This version of the form is not currently in use and is provided for reference only. Download this version of

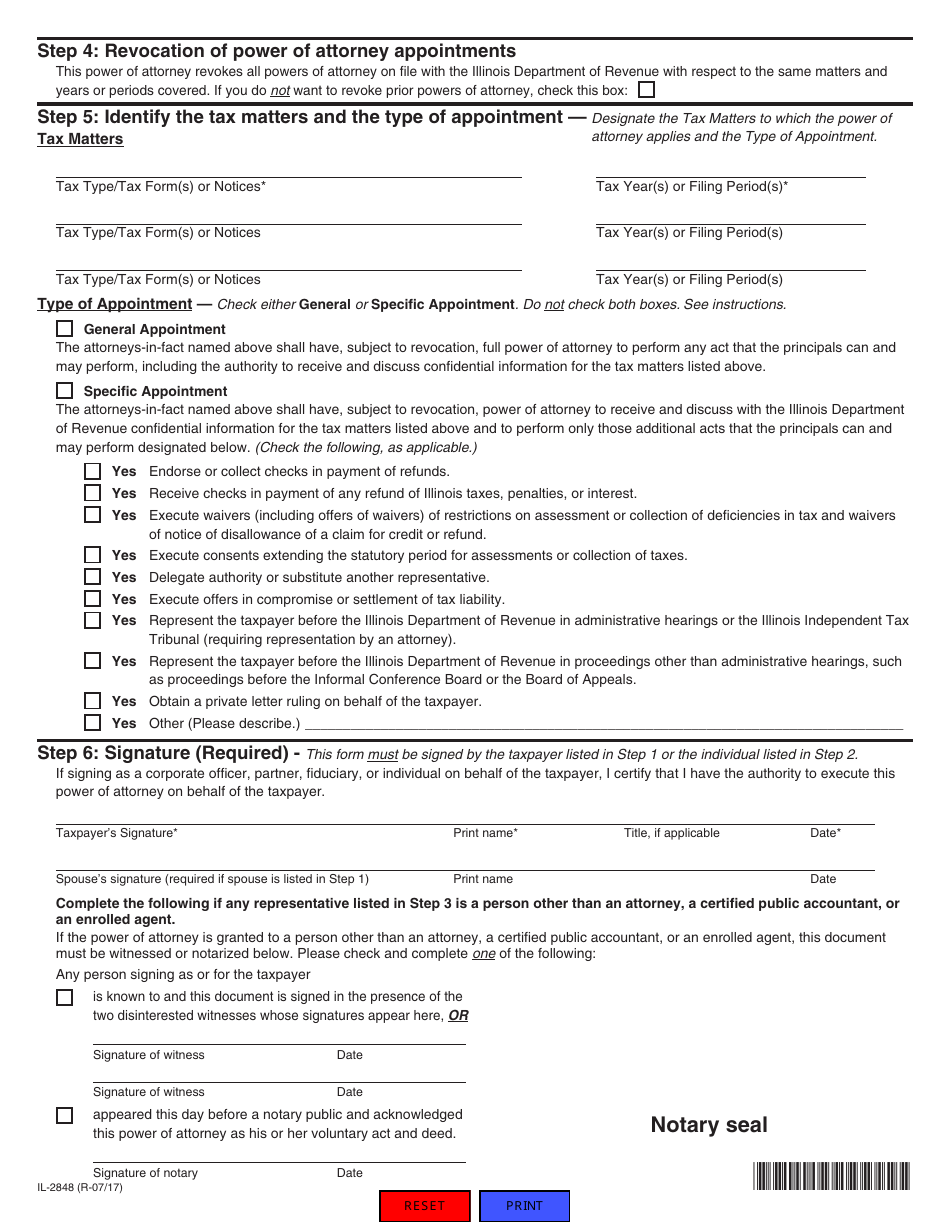

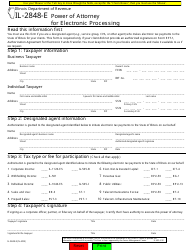

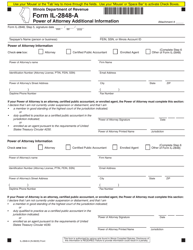

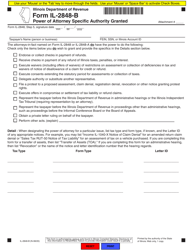

Form IL-2848

for the current year.

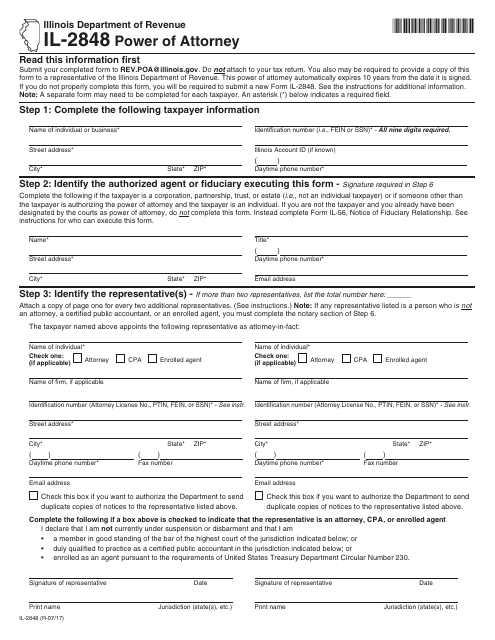

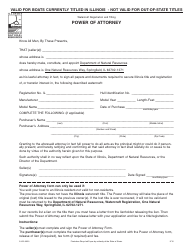

Form IL-2848 Power of Attorney - Illinois

What Is Form IL-2848?

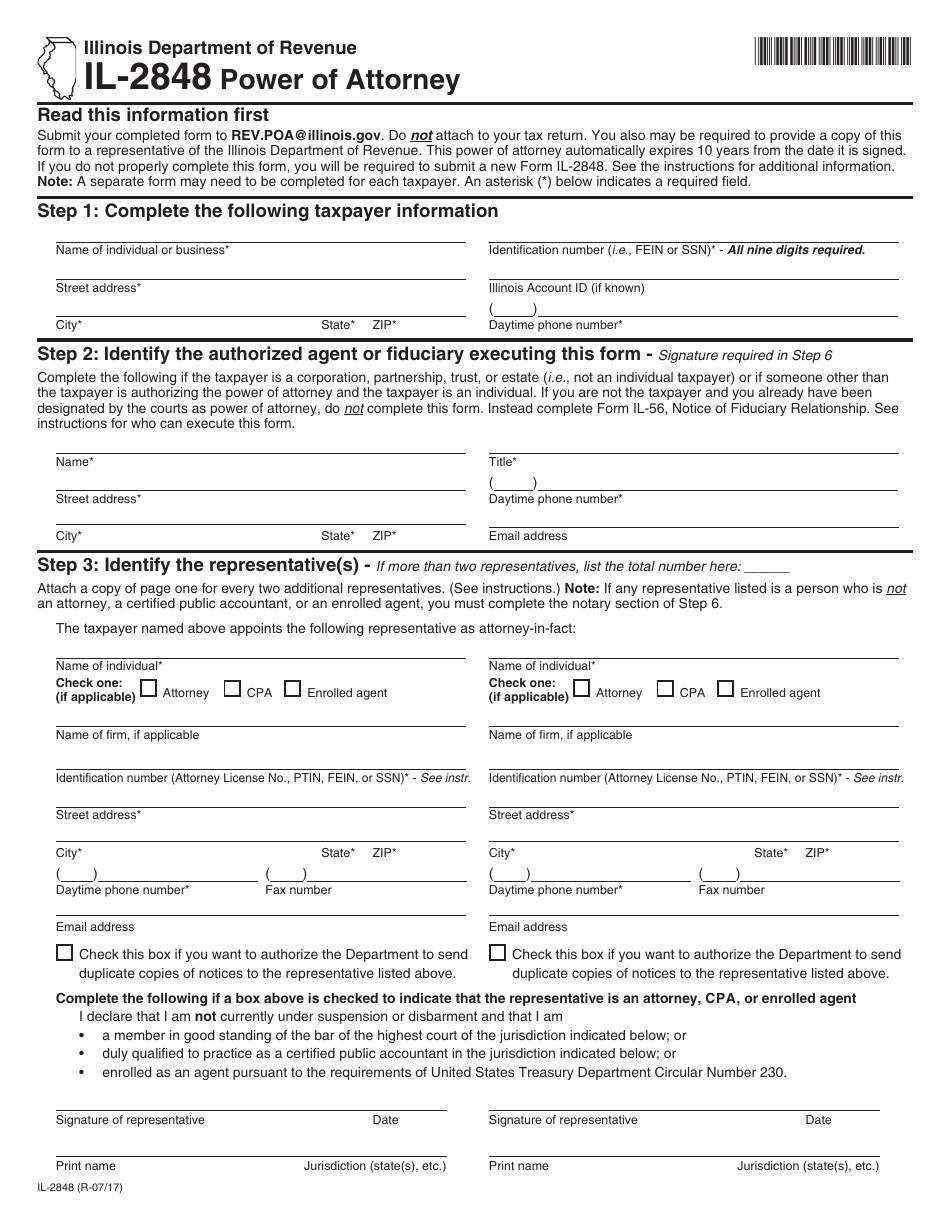

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form IL-2848?

A: Form IL-2848 is a Power of Attorney form used in the state of Illinois.

Q: What is the purpose of Form IL-2848?

A: The purpose of Form IL-2848 is to authorize someone to act on your behalf in tax matters related to the Illinois Department of Revenue.

Q: Who should use Form IL-2848?

A: Individuals or businesses who want to authorize someone else to represent them before the Illinois Department of Revenue should use Form IL-2848.

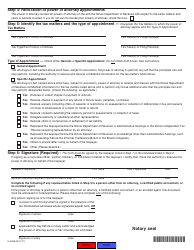

Q: What information is required on Form IL-2848?

A: Form IL-2848 requires information such as the taxpayer's name, taxpayer identification number, representative's name and address, and a description of the tax matters for which the representative is authorized.

Q: Is there a fee to file Form IL-2848?

A: No, there is no fee to file Form IL-2848.

Q: Can I revoke a Power of Attorney granted with Form IL-2848?

A: Yes, you can revoke a Power of Attorney granted with Form IL-2848 by submitting a written statement to the Illinois Department of Revenue.

Q: How long is Form IL-2848 valid?

A: Form IL-2848 is generally valid for three years from the date of signature, unless a specific end date is indicated.

Form Details:

- Released on July 1, 2017;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-2848 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.