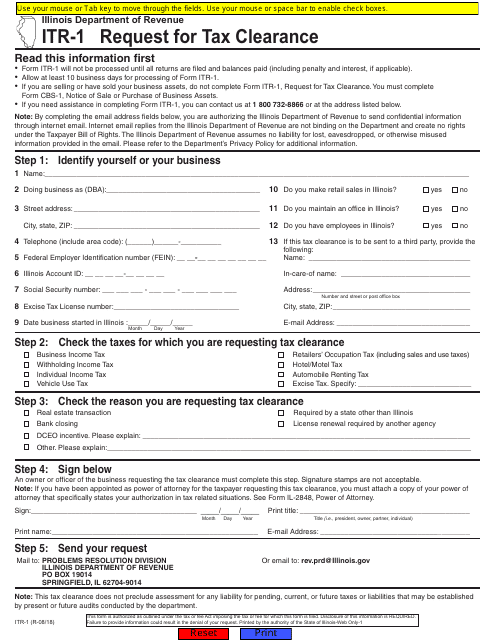

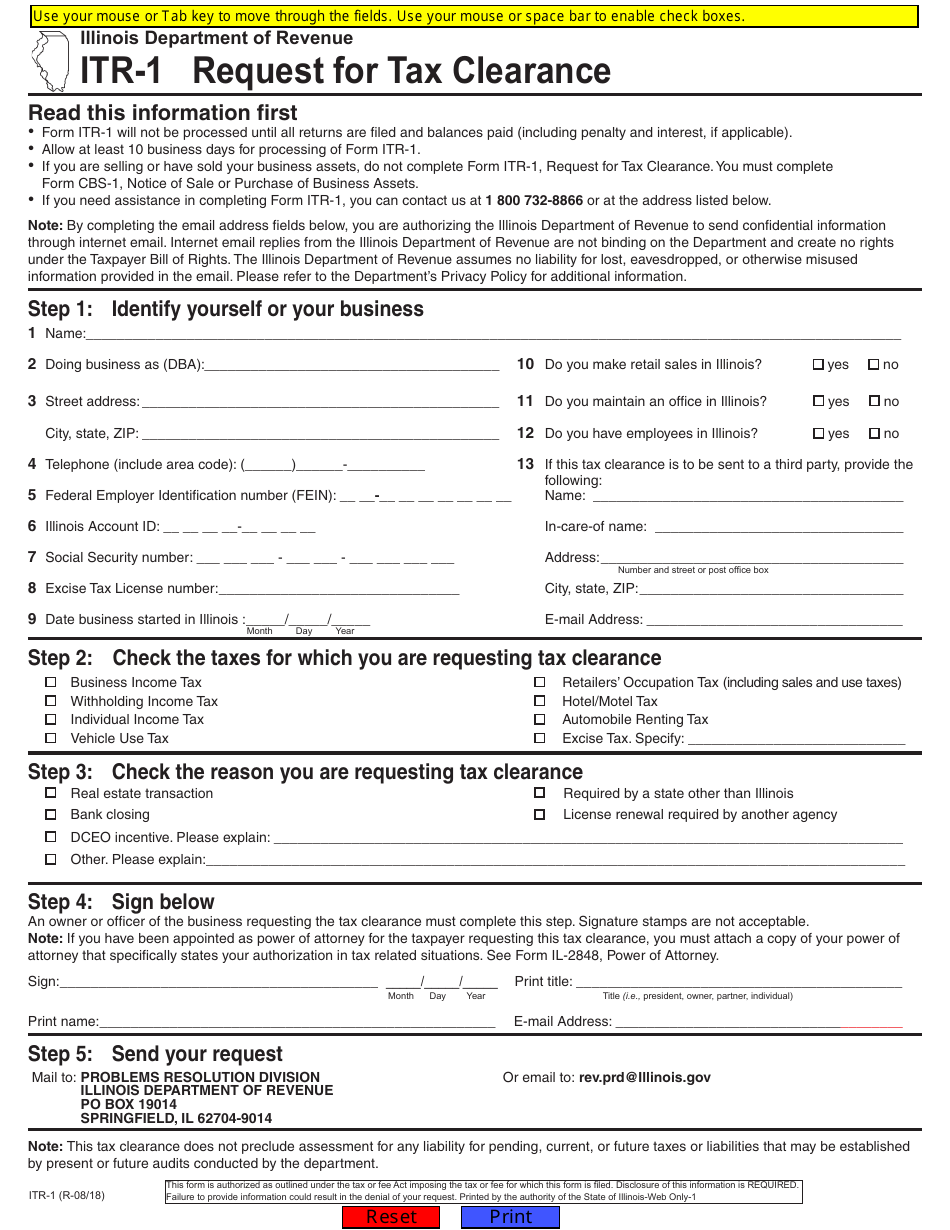

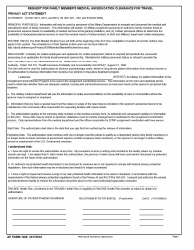

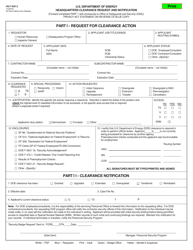

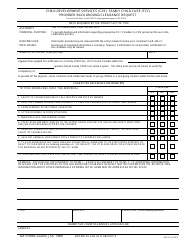

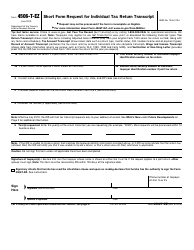

Form ITR-1 Itr-1 Request for Tax Clearance - Illinois

What Is Form ITR-1?

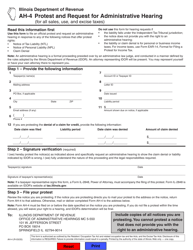

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

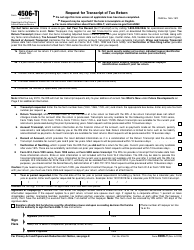

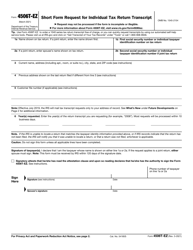

Q: What is Form ITR-1?

A: Form ITR-1 is an income tax return form used by individuals who have earned income from salary, pension, or income from one house property.

Q: What is the purpose of Form ITR-1?

A: The purpose of Form ITR-1 is to file your income tax return and claim any deductions or refunds you may be eligible for.

Q: Who should file Form ITR-1?

A: Form ITR-1 should be filed by individuals whose total income for the financial year includes income from salary, pension, or income from one house property.

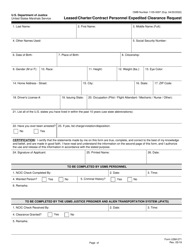

Q: What is Tax Clearance?

A: Tax clearance is a confirmation from the tax authorities that an individual's tax obligations have been met and there are no outstanding tax dues.

Q: What is the Illinois tax clearance process?

A: The Illinois tax clearance process involves submitting Form ITR-1 to the tax authorities to request a tax clearance certificate, which confirms that your tax obligations have been fulfilled in the state of Illinois.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ITR-1 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.