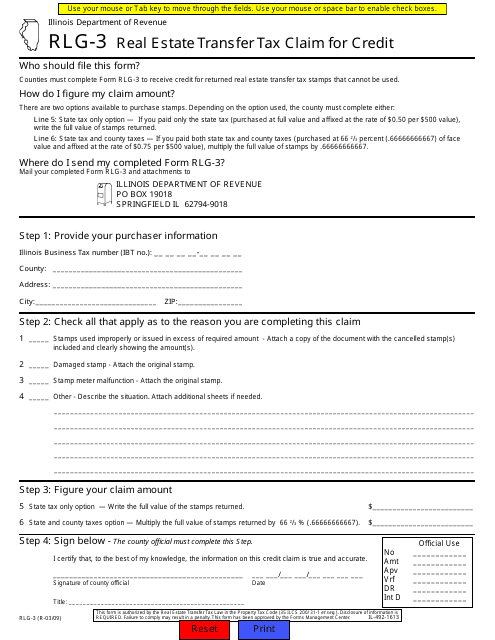

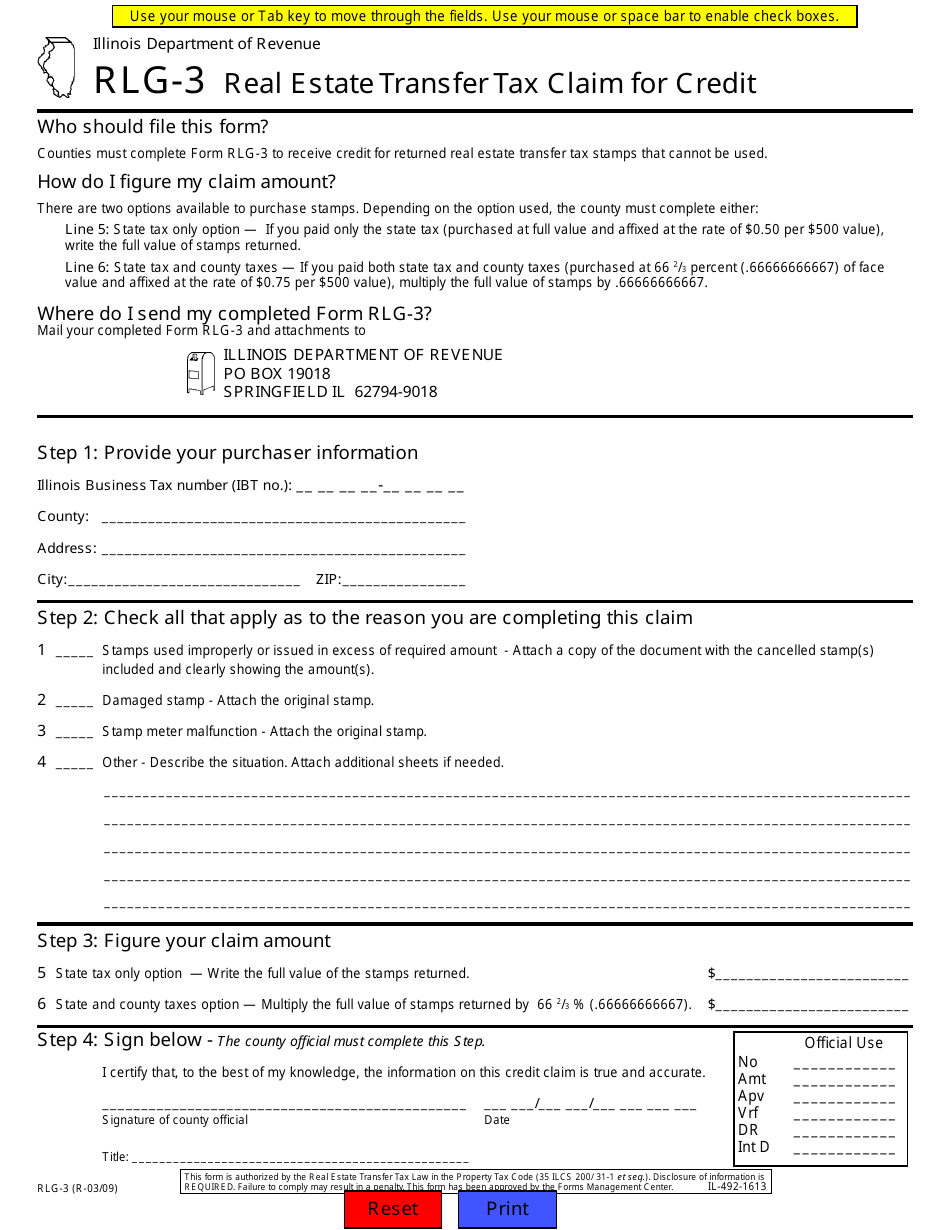

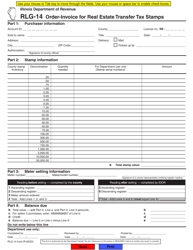

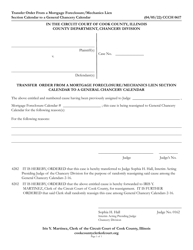

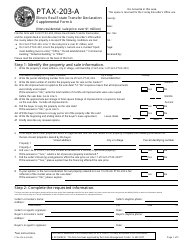

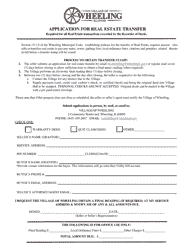

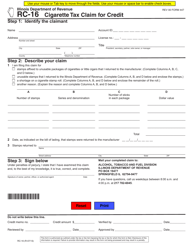

Form RLG-3 Real Estate Transfer Tax Claim for Credit - Illinois

What Is Form RLG-3?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RLG-3?

A: Form RLG-3 is the Real Estate Transfer Tax Claim for Credit form used in Illinois.

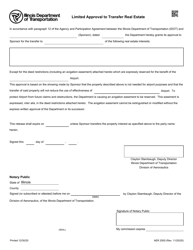

Q: What is the purpose of Form RLG-3?

A: The purpose of Form RLG-3 is to claim a credit for real estate transfertax paid in Illinois.

Q: Who can use Form RLG-3?

A: Anyone who has paid real estate transfer tax in Illinois can use Form RLG-3 to claim a credit.

Q: How do I fill out Form RLG-3?

A: You must provide your personal information, details of the real estate transaction, and evidence of the transfer tax paid.

Q: Is there a deadline for filing Form RLG-3?

A: Yes, Form RLG-3 must be filed within one year from the date of the real estate transaction to claim the credit.

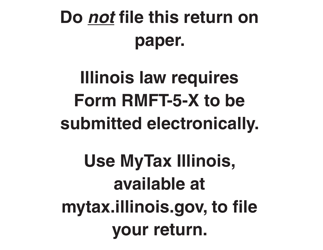

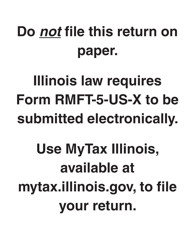

Q: Can I file Form RLG-3 electronically?

A: No, currently Form RLG-3 can only be filed by mail.

Q: What happens after I submit Form RLG-3?

A: The Illinois Department of Revenue will review your claim and notify you of their decision.

Q: Can I appeal if my claim is denied?

A: Yes, if your claim is denied, you can file an appeal with the Illinois Department of Revenue.

Form Details:

- Released on March 1, 2009;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RLG-3 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.