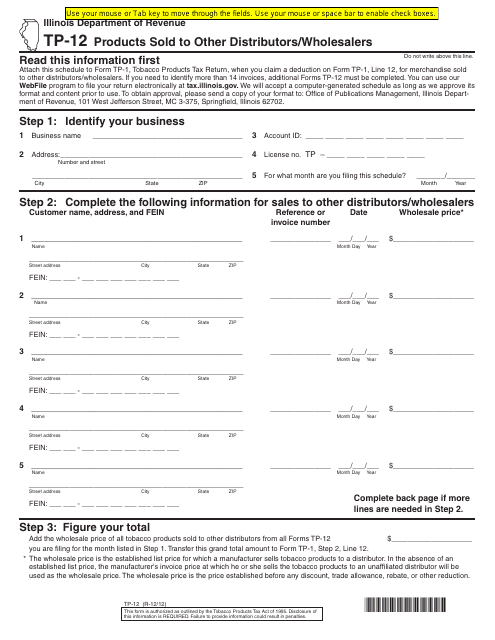

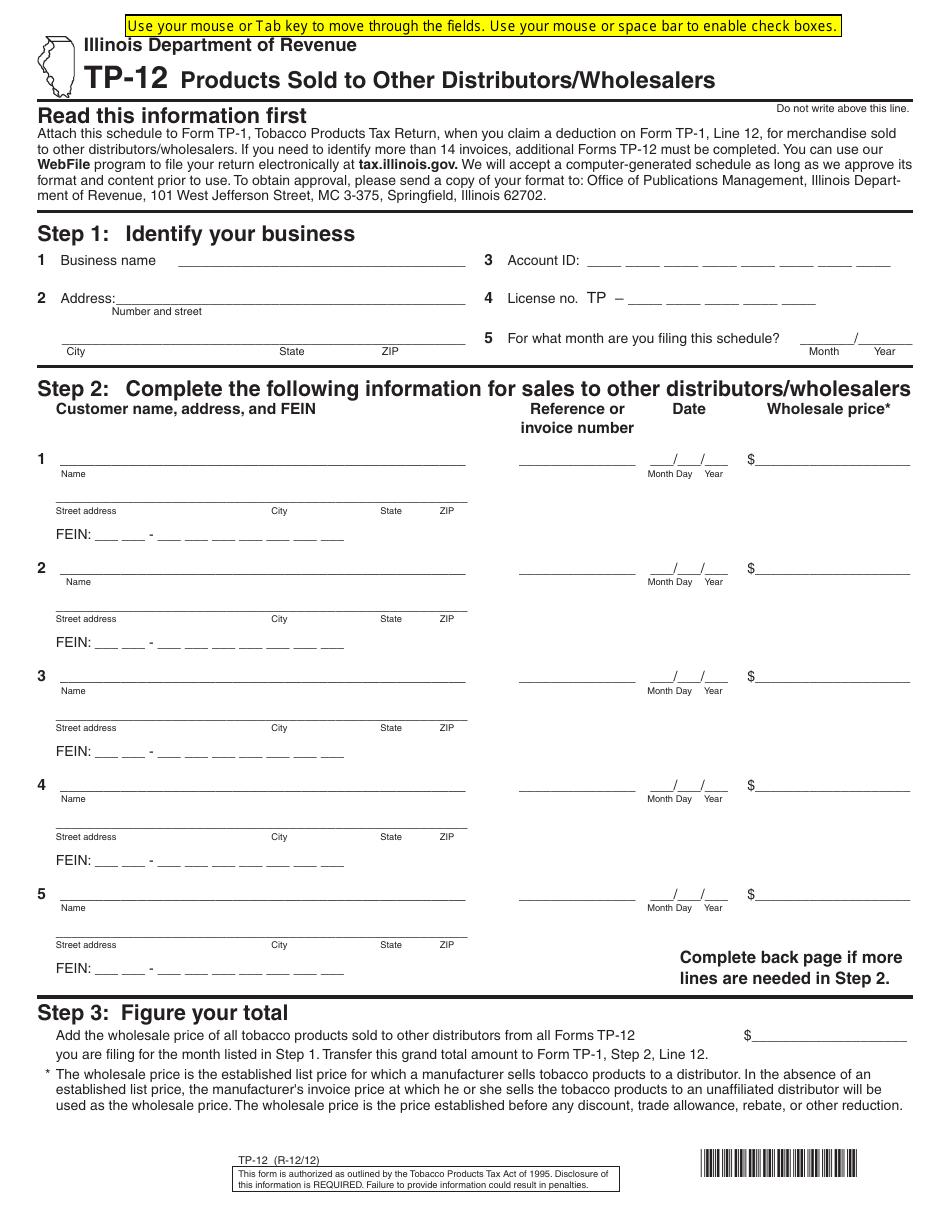

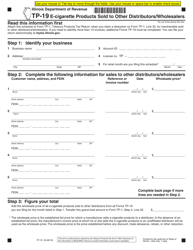

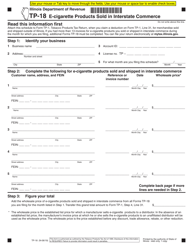

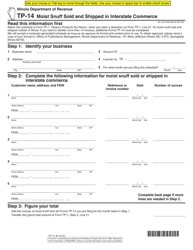

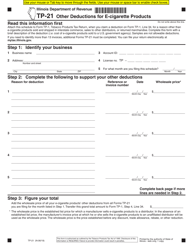

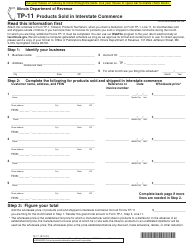

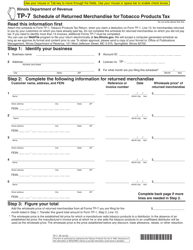

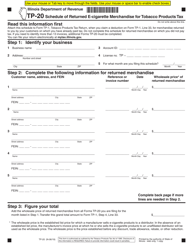

Form TP-12 Products Sold to Other Distributors / Wholesalers - Illinois

What Is Form TP-12?

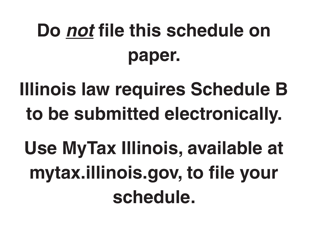

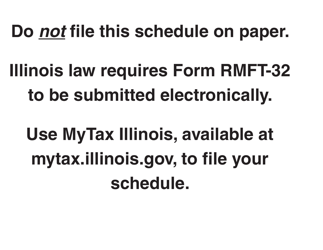

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form TP-12?

A: Form TP-12 is a sales tax form used in Illinois by distributors/wholesalers to report the sale of products to other distributors/wholesalers.

Q: Who needs to file Form TP-12?

A: Distributors/wholesalers in Illinois who have sold products to other distributors/wholesalers need to file Form TP-12.

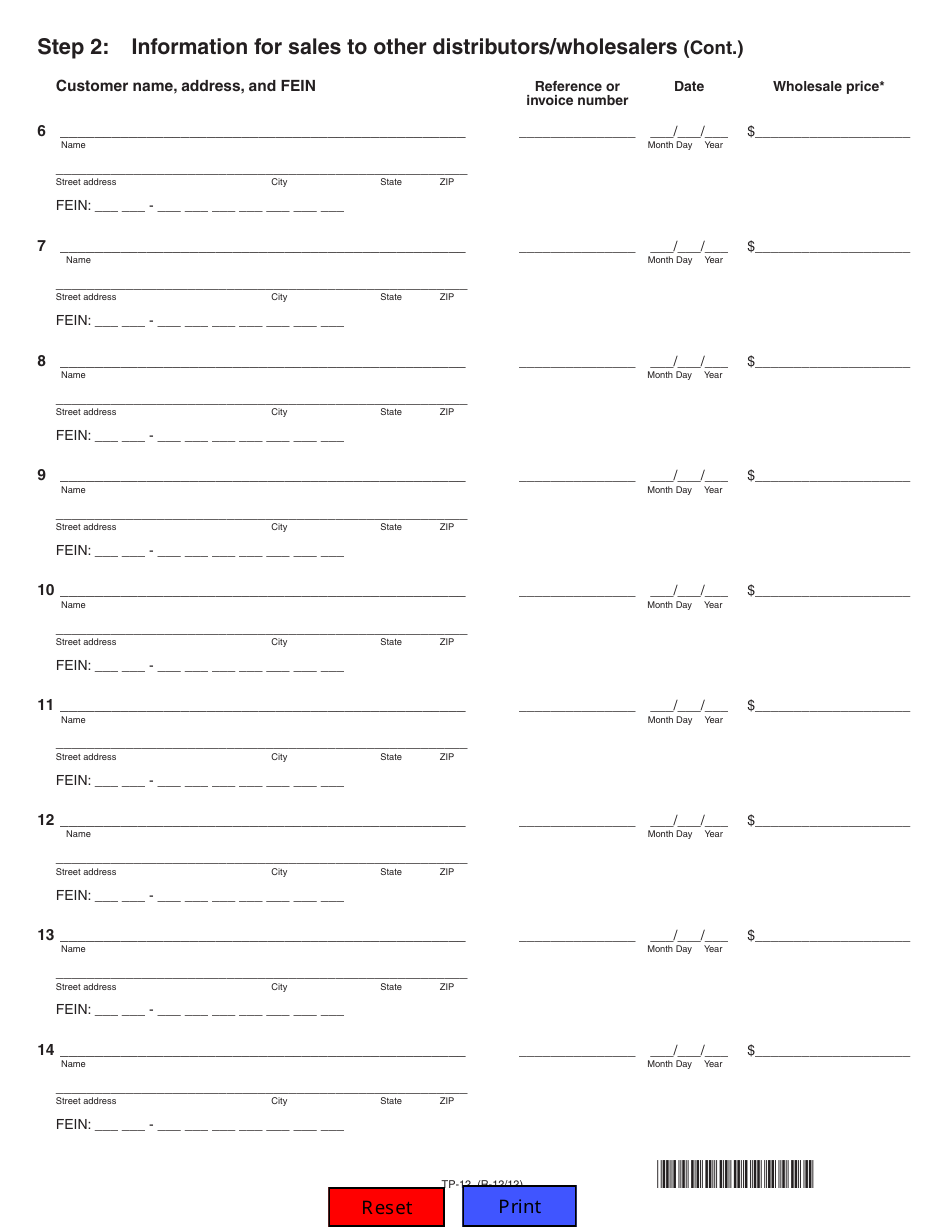

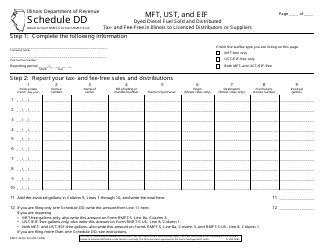

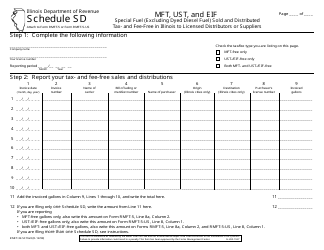

Q: What information is required on Form TP-12?

A: Form TP-12 requires information such as the names and addresses of the seller and buyer, the total sales amount, and the products sold.

Q: When is Form TP-12 due?

A: Form TP-12 is due on the 20th day of the month following the reporting period. For example, if the products were sold in January, the form is due by February 20th.

Q: Are there any penalties for late or incorrect filing of Form TP-12?

A: Yes, there may be penalties for late or incorrect filing of Form TP-12. It is important to file the form accurately and on time to avoid penalties.

Form Details:

- Released on December 1, 2012;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TP-12 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.