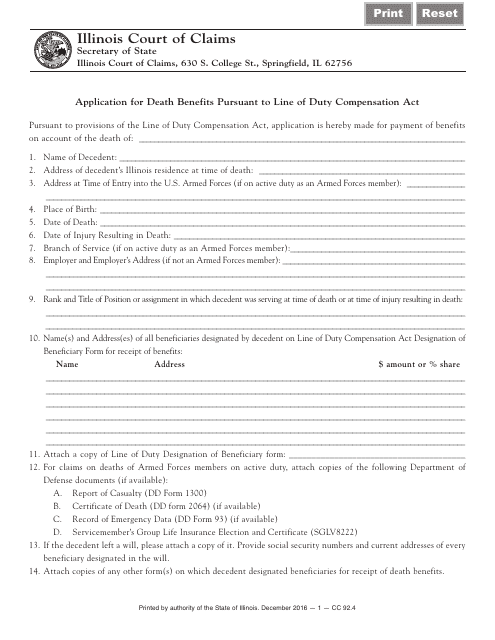

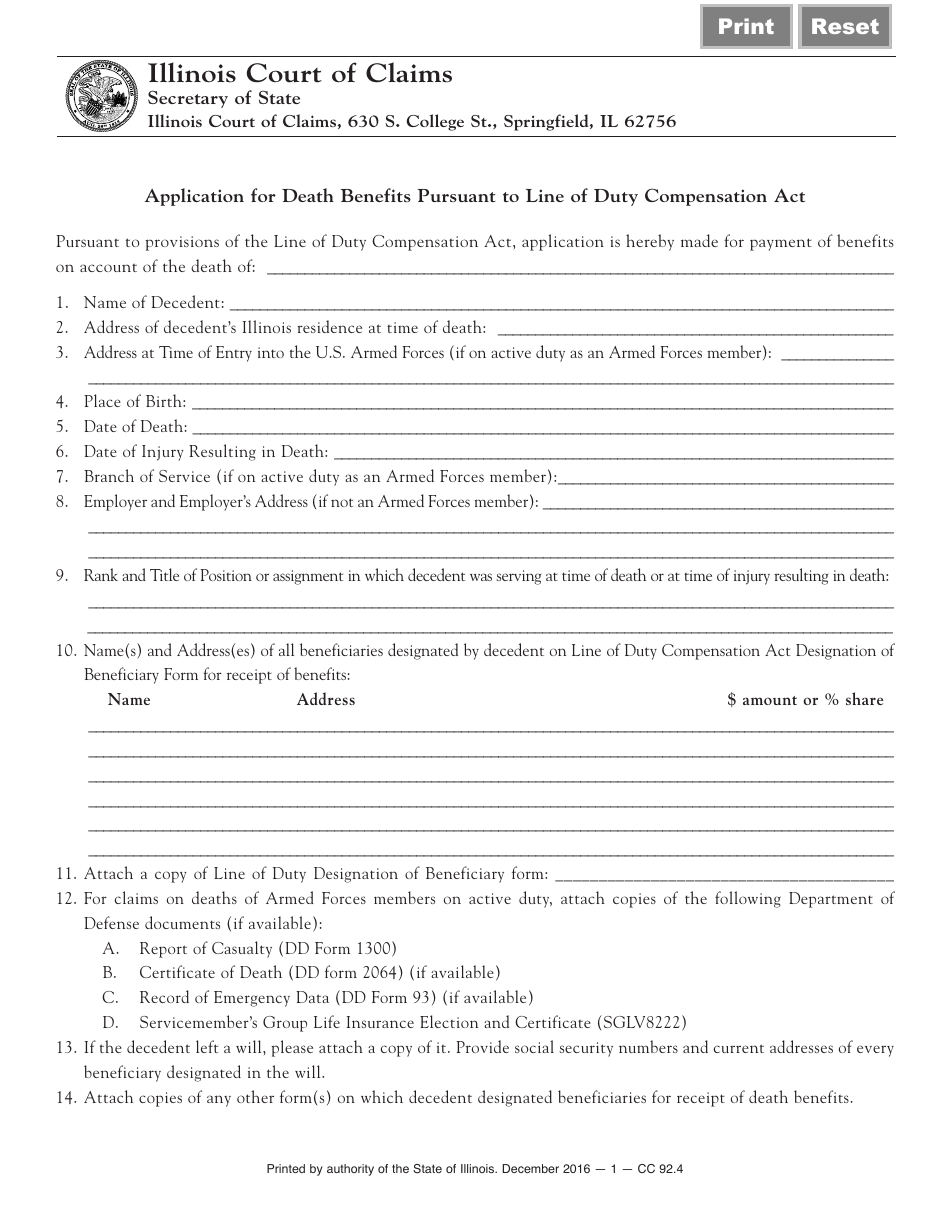

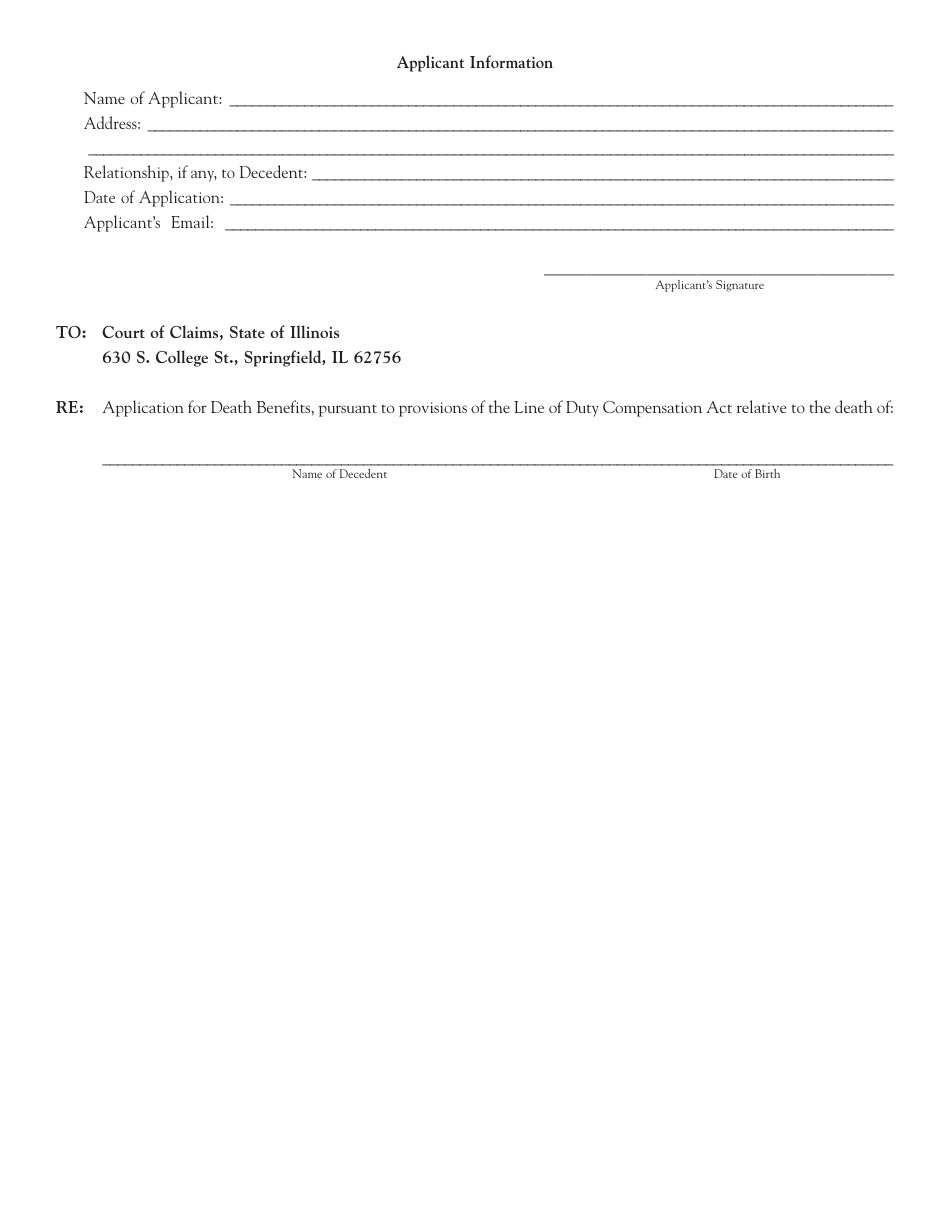

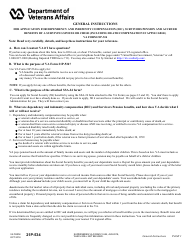

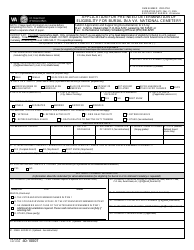

Form CC92 Application for Death Benefits Pursuant to Line of Duty Compensation Act - Illinois

What Is Form CC92?

This is a legal form that was released by the Illinois Secretary of State - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CC92?

A: Form CC92 is the application for death benefits under the Line of Duty Compensation Act in Illinois.

Q: What is the Line of Duty Compensation Act?

A: The Line of Duty Compensation Act in Illinois provides benefits to the surviving family members of certain public safety officers killed in the line of duty.

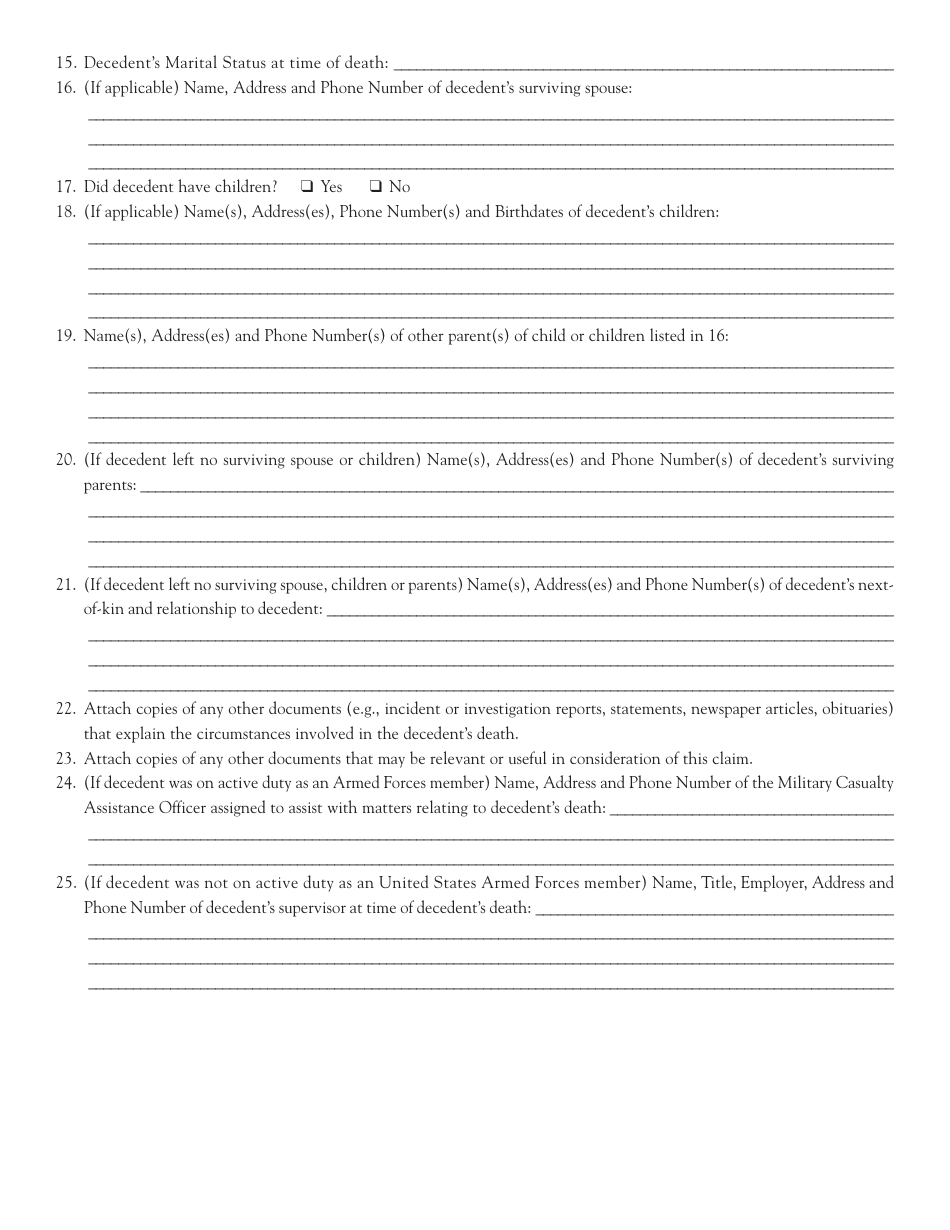

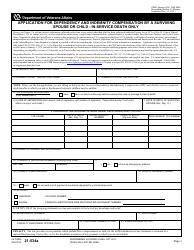

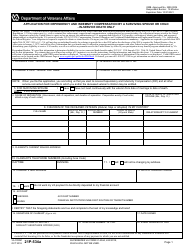

Q: Who is eligible to apply for death benefits under the Line of Duty Compensation Act?

A: The surviving spouse, child, or parent of a public safety officer killed in the line of duty may be eligible to apply for death benefits.

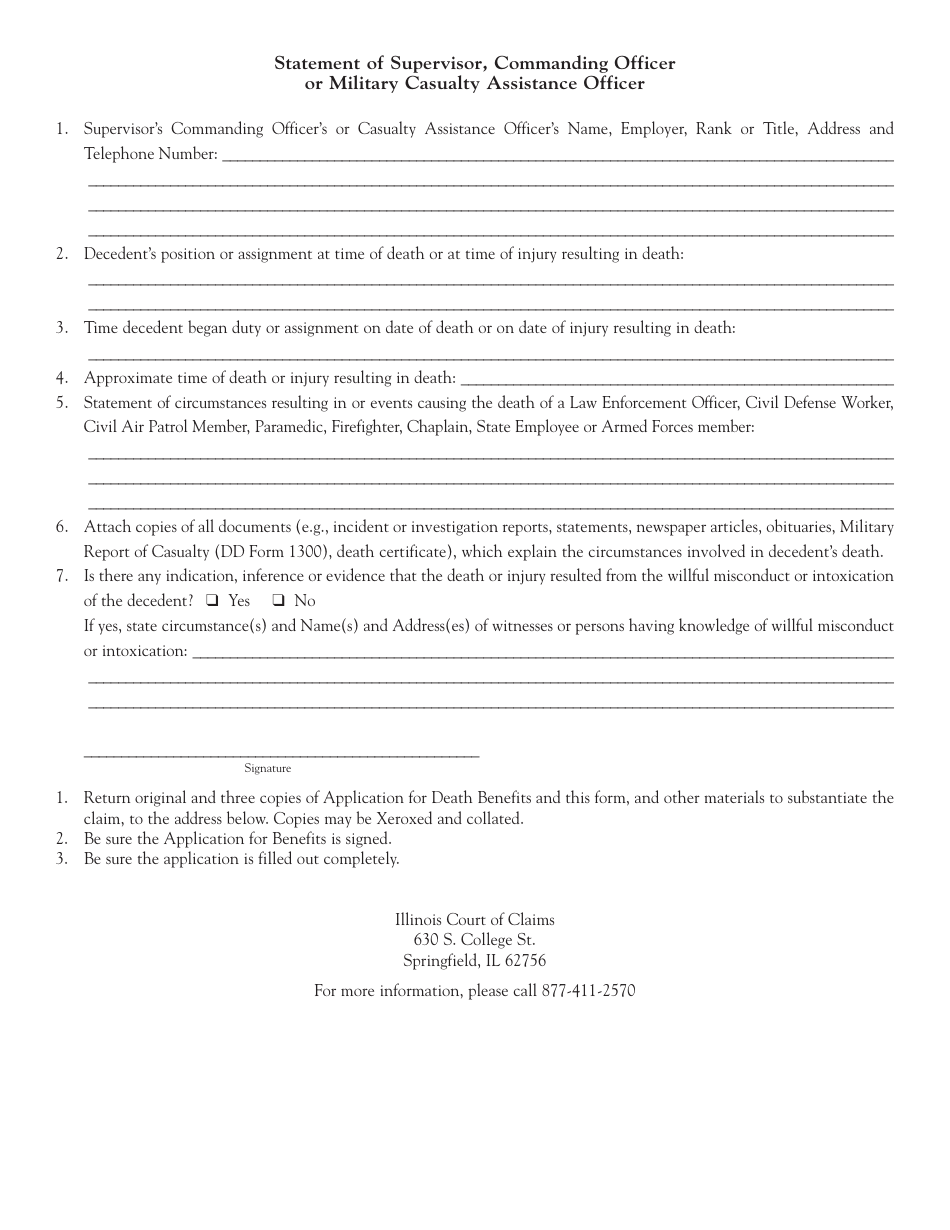

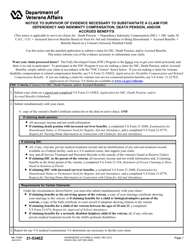

Q: What documents do I need to submit with Form CC92?

A: You will need to submit a certified copy of the public safety officer's death certificate and any other supporting documentation requested on the form.

Q: What is the deadline for submitting Form CC92?

A: There is no specific deadline for submitting Form CC92, but it should be filed as soon as possible after the death of the public safety officer.

Q: What benefits are available under the Line of Duty Compensation Act?

A: Benefits under the Line of Duty Compensation Act may include a death benefit, a monthly pension, and payment of educational expenses for the surviving spouse and children.

Q: Are the benefits taxable?

A: No, the benefits received under the Line of Duty Compensation Act are exempt from state and federal income tax.

Q: Is there a fee to apply for death benefits?

A: No, there is no fee to apply for death benefits under the Line of Duty Compensation Act.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the Illinois Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CC92 by clicking the link below or browse more documents and templates provided by the Illinois Secretary of State.