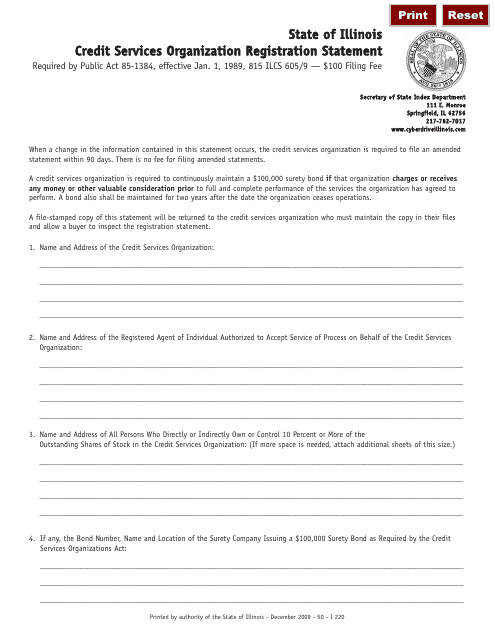

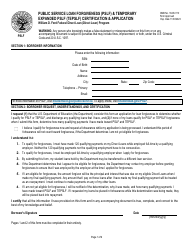

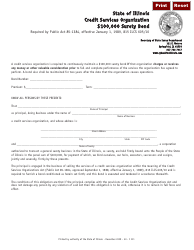

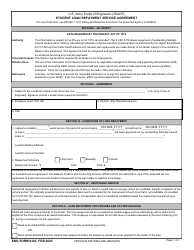

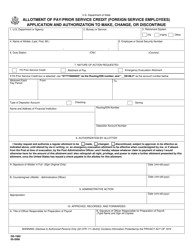

Form I-220 Credit Services Organization Registration Statement - Illinois

What Is Form I-220?

This is a legal form that was released by the Illinois Secretary of State - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form I-220?

A: Form I-220 is the Credit Services Organization Registration Statement specific to the state of Illinois.

Q: What is a Credit Services Organization (CSO)?

A: A Credit Services Organization (CSO) is a company that provides services related to improving a consumer's credit.

Q: Why do I need to file Form I-220 in Illinois?

A: You need to file Form I-220 in Illinois if you operate as a Credit Services Organization (CSO) in the state.

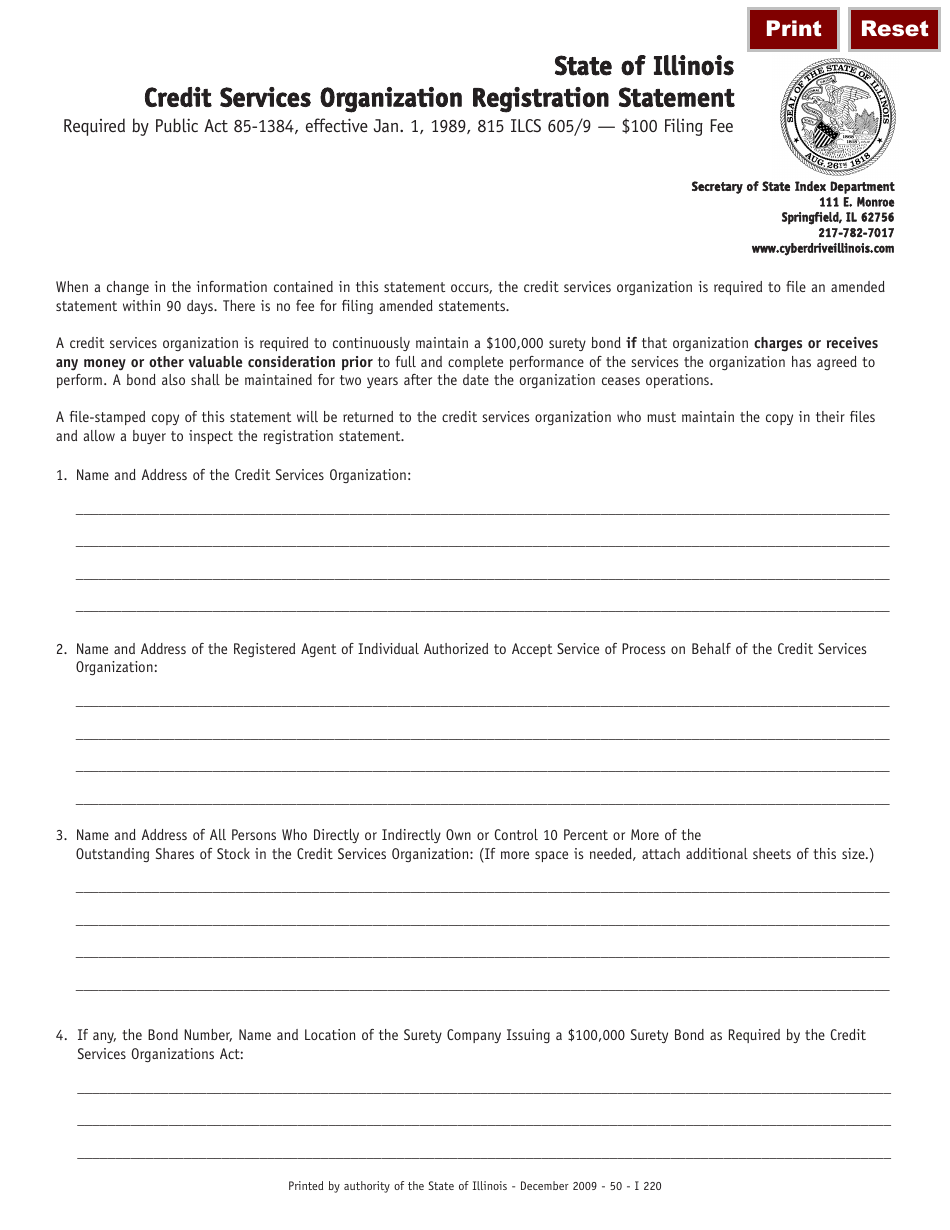

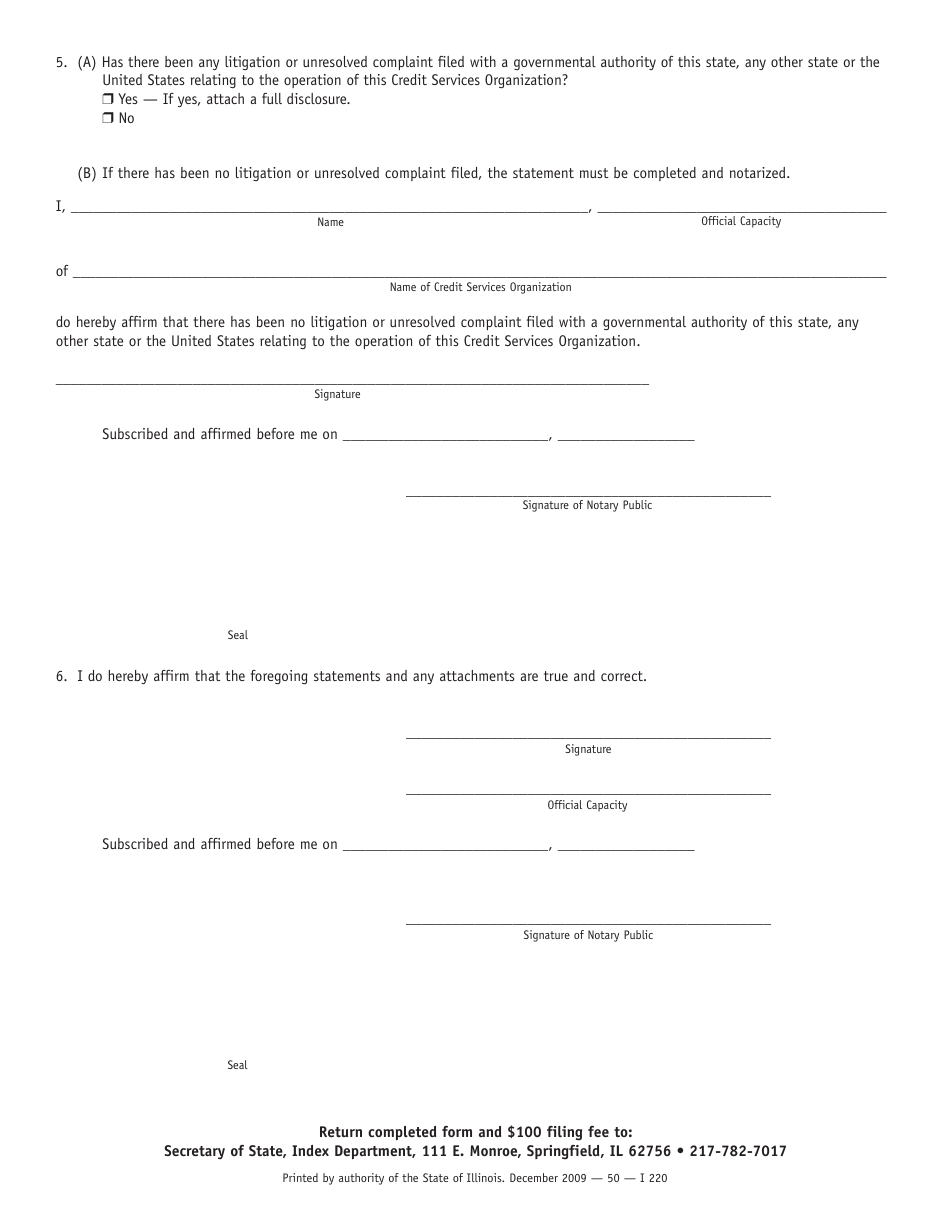

Q: What information is required on Form I-220?

A: Form I-220 requires information about the CSO, including the company's contact details, owners, and registered agents.

Q: What are the consequences of not filing Form I-220 in Illinois?

A: Failure to file Form I-220 as a Credit Services Organization (CSO) in Illinois can result in penalties and legal consequences.

Q: Can I cancel or withdraw my Form I-220 registration in Illinois?

A: Yes, you can cancel or withdraw your Form I-220 registration in Illinois. Contact the Illinois Secretary of State's office for instructions.

Q: Is Form I-220 specific to Illinois only?

A: Yes, Form I-220 is specific to the state of Illinois and is used for Credit Services Organization (CSO) registration in Illinois.

Form Details:

- The latest edition provided by the Illinois Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form I-220 by clicking the link below or browse more documents and templates provided by the Illinois Secretary of State.