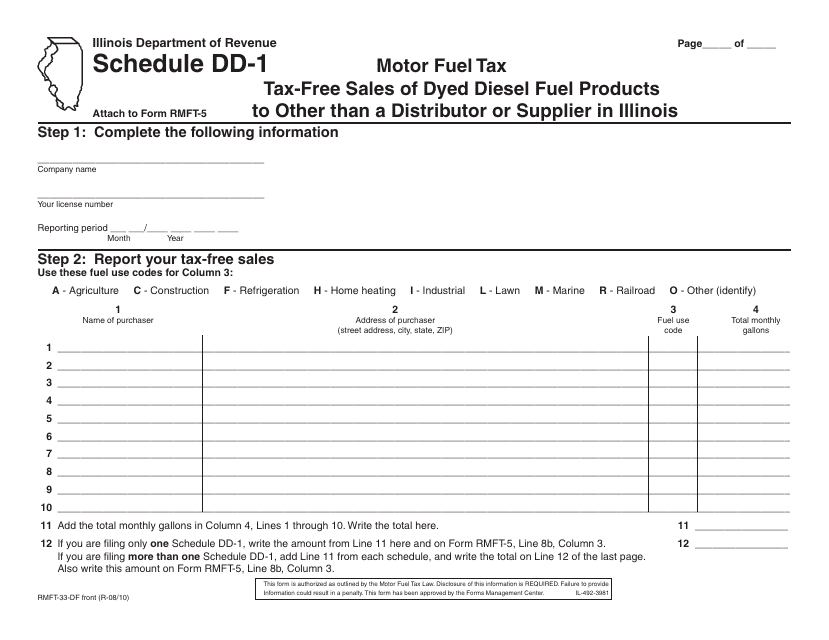

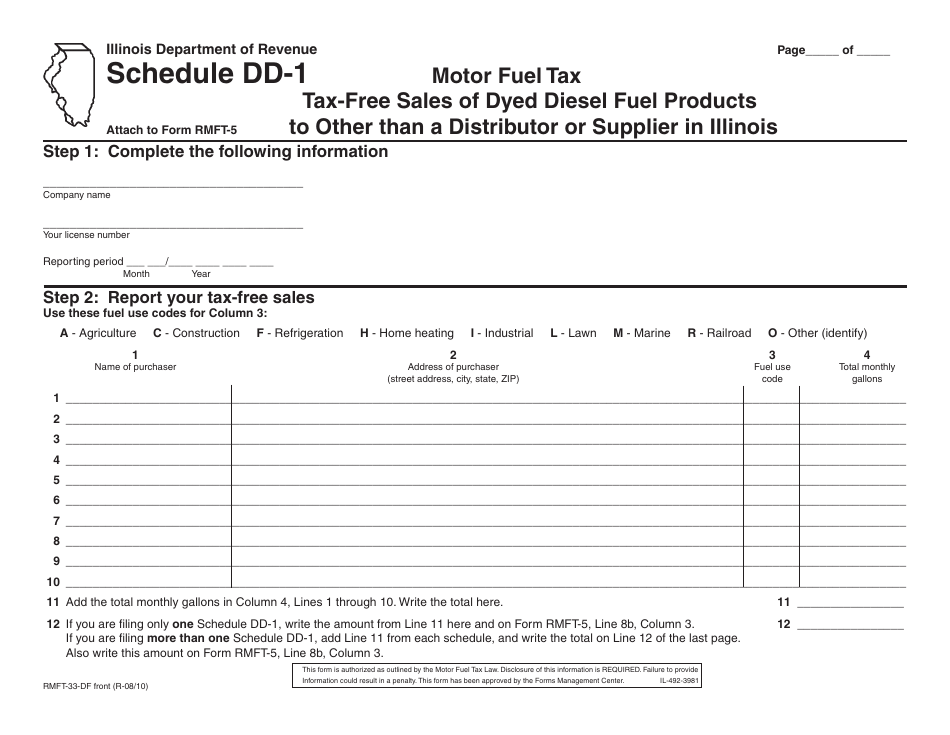

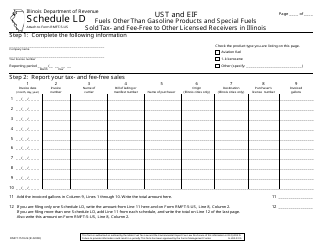

Form RMFT-33-DF Schedule DD-1 Tax-Free Sales of Dyed Diesel Fuel Products to Other Than a Distributor or Supplier in Illinois - Illinois

What Is Form RMFT-33-DF Schedule DD-1?

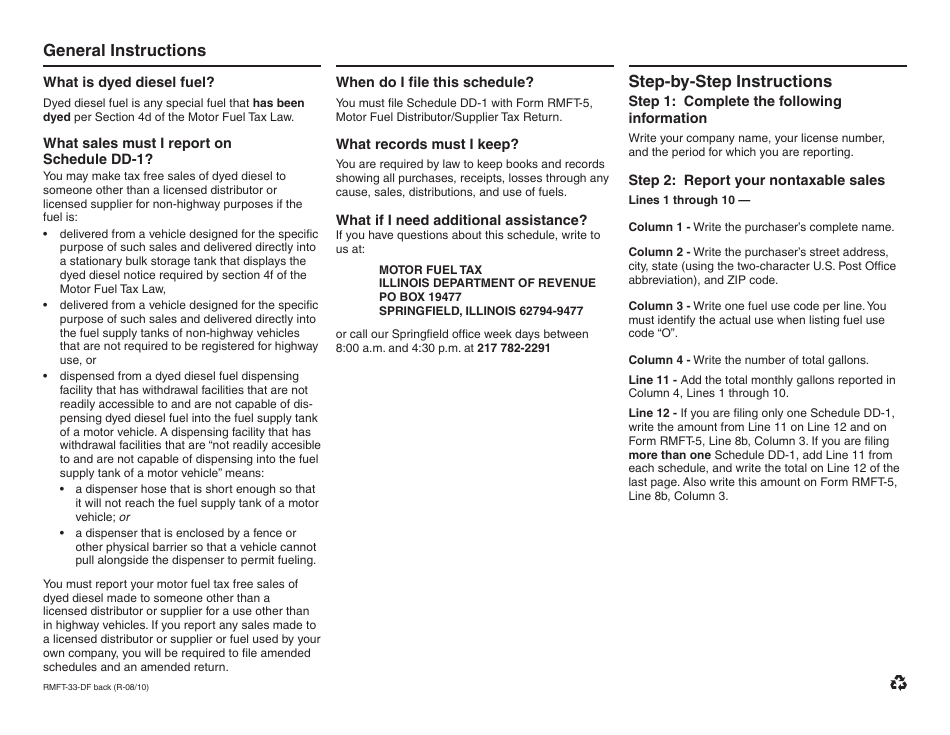

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RMFT-33-DF?

A: Form RMFT-33-DF is a schedule used to report tax-free sales of dyed diesel fuel products to other than a distributor or supplier in Illinois.

Q: What is dyed diesel fuel?

A: Dyed diesel fuel is diesel fuel that has been dyed to show that it is not intended for use on public highways.

Q: Who should use Form RMFT-33-DF?

A: Form RMFT-33-DF should be used by suppliers or retailers who make tax-free sales of dyed diesel fuel products to customers other than distributors or suppliers in Illinois.

Q: What is the purpose of Form RMFT-33-DF?

A: The purpose of Form RMFT-33-DF is to report tax-free sales of dyed diesel fuel products to ensure compliance with state tax laws.

Q: When is Form RMFT-33-DF due?

A: Form RMFT-33-DF is due on a monthly basis and must be filed by the 20th day of the following month.

Q: Are there any penalties for not filing Form RMFT-33-DF?

A: Yes, there are penalties for not filing Form RMFT-33-DF or for filing it late. It is important to file the form on time to avoid penalties.

Form Details:

- Released on August 1, 2010;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RMFT-33-DF Schedule DD-1 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.