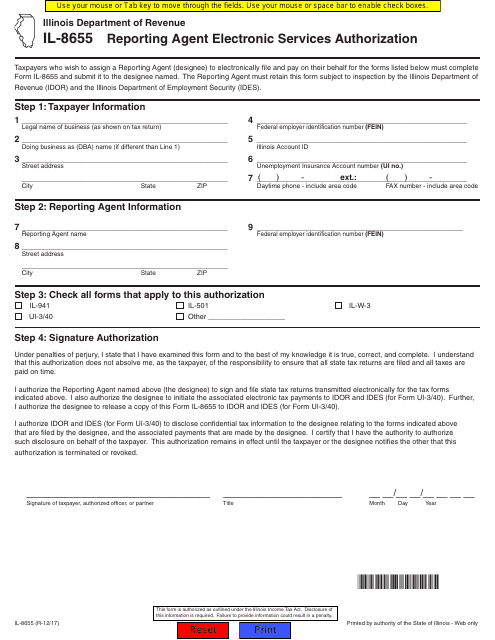

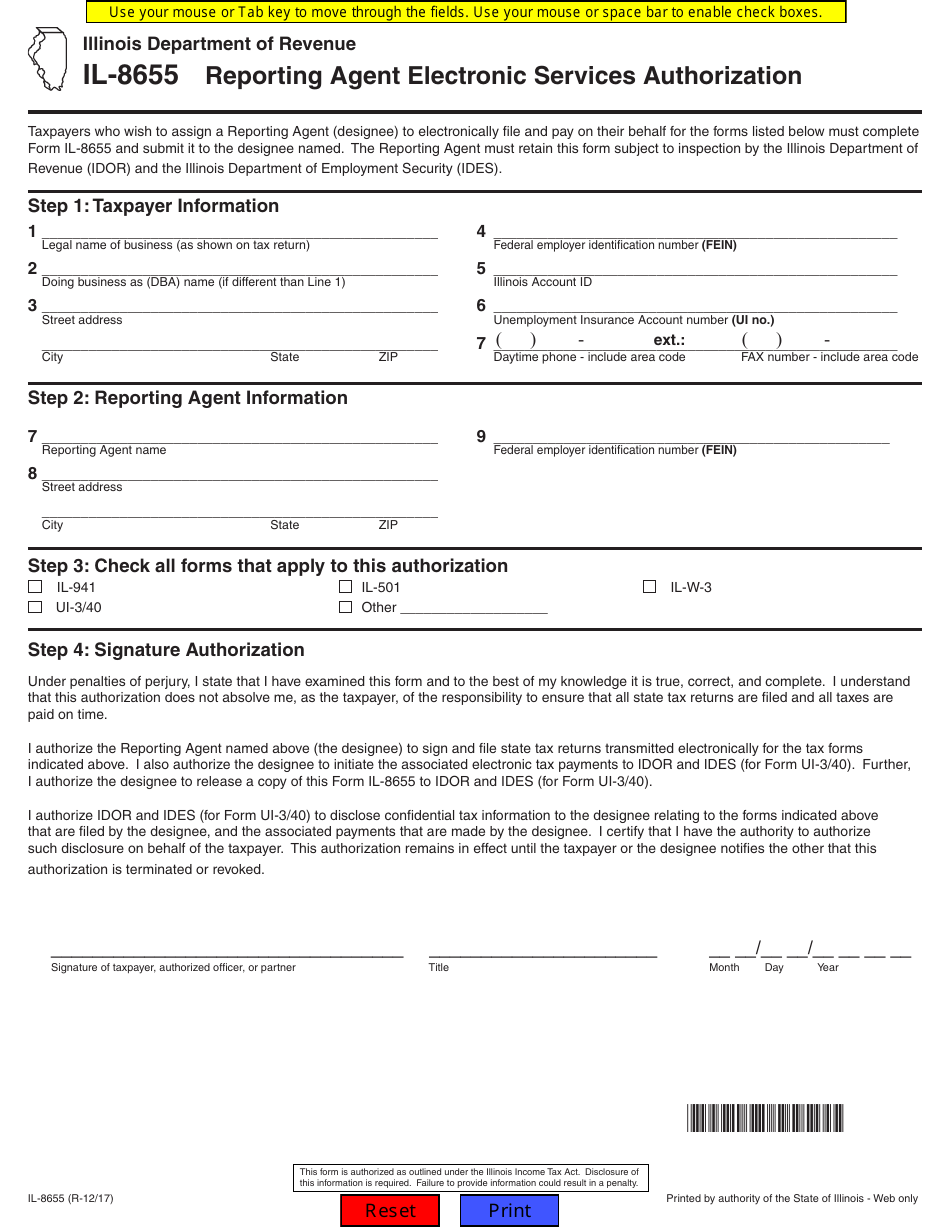

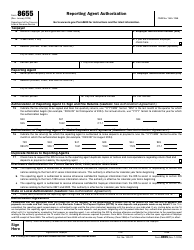

Form IL-8655 Reporting Agent Electronic Services Authorization - Illinois

What Is Form IL-8655?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IL-8655?

A: Form IL-8655 is the Reporting Agent Electronic Services Authorization for Illinois.

Q: What is the purpose of Form IL-8655?

A: The purpose of Form IL-8655 is to authorize a reporting agent to file electronic returns, reports, and other documents on behalf of the taxpayer.

Q: Who needs to file Form IL-8655?

A: Taxpayers who want to authorize a reporting agent to file electronic returns, reports, and other documents on their behalf need to file Form IL-8655.

Q: Is there a fee for filing Form IL-8655?

A: No, there is no fee for filing Form IL-8655.

Q: Can Form IL-8655 be filed electronically?

A: Yes, Form IL-8655 can be filed electronically.

Q: What information is required on Form IL-8655?

A: Form IL-8655 requires information such as the taxpayer's name, address, tax identification number, and the reporting agent's information.

Q: Is Form IL-8655 only for individuals or can businesses also file it?

A: Both individuals and businesses can file Form IL-8655.

Q: Can a taxpayer revoke the authorization granted on Form IL-8655?

A: Yes, a taxpayer can revoke the authorization granted on Form IL-8655 by submitting a written notice to the Illinois Department of Revenue.

Q: What are the consequences of revoking the authorization on Form IL-8655?

A: Revoking the authorization on Form IL-8655 means the reporting agent will no longer be able to file electronic returns, reports, and other documents on behalf of the taxpayer.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IL-8655 by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.