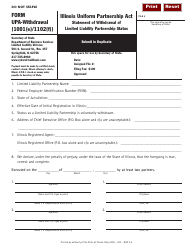

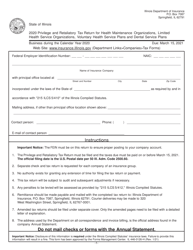

Form LLC-5.5

for the current year.

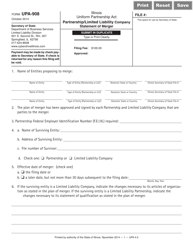

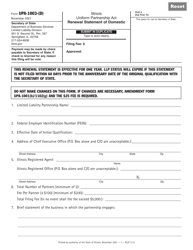

Form LLC-5.5 Articles of Organization - Illinois

What Is Form LLC-5.5?

This is a legal form that was released by the Illinois Secretary of State - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is an LLC?

A: An LLC is a limited liability company, which is a type of business entity.

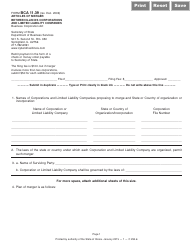

Q: What is the LLC-5.5 Articles of Organization?

A: The LLC-5.5 Articles of Organization is a form used to officially establish an LLC in the state of Illinois.

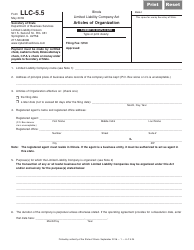

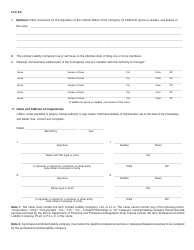

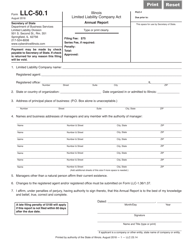

Q: What information is needed for the LLC-5.5 Articles of Organization?

A: The form requires information such as the LLC's name, address, purpose, and the names and addresses of its members and managers.

Q: Are there any fees associated with filing the LLC-5.5 Articles of Organization?

A: Yes, there is a filing fee that must be paid when submitting the form.

Q: Are there any additional requirements after filing the LLC-5.5 Articles of Organization?

A: Once the form is filed and approved, you may need to fulfill other requirements such as obtaining a federal tax ID number and registering for state taxes.

Q: What are the benefits of forming an LLC?

A: Forming an LLC provides limited liability protection, flexible management structure, and potential tax advantages.

Q: Can I form an LLC in Illinois even if I don't live there?

A: Yes, you can form an LLC in Illinois regardless of your residency.

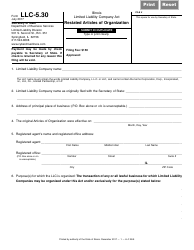

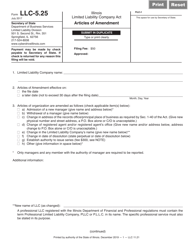

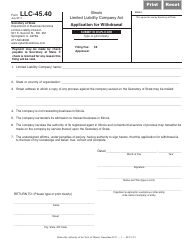

Q: Can I change the information in the LLC-5.5 Articles of Organization after it is filed?

A: Yes, you can file an amendment to the articles of organization to update or change information.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the Illinois Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LLC-5.5 by clicking the link below or browse more documents and templates provided by the Illinois Secretary of State.