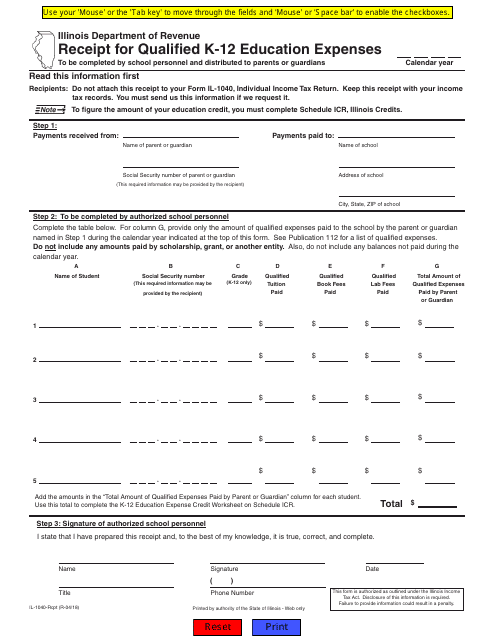

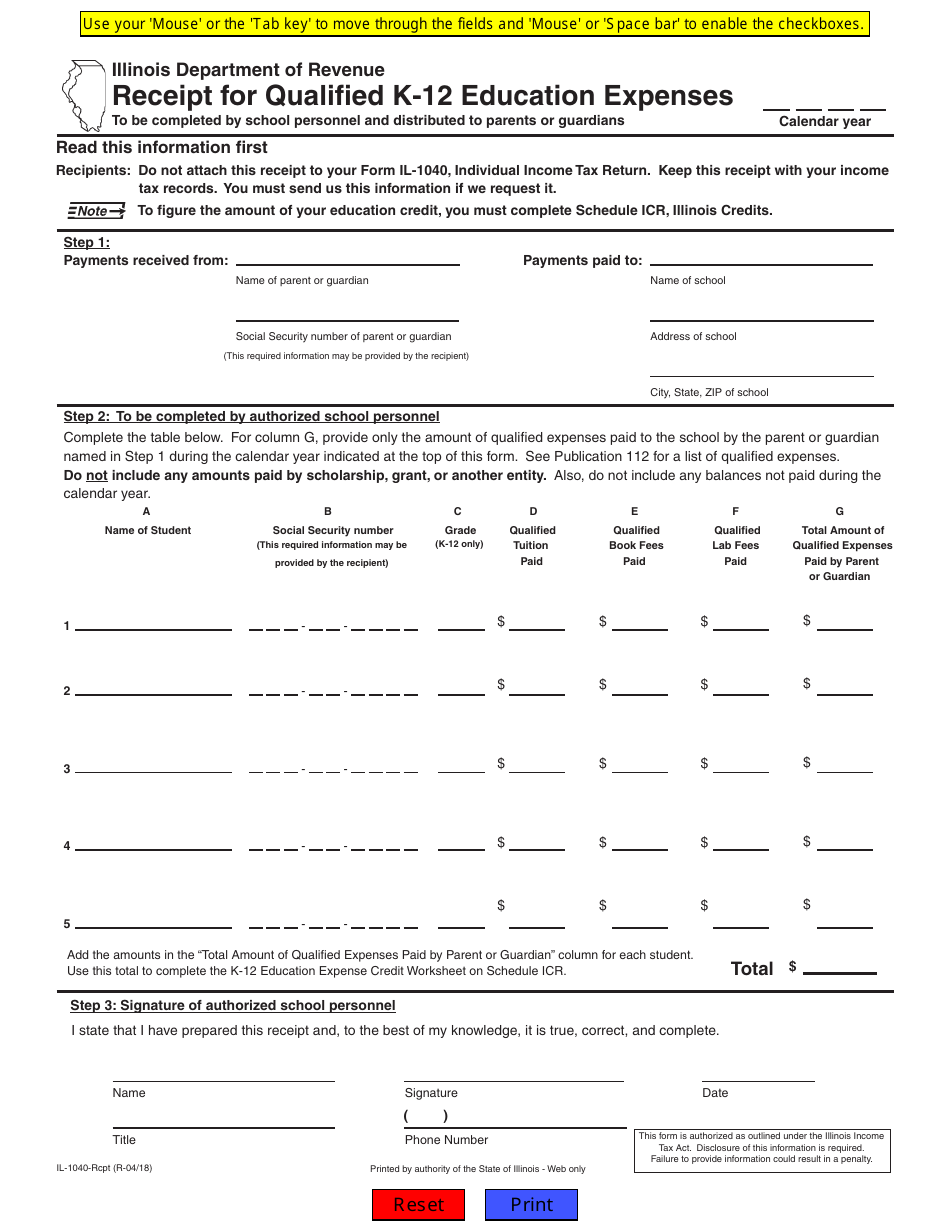

Form IL-1040-RCPT Receipt for Qualified K-12 Education Expenses - Illinois

What Is Form IL-1040-RCPT?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL-1040-RCPT?

A: Form IL-1040-RCPT is a receipt for qualified K-12 education expenses in Illinois.

Q: What are qualified K-12 education expenses?

A: Qualified K-12 education expenses are expenses related to tuition, books, supplies, and certain educational programs for children in kindergarten through 12th grade.

Q: Who should use Form IL-1040-RCPT?

A: Parents or guardians who have incurred qualified K-12 education expenses for their children in Illinois should use Form IL-1040-RCPT.

Q: What do I need to include on Form IL-1040-RCPT?

A: You need to include the name of the educational institution, the child's name, the child's date of birth, the amount of qualified education expenses, and your contact information on Form IL-1040-RCPT.

Q: When is the deadline to submit Form IL-1040-RCPT?

A: Form IL-1040-RCPT should be submitted at the same time as your Illinois income tax return, which is typically due on April 15th each year.

Q: What happens after I submit Form IL-1040-RCPT?

A: If your qualified K-12 education expenses meet the necessary criteria, you may be eligible for the Illinois Education Expense Credit or the Illinois K-12 Education Expense Credit.

Q: Are there any limitations or restrictions on the Illinois Education Expense Credit?

A: Yes, there are income limitations and other restrictions that apply to the Illinois Education Expense Credit. It's important to review the instructions and consult with a tax professional if needed.

Q: Can I claim the Illinois Education Expense Credit if I homeschool my children?

A: No, the Illinois Education Expense Credit is not available for homeschooling expenses. It is only applicable to expenses incurred at qualified educational institutions.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-1040-RCPT by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.