This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form REG-8-A

for the current year.

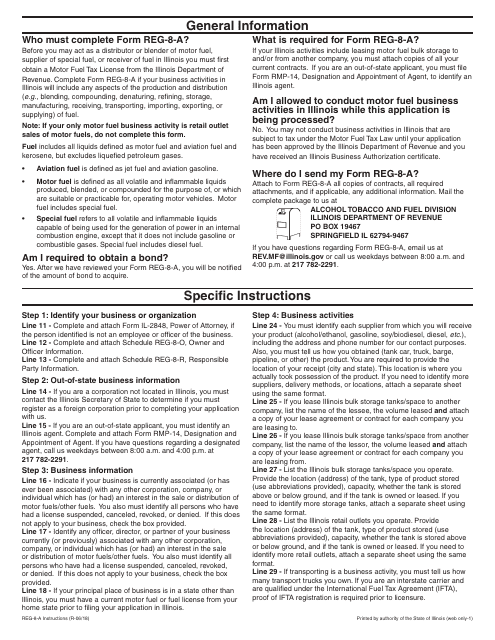

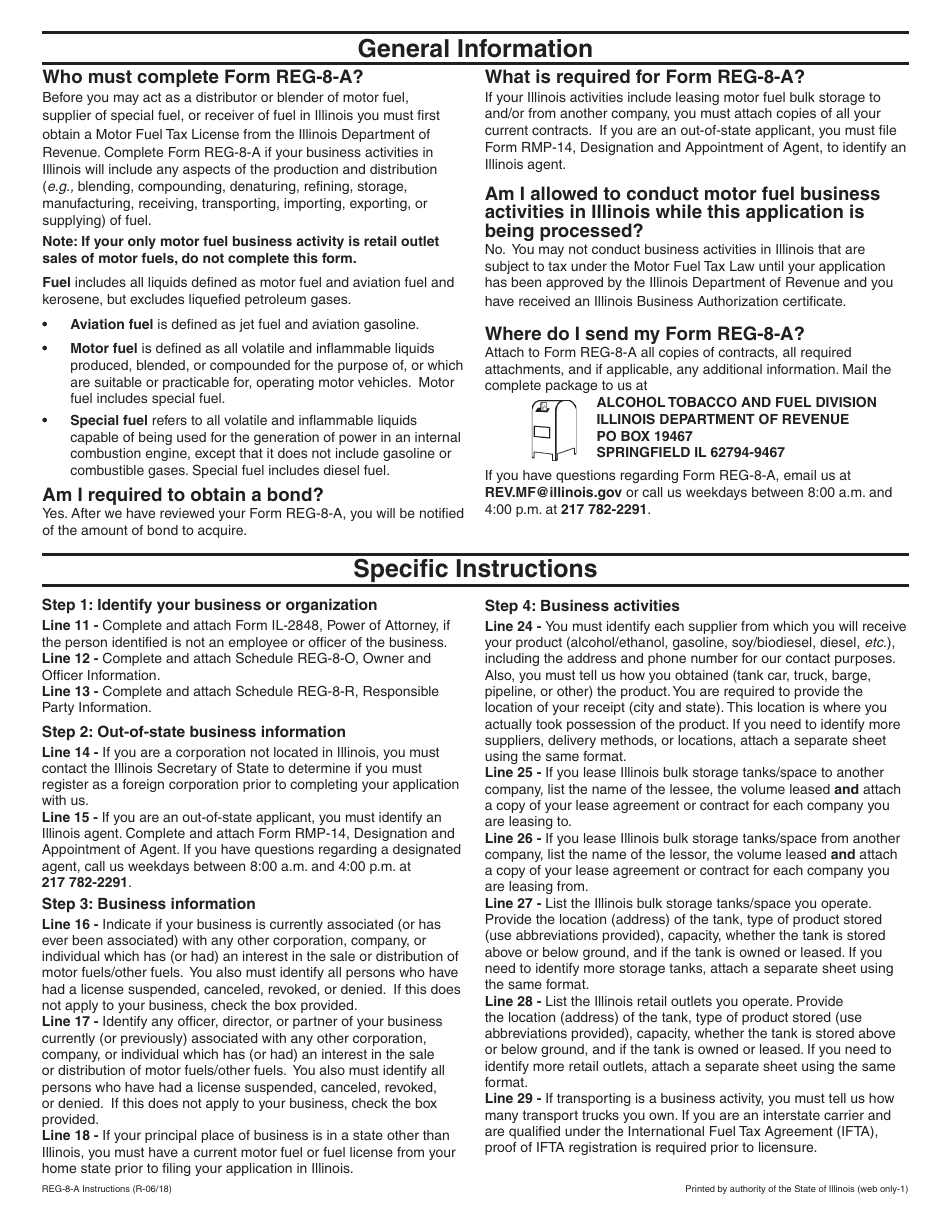

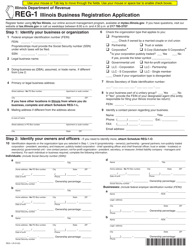

Instructions for Form REG-8-A Application for Motor Fuel Tax License (Distributor, Supplier, Receiver, and / or Blender) - Illinois

This document contains official instructions for Form REG-8-A , Application for Tax License (Distributor, Supplier, Receiver, and/or Blender) - a form released and collected by the Illinois Department of Revenue. An up-to-date fillable Form REG-8-A is available for download through this link.

FAQ

Q: What is Form REG-8-A?

A: Form REG-8-A is an application form for obtaining a Motor Fuel Tax License in Illinois.

Q: Who needs to complete Form REG-8-A?

A: Distributors, suppliers, receivers, and/or blenders of motor fuel in Illinois need to complete Form REG-8-A.

Q: What is a Motor Fuel Tax License?

A: A Motor Fuel Tax License is a license that allows individuals or businesses to distribute, supply, receive, or blend motor fuel in Illinois.

Q: What information is required on Form REG-8-A?

A: Form REG-8-A requires information such as the applicant's name, business address, ownership structure, and details about the motor fuel operations.

Q: Are there any fees associated with the application?

A: Yes, there are fees associated with the application. The specific fee amounts can be found on the Form REG-8-A instructions.

Q: How long does it take to process the application?

A: The processing time for Form REG-8-A may vary, but it is typically processed within a few weeks.

Q: What should I do if I have additional questions about Form REG-8-A?

A: If you have additional questions about Form REG-8-A, you can contact the Illinois Department of Revenue for assistance.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.