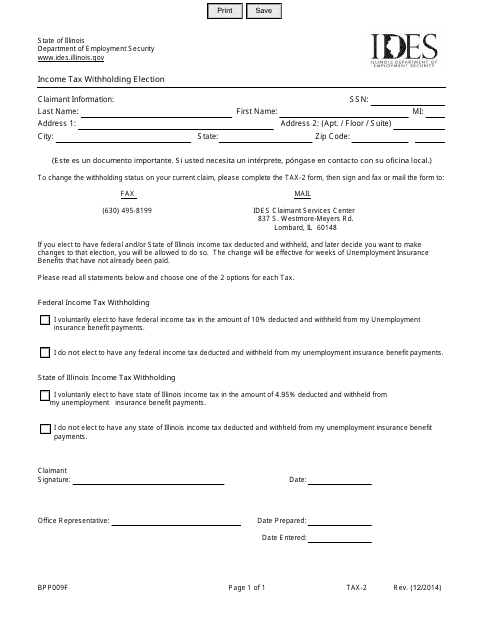

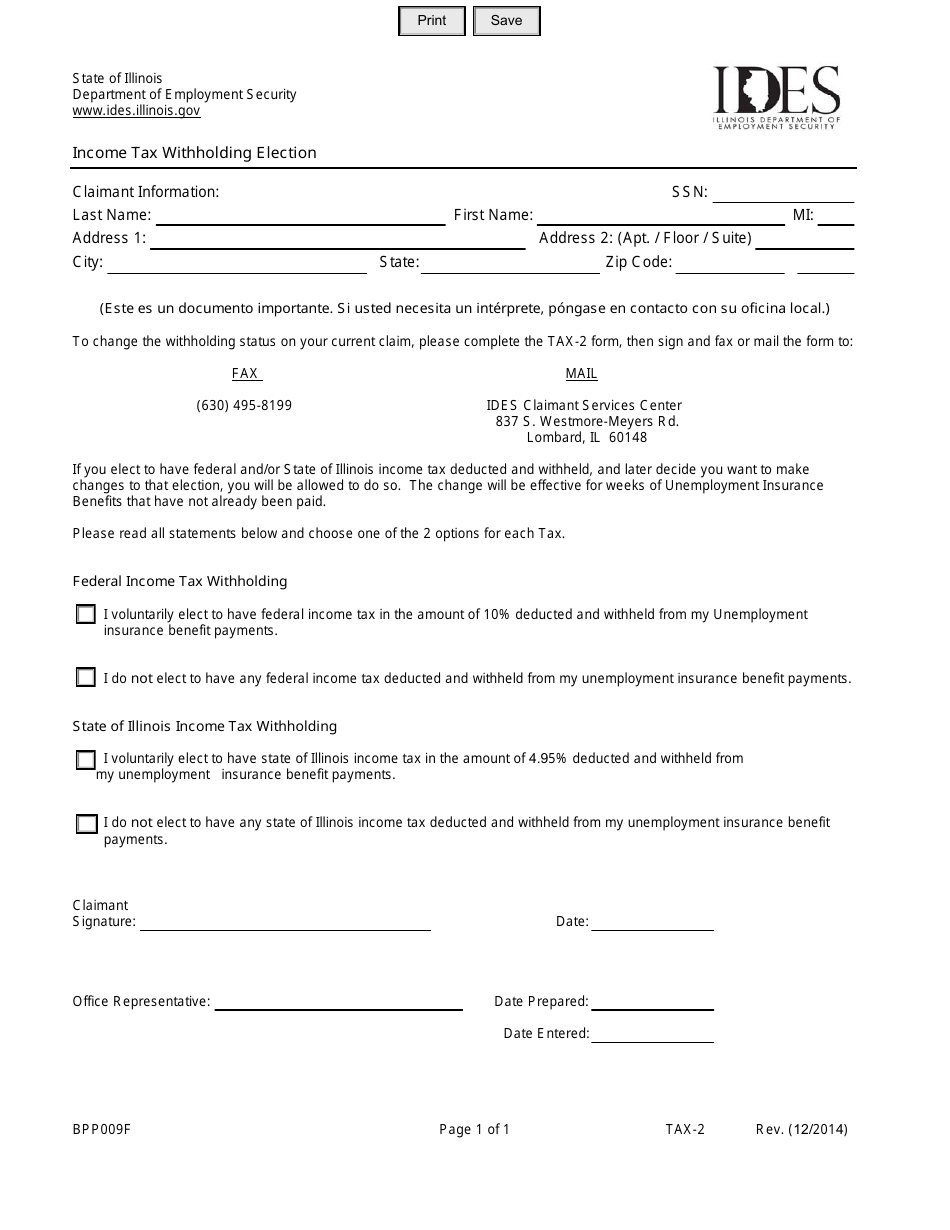

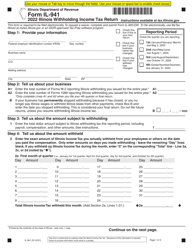

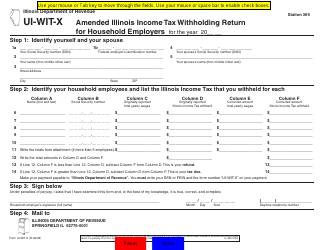

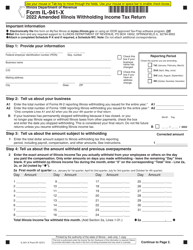

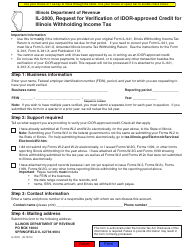

Form BPP009F (TAX-2) Income Tax Withholding Election - Illinois

What Is Form BPP009F (TAX-2)?

This is a legal form that was released by the Illinois Department of Employment Security - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form BPP009F?

A: Form BPP009F is the Income Tax Withholding Election form for Illinois.

Q: What is the purpose of Form BPP009F?

A: The purpose of Form BPP009F is to allow employees to elect their income tax withholding preferences for the state of Illinois.

Q: Who should fill out Form BPP009F?

A: Employees who work in Illinois and want to specify their income tax withholding preferences should fill out Form BPP009F.

Q: When should Form BPP009F be submitted?

A: Form BPP009F should be submitted to your employer as soon as possible to ensure accurate income tax withholding.

Q: Are there any specific instructions for filling out Form BPP009F?

A: Yes, you should carefully read the instructions provided with Form BPP009F to ensure you complete it correctly.

Q: Can I make changes to my income tax withholding election after submitting Form BPP009F?

A: Yes, you can make changes to your income tax withholding election by submitting a new Form BPP009F to your employer.

Q: Is Form BPP009F only for Illinois residents?

A: No, Form BPP009F is for anyone who works in Illinois, regardless of their residency.

Q: Is Form BPP009F mandatory?

A: No, completing Form BPP009F is not mandatory, but it is recommended to ensure accurate income tax withholding.

Q: What if I have questions about Form BPP009F?

A: If you have questions about Form BPP009F, you can contact the Illinois Department of Revenue or seek assistance from your employer's payroll department.

Form Details:

- Released on December 1, 2014;

- The latest edition provided by the Illinois Department of Employment Security;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BPP009F (TAX-2) by clicking the link below or browse more documents and templates provided by the Illinois Department of Employment Security.