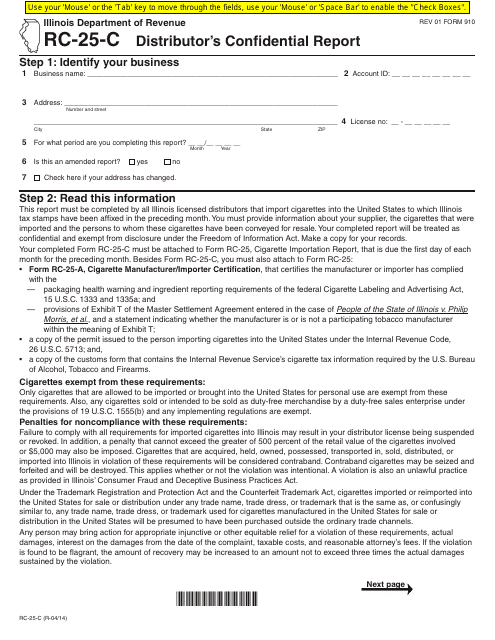

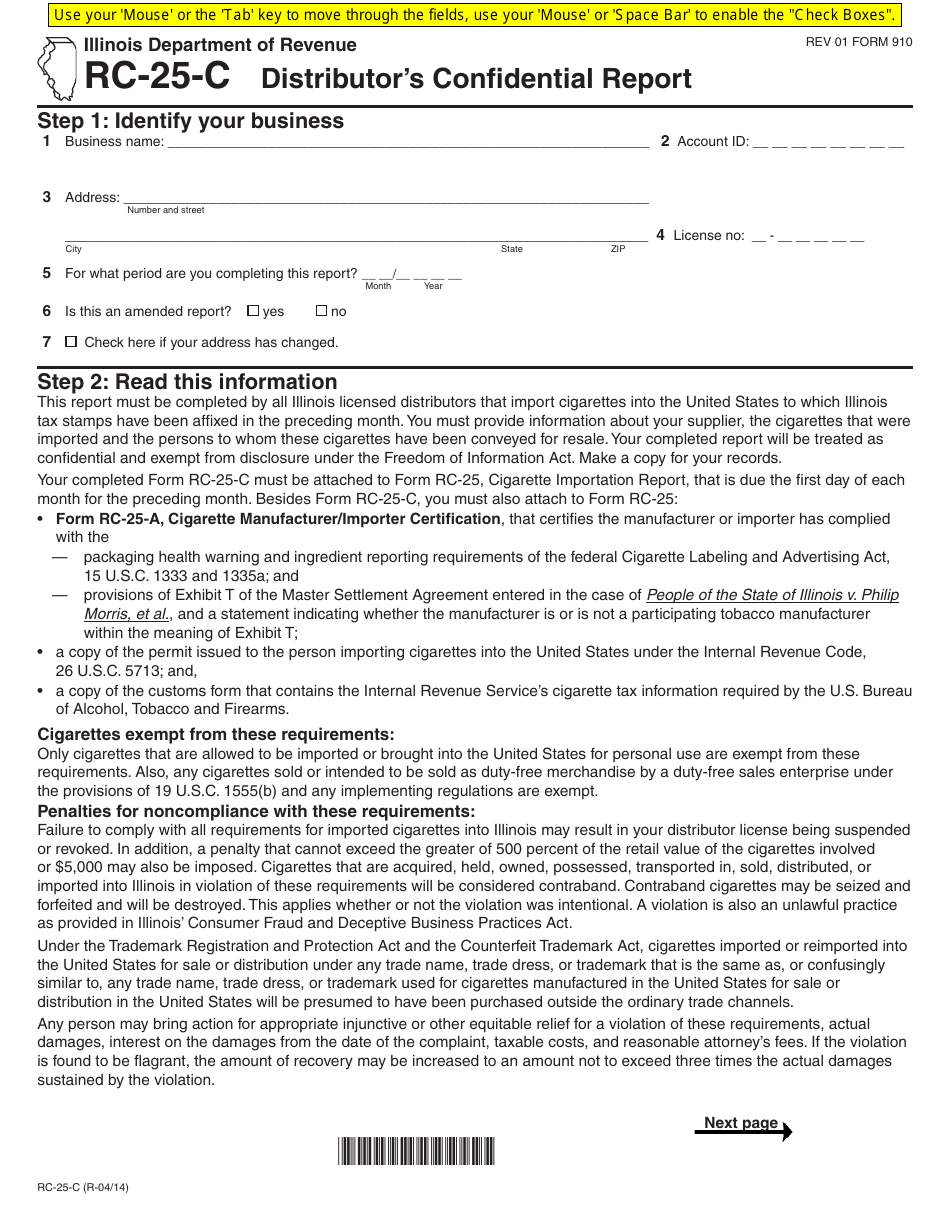

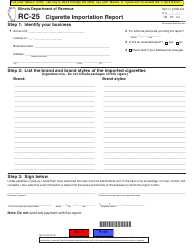

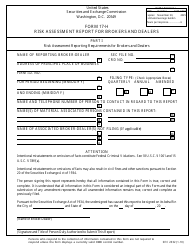

Form RC-25-C Distributor's Confidential Report - Illinois

What Is Form RC-25-C?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RC-25-C?

A: Form RC-25-C is the Distributor's Confidential Report for Illinois.

Q: Who needs to file Form RC-25-C?

A: Distributors in Illinois are required to file Form RC-25-C.

Q: What is the purpose of Form RC-25-C?

A: The purpose of Form RC-25-C is to report confidential information related to the distribution of products in Illinois.

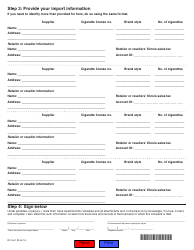

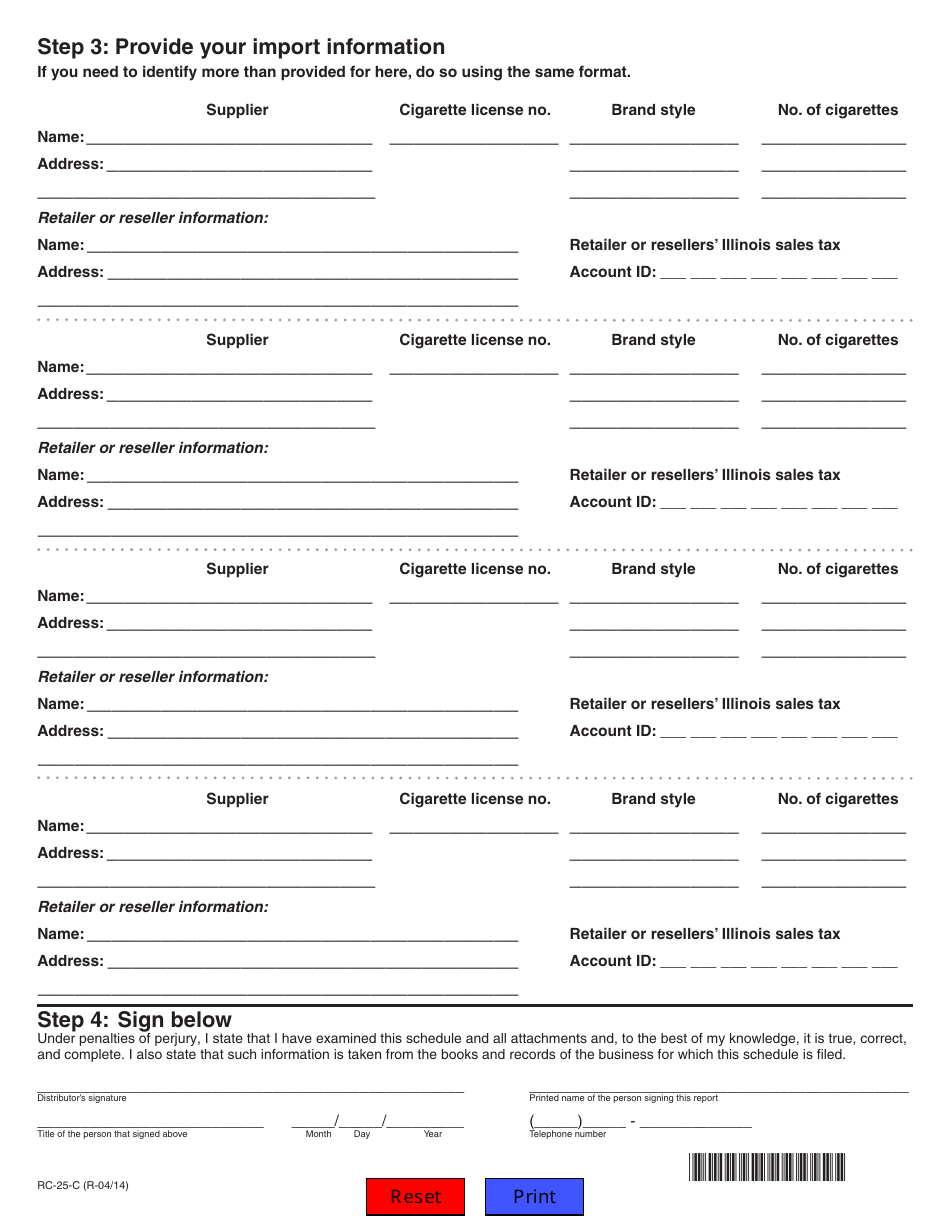

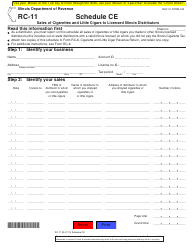

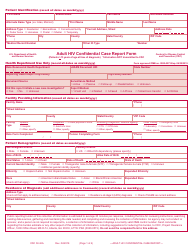

Q: What information is required on Form RC-25-C?

A: Form RC-25-C requires information such as sales, purchases, inventory, and other related data.

Q: When is Form RC-25-C due?

A: Form RC-25-C is due by the 20th day of the month following the end of the reporting period.

Q: Are there any penalties for late filing of Form RC-25-C?

A: Yes, there may be penalties for late filing of Form RC-25-C, including interest charges and potential enforcement actions by the Illinois Department of Revenue.

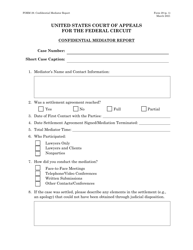

Q: Is Form RC-25-C confidential?

A: Yes, Form RC-25-C is considered confidential and should only be shared with the Illinois Department of Revenue.

Q: Can I electronically file Form RC-25-C?

A: Yes, electronic filing is available for Form RC-25-C through the Illinois Department of Revenue's e-services portal.

Q: What should I do if I have questions about Form RC-25-C?

A: If you have questions about Form RC-25-C, you should contact the Illinois Department of Revenue for assistance.

Form Details:

- Released on April 1, 2014;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RC-25-C by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.