This version of the form is not currently in use and is provided for reference only. Download this version of

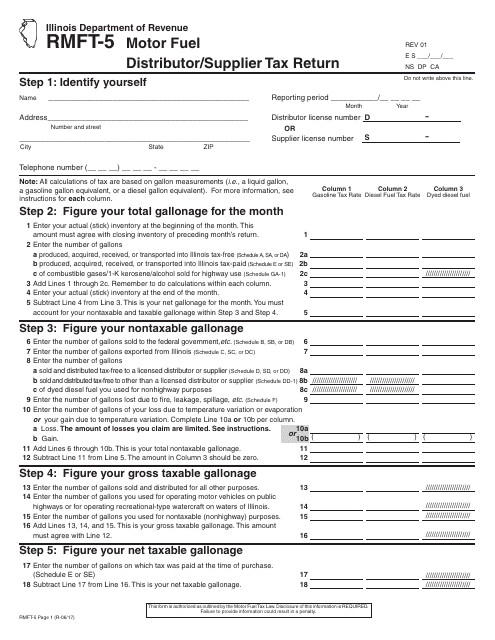

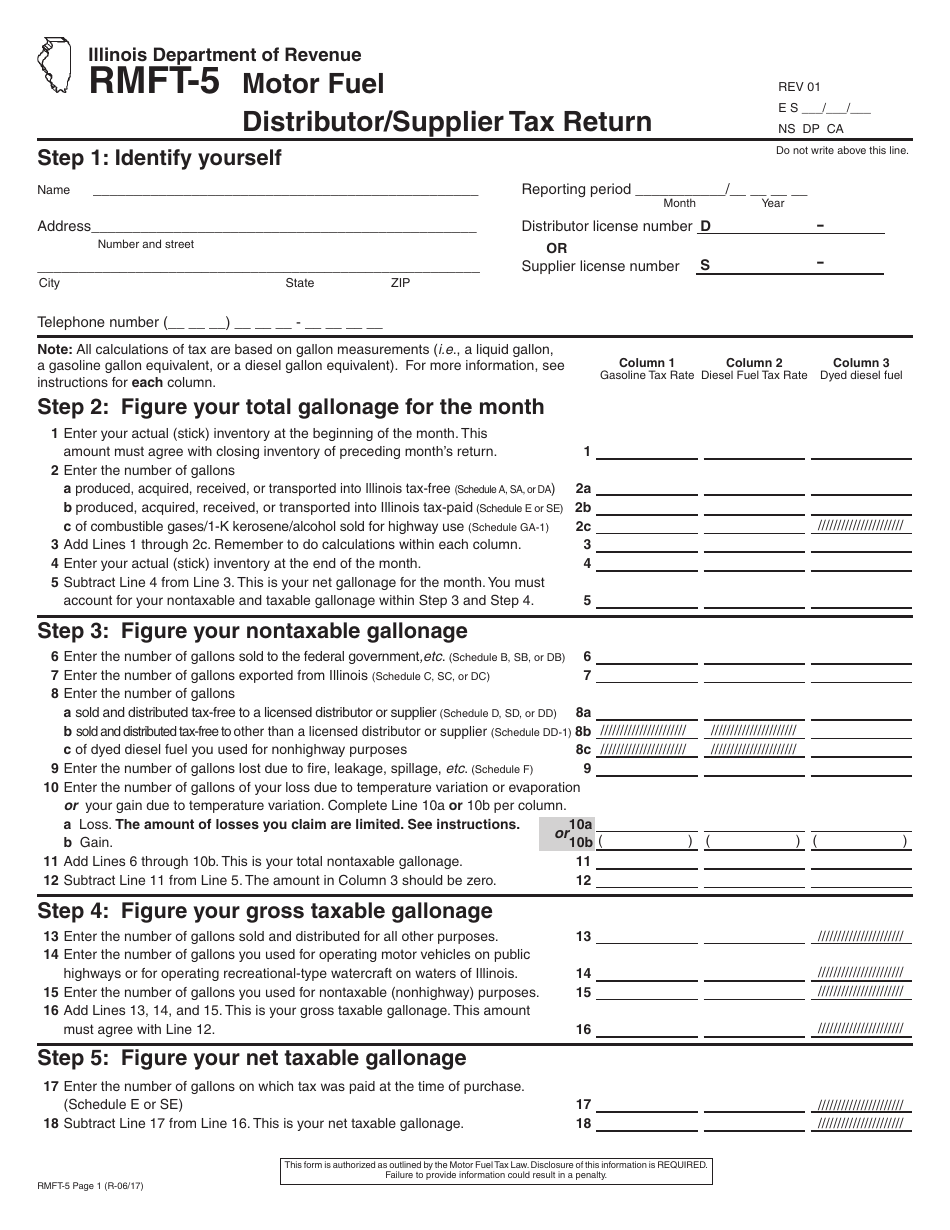

Form RMFT-5

for the current year.

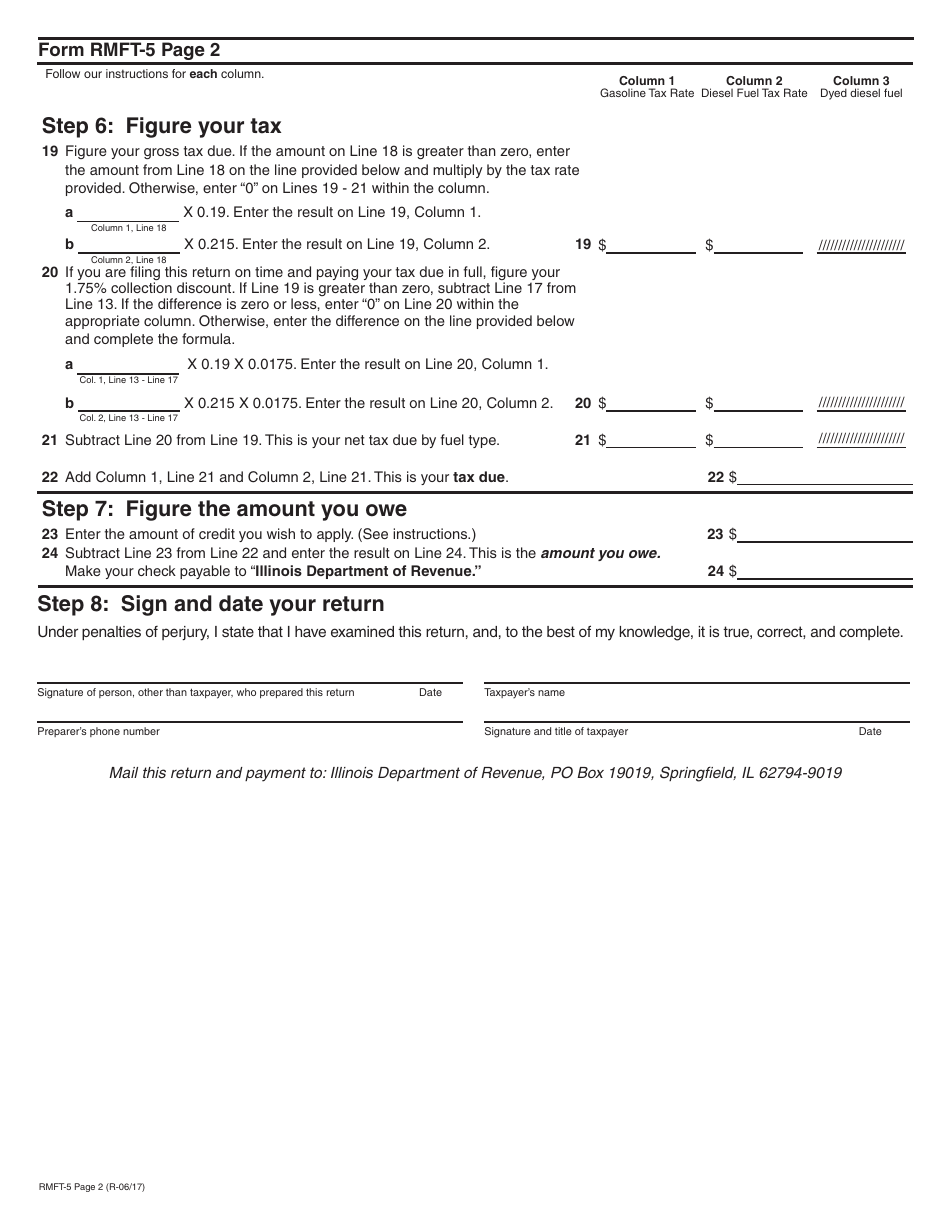

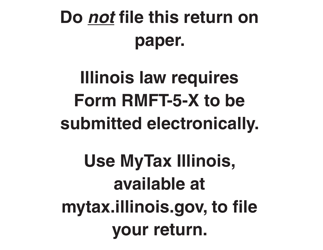

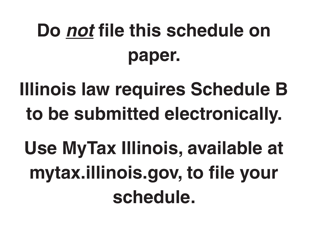

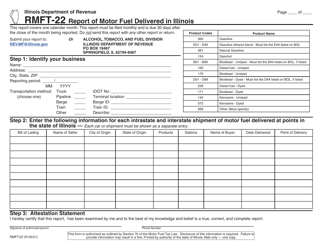

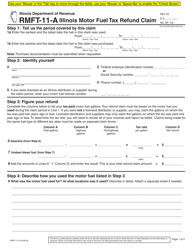

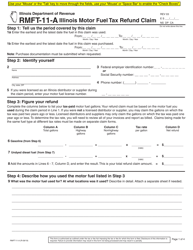

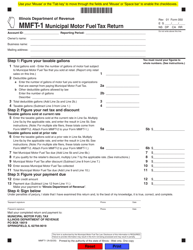

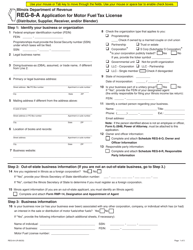

Form RMFT-5 Motor Fuel Distributor / Supplier Tax Return - Illinois

What Is Form RMFT-5?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the RMFT-5 Motor Fuel Distributor/Supplier Tax Return?

A: The RMFT-5 Motor Fuel Distributor/Supplier Tax Return is a tax form used in Illinois to report and pay motor fuel taxes.

Q: Who needs to file the RMFT-5 Motor Fuel Distributor/Supplier Tax Return?

A: Motor fuel distributors and suppliers in Illinois need to file the RMFT-5 Tax Return.

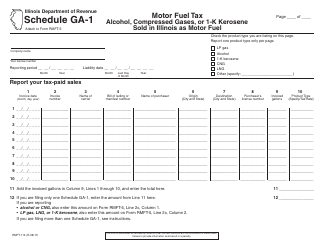

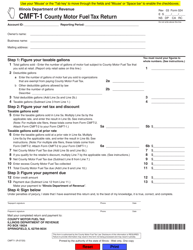

Q: What information is required to complete the RMFT-5 Tax Return?

A: The RMFT-5 Tax Return requires information about fuel sales, gallons sold, and taxes due.

Q: How often do I need to file the RMFT-5 Tax Return?

A: The frequency of filing the RMFT-5 Tax Return depends on the volume of fuel sales. It can be filed monthly, quarterly, or annually.

Q: What are the penalties for late filing or non-compliance with the RMFT-5 Tax Return?

A: Penalties for late filing or non-compliance with the RMFT-5 Tax Return may include interest charges, additional fees, and legal consequences.

Q: Are there any exemptions or deductions available for the RMFT-5 Tax Return?

A: Yes, there are certain exemptions and deductions available for motor fuel distributors and suppliers. Consult the instructions or contact the Illinois Department of Revenue for more information.

Form Details:

- Released on June 1, 2017;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form RMFT-5 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.