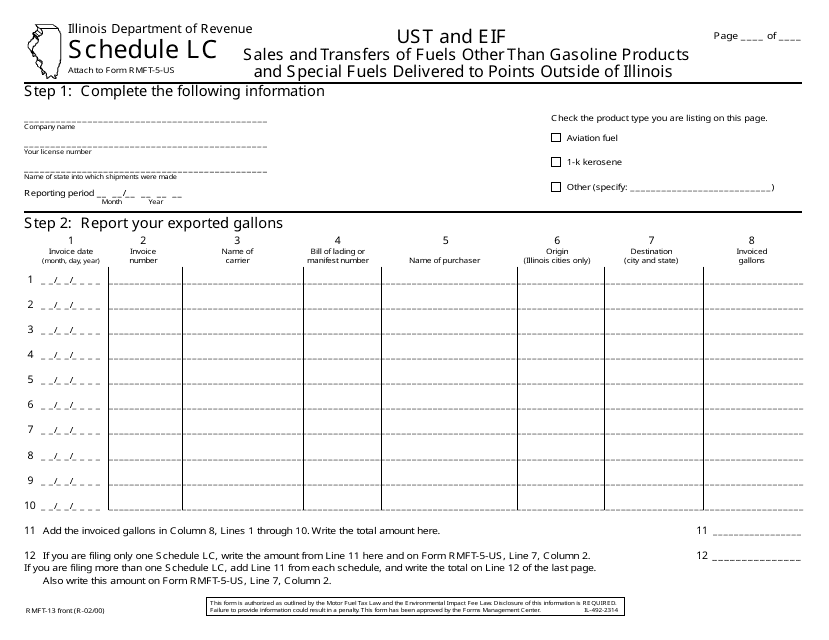

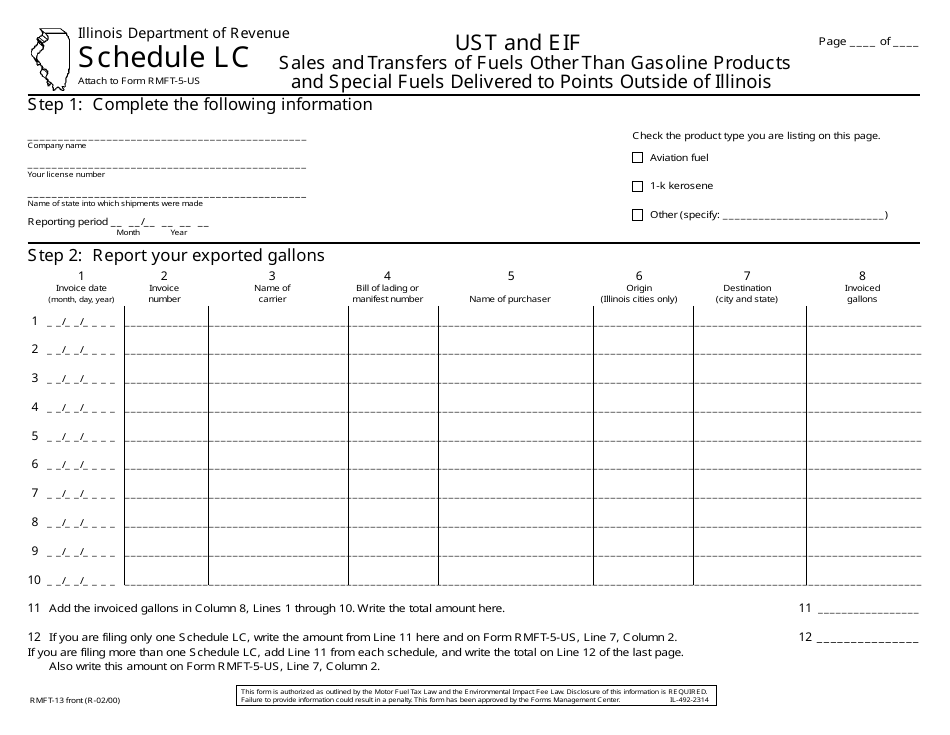

Form RMFT-13 Schedule LC Sales and Transfers of Fuels Other Than Gasoline Products and Special Fuels Delivered to Points Outside of Illinois - Illinois

What Is Form RMFT-13 Schedule LC?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RMFT-13?

A: Form RMFT-13 is a schedule used to report sales and transfers of fuels other thangasoline products and special fuels delivered to points outside of Illinois.

Q: Who is required to file Form RMFT-13?

A: Any person engaged in the business of selling or transferring fuels other than gasoline products and special fuels delivered to points outside of Illinois is required to file Form RMFT-13.

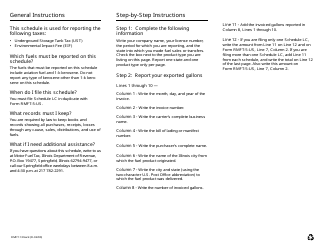

Q: What information needs to be reported on Form RMFT-13?

A: Form RMFT-13 requires the reporting of various details such as the type of fuel, volume of fuel transferred, destination of the fuel, and other related information.

Q: When is Form RMFT-13 due?

A: Form RMFT-13 is due on a monthly basis and must be filed by the 20th day of the month following the end of the reporting period.

Form Details:

- Released on February 1, 2000;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RMFT-13 Schedule LC by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.