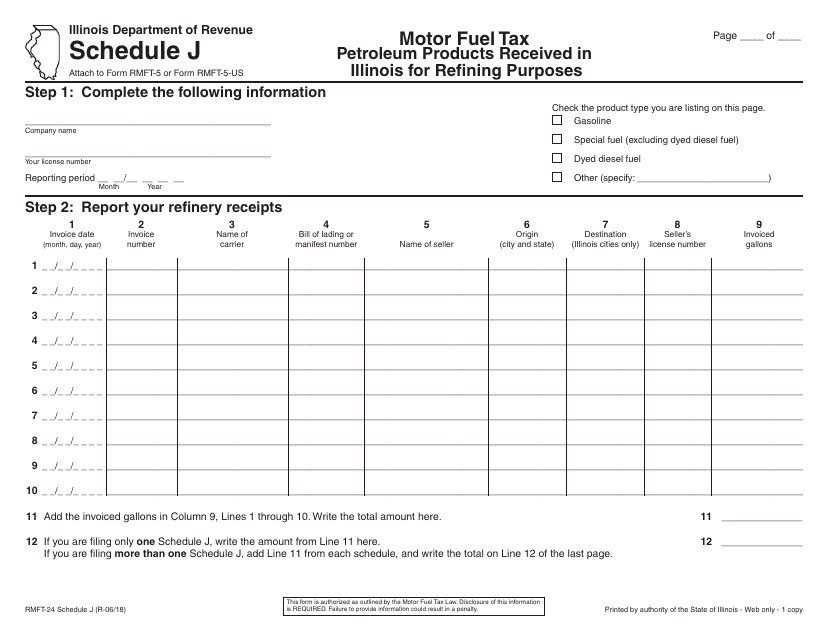

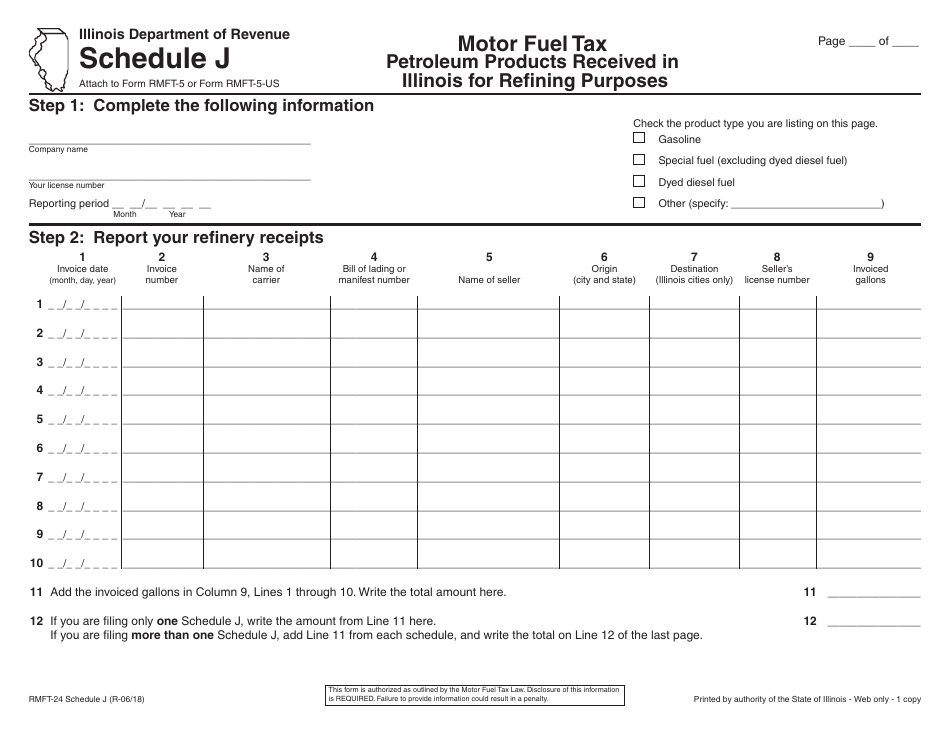

Form RMFT-24 Schedule J Petroleum Products Received in Illinois for Refining Purposes - Illinois

What Is Form RMFT-24 Schedule J?

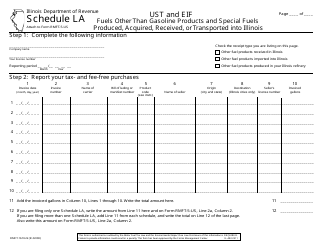

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is RMFT-24 Schedule J?

A: RMFT-24 Schedule J is a form used to report petroleum products received in Illinois for refining purposes.

Q: Who is required to file RMFT-24 Schedule J?

A: Any business or individual that receives petroleum products in Illinois for refining purposes is required to file RMFT-24 Schedule J.

Q: What information is required on RMFT-24 Schedule J?

A: RMFT-24 Schedule J requires information about the types and quantities of petroleum products received, as well as the suppliers and transporters of the products.

Q: How often is RMFT-24 Schedule J filed?

A: RMFT-24 Schedule J is filed on a monthly basis.

Q: What is the purpose of filing RMFT-24 Schedule J?

A: The purpose of filing RMFT-24 Schedule J is to accurately report and track petroleum products received in Illinois for refining purposes, and to ensure compliance with relevant tax and regulatory requirements.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RMFT-24 Schedule J by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.