This version of the form is not currently in use and is provided for reference only. Download this version of

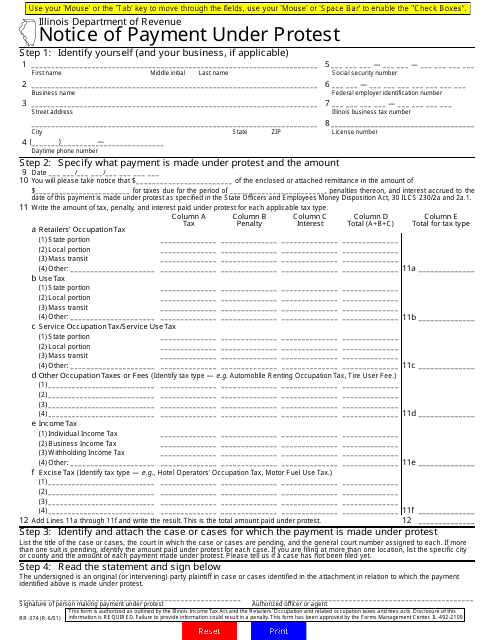

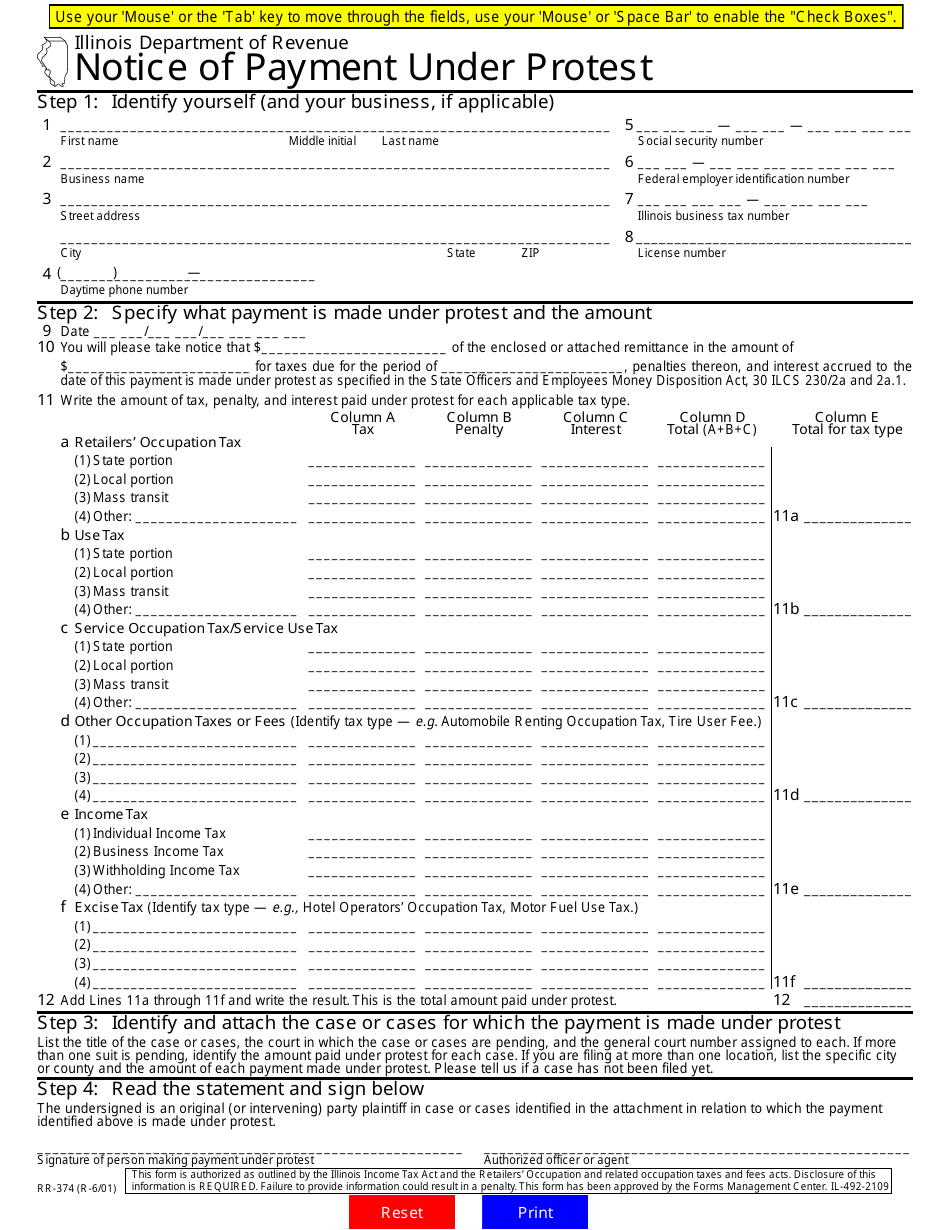

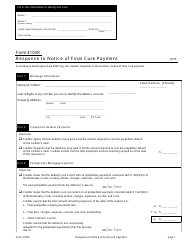

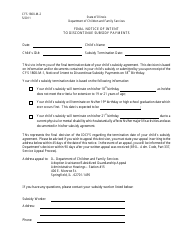

Form RR-374

for the current year.

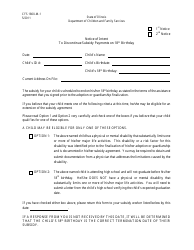

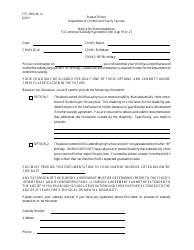

Form RR-374 Notice of Payment Under Protest - Illinois

What Is Form RR-374?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RR-374?

A: Form RR-374 is the Notice of Payment Under Protest form in Illinois.

Q: When should I use Form RR-374?

A: You should use Form RR-374 when you want to protest a payment in Illinois.

Q: What is the purpose of Form RR-374?

A: The purpose of Form RR-374 is to notify the Illinois Department of Revenue that you are paying a tax under protest and to preserve your right to challenge the tax.

Q: How do I fill out Form RR-374?

A: You need to fill out the taxpayer information, provide the details of the tax being paid under protest, state the reason for the protest, and sign the form.

Q: Is there a deadline for filing Form RR-374?

A: Yes, you must file Form RR-374 within one year from the date of the protested payment.

Q: What happens after I file Form RR-374?

A: After you file Form RR-374, the Illinois Department of Revenue will review your protest and may schedule a hearing to resolve the dispute.

Q: Can I get a refund if my protest is successful?

A: Yes, if your protest is successful, you may be eligible for a refund of the payment made under protest.

Form Details:

- Released on June 1, 2001;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RR-374 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.