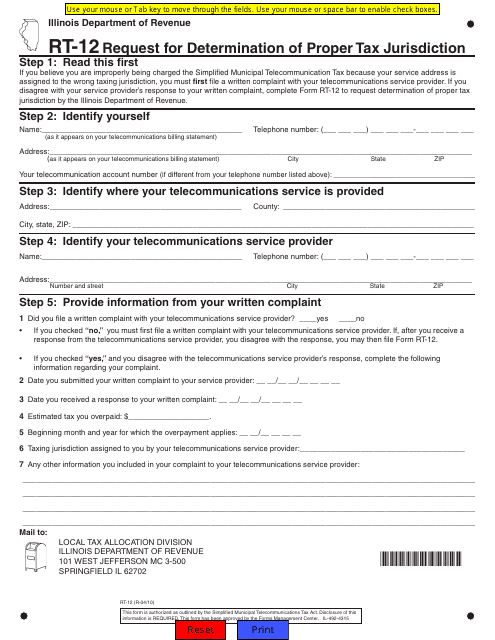

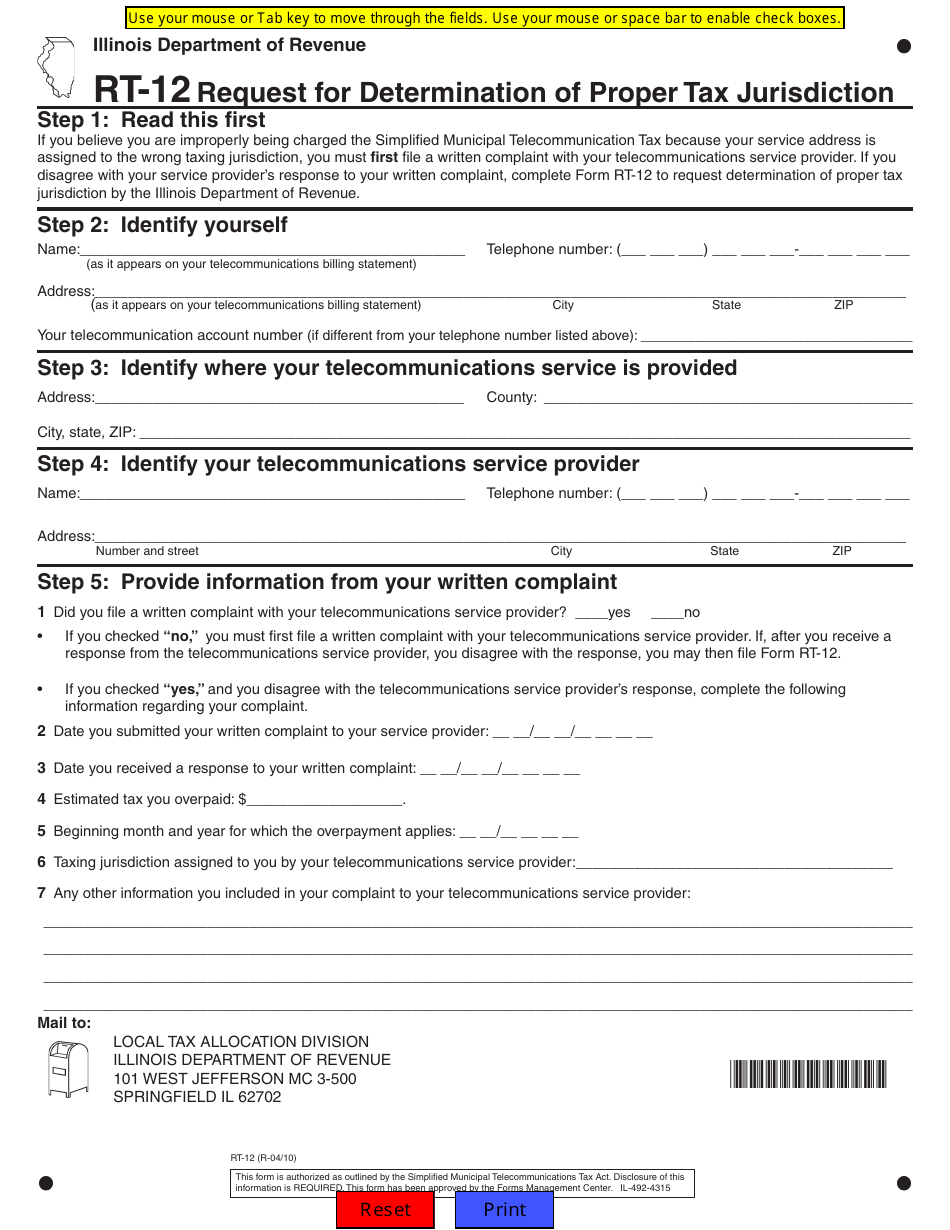

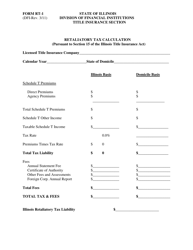

Form RT-12 Request for Determination of Proper Tax Jurisdiction - Illinois

What Is Form RT-12?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Form RT-12?

A: The Form RT-12 is the Request for Determination of Proper Tax Jurisdiction in Illinois.

Q: Who should file the Form RT-12?

A: Anyone who is unsure about their proper tax jurisdiction in Illinois should file the Form RT-12.

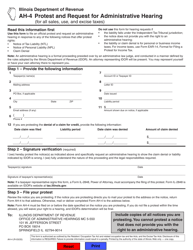

Q: How do I file the Form RT-12?

A: You can file the Form RT-12 by completing it and mailing it to the Illinois Department of Revenue.

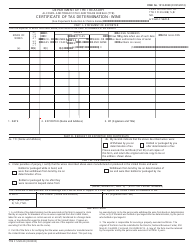

Q: What information is required on the Form RT-12?

A: The Form RT-12 requires information about your personal circumstances, including your residency and income sources.

Q: What is the purpose of the Form RT-12?

A: The Form RT-12 helps determine your proper tax jurisdiction in Illinois, ensuring you pay the right amount of taxes.

Form Details:

- Released on April 1, 2010;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RT-12 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.