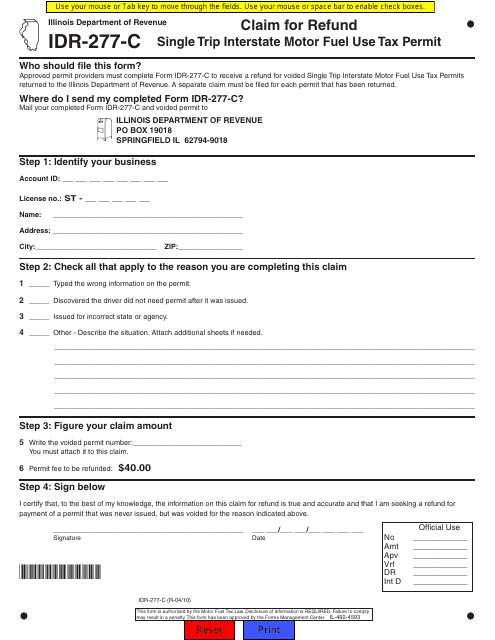

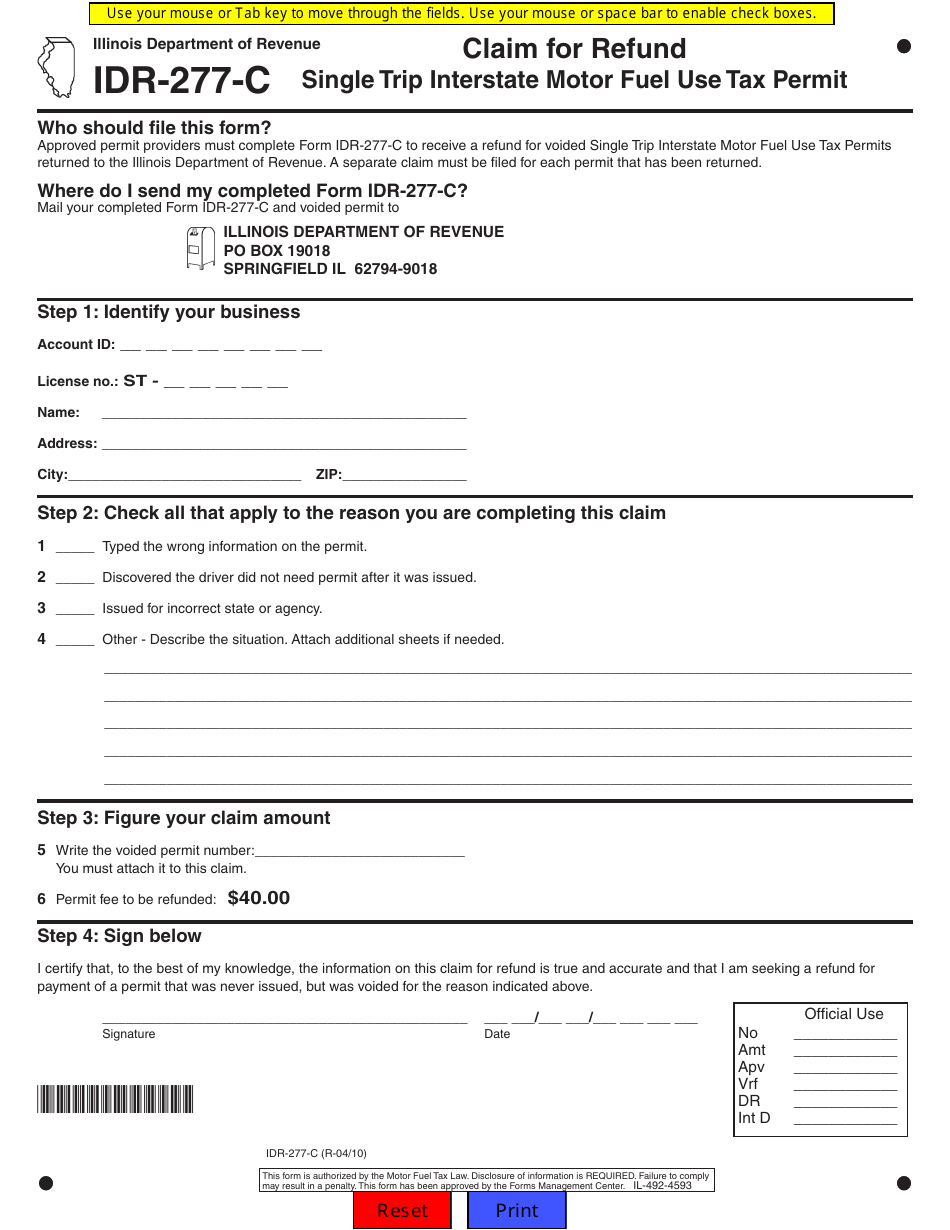

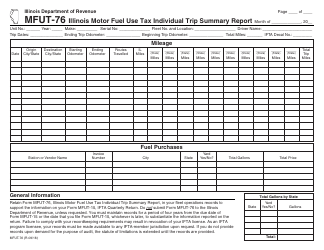

Form IDR-277-C Claim for Refund - Single Trip Interstate Motor Fuel Use Tax Permit - Illinois

What Is Form IDR-277-C?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form IDR-277-C?

A: The Form IDR-277-C is a Claim for Refund for Single Trip Interstate Motor Fuel Use Tax Permit in Illinois.

Q: What is Single Trip Interstate Motor Fuel Use Tax Permit?

A: Single Trip Interstate Motor Fuel Use Tax Permit is a permit allowing the transportation of motor fuel through Illinois.

Q: Who can file a Claim for Refund using Form IDR-277-C?

A: Any person who paid motor fuel use tax in Illinois for a single trip can file a Claim for Refund using Form IDR-277-C.

Q: What information is required on Form IDR-277-C?

A: Form IDR-277-C requires information such as the trip start and end dates, origin and destination, gallons of fuel used, and the amount of tax paid.

Q: Is there a deadline for filing Form IDR-277-C?

A: Yes, the deadline for filing Form IDR-277-C is three years from the due date of the original tax return or one year from the date of overpayment, whichever is later.

Q: Can I claim a refund for a trip that occurred more than three years ago?

A: No, you cannot claim a refund for a trip that occurred more than three years ago.

Q: What should I do if I made a mistake on Form IDR-277-C?

A: If you made a mistake on Form IDR-277-C, you should file an amended claim with the correct information.

Q: How long does it take to process a claim for refund using Form IDR-277-C?

A: The processing time for a claim for refund using Form IDR-277-C can vary, but it typically takes several weeks.

Q: What happens if my claim for refund is approved?

A: If your claim for refund is approved, you will receive a refund of the motor fuel use tax you paid for the single trip.

Form Details:

- Released on April 1, 2010;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IDR-277-C by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.