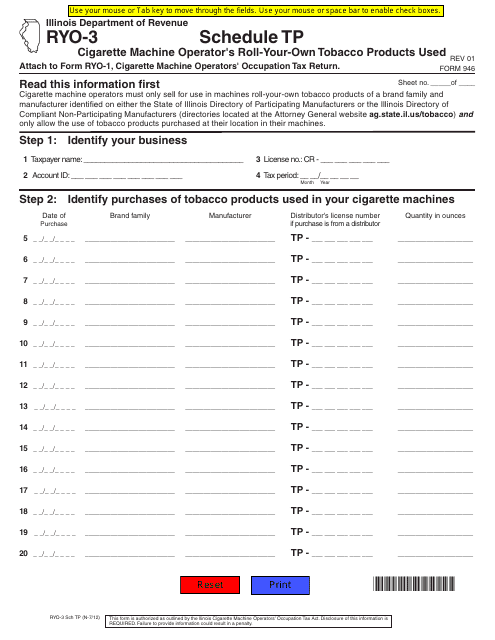

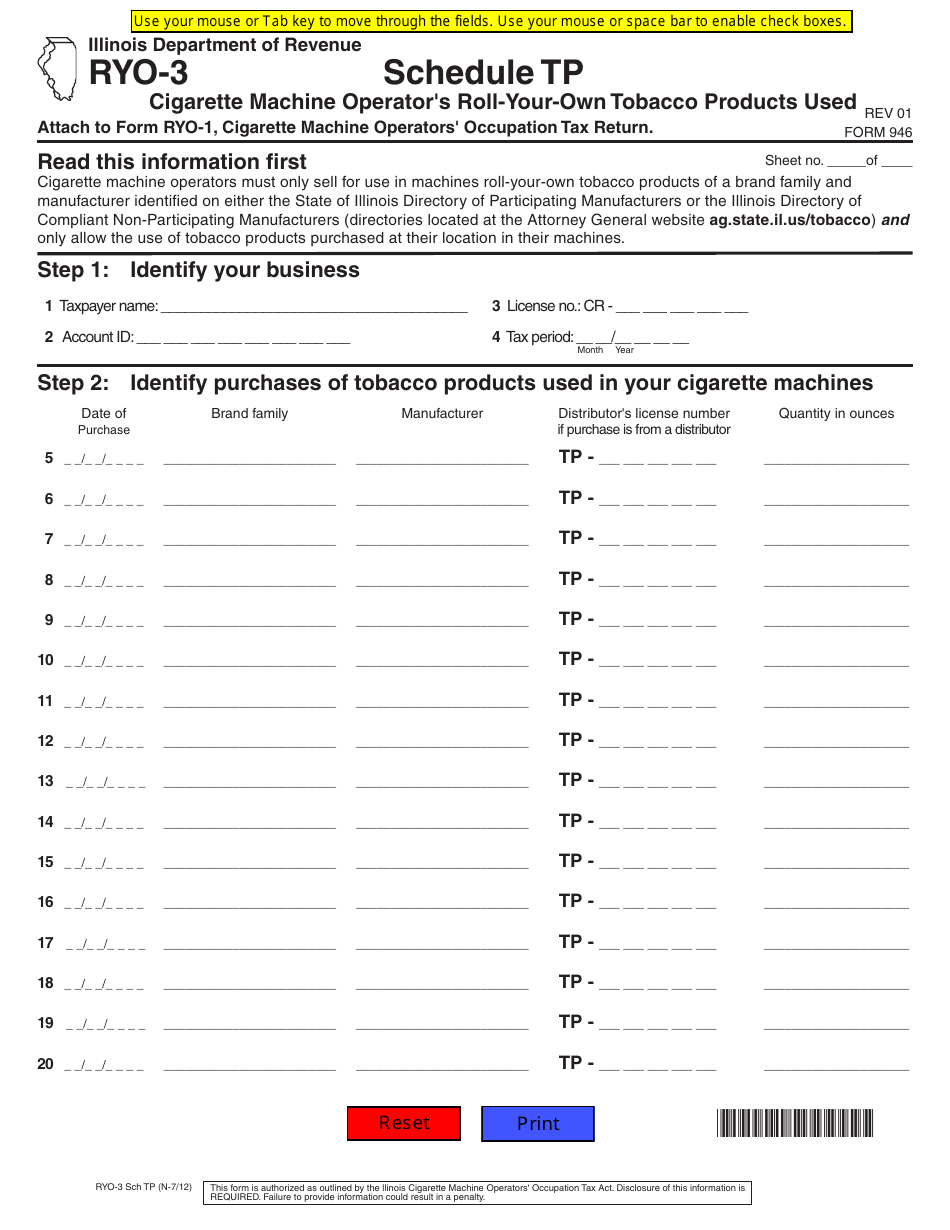

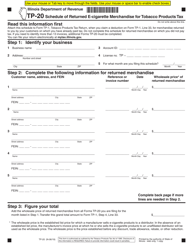

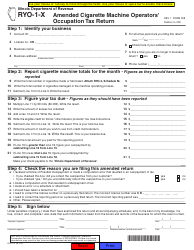

Form RYO-3 Schedule TP Cigarette Machine Operator's Roll-Your-Own Tobacco Products Used - Illinois

What Is Form RYO-3 Schedule TP?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RYO-3 Schedule TP?

A: Form RYO-3 Schedule TP is a tax form used in Illinois for reporting the usage of roll-your-own tobacco products.

Q: Who needs to file Form RYO-3 Schedule TP?

A: Cigarette machine operators who use roll-your-own tobacco products in Illinois need to file Form RYO-3 Schedule TP.

Q: What is the purpose of Form RYO-3 Schedule TP?

A: The purpose of Form RYO-3 Schedule TP is to report the usage of roll-your-own tobacco products for tax purposes in Illinois.

Q: What information is required on Form RYO-3 Schedule TP?

A: Form RYO-3 Schedule TP requires the cigarette machine operator to report the quantity of roll-your-own tobacco products used and the tax due.

Q: When is Form RYO-3 Schedule TP due?

A: Form RYO-3 Schedule TP is typically due on a monthly or quarterly basis, depending on the frequency of roll-your-own tobacco product usage.

Form Details:

- Released on July 1, 2012;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RYO-3 Schedule TP by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.