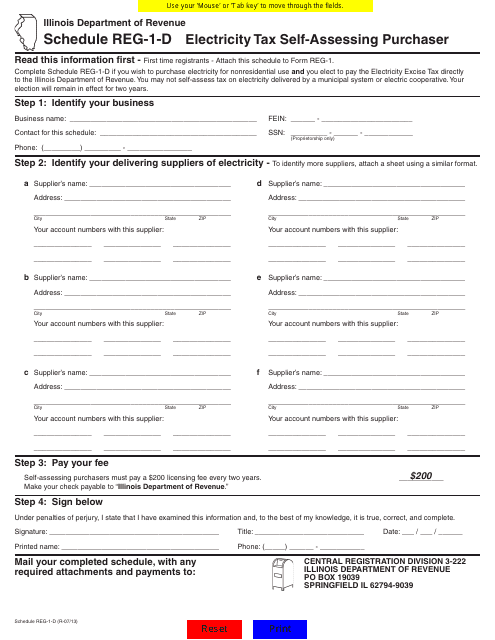

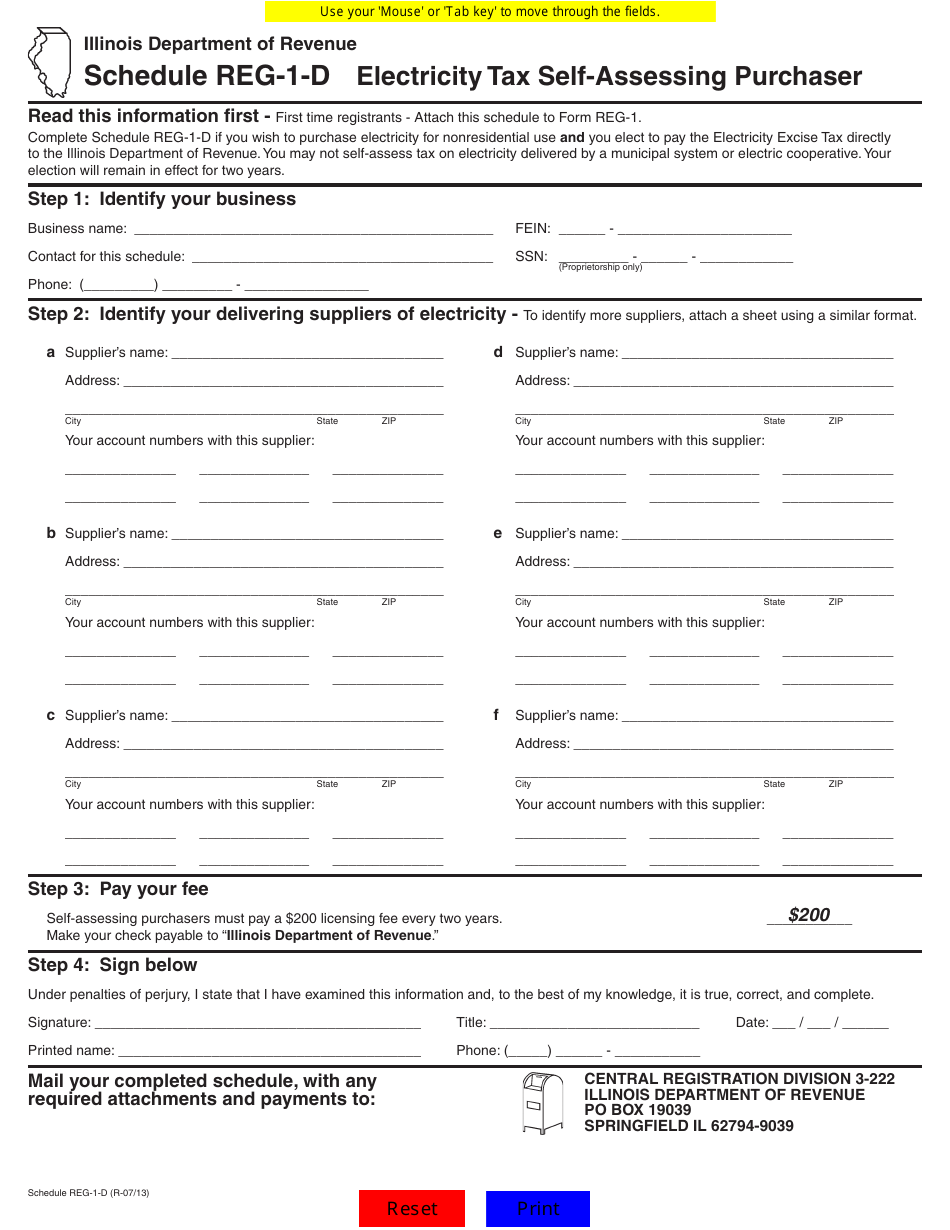

Form REG-1 Schedule REG-1-D Electricity Tax Self-assessing Purchaser - Illinois

What Is Form REG-1 Schedule REG-1-D?

This is a legal form that was released by the Illinois Department of Revenue - a government authority operating within Illinois.The document is a supplement to Form REG-1, Illinois Business Registration Application. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is REG-1 Schedule REG-1-D?

A: REG-1 Schedule REG-1-D is a form used for self-assessing electricity tax by purchasers in Illinois.

Q: Who uses REG-1 Schedule REG-1-D?

A: Purchasers of electricity in Illinois use REG-1 Schedule REG-1-D.

Q: What is the purpose of REG-1 Schedule REG-1-D?

A: The purpose of REG-1 Schedule REG-1-D is to self-assess and pay electricity tax.

Q: What is electricity tax?

A: Electricity tax is a tax imposed on the use and consumption of electricity.

Q: How do I complete REG-1 Schedule REG-1-D?

A: Follow the instructions provided on the form to complete REG-1 Schedule REG-1-D accurately.

Q: When is REG-1 Schedule REG-1-D due?

A: REG-1 Schedule REG-1-D is generally due on a monthly basis, but refer to the instructions or your tax advisor for specific deadlines.

Q: What happens if I don't file REG-1 Schedule REG-1-D?

A: Failure to file REG-1 Schedule REG-1-D or pay the electricity tax may result in penalties and interest.

Q: Can I file REG-1 Schedule REG-1-D electronically?

A: Yes, you can file REG-1 Schedule REG-1-D electronically through the Illinois Department of Revenue's e-Services.

Q: Are there any exemptions or deductions available for electricity tax?

A: There may be exemptions or deductions available for electricity tax, and you should refer to the instructions or consult a tax advisor for more information.

Form Details:

- Released on July 1, 2013;

- The latest edition provided by the Illinois Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REG-1 Schedule REG-1-D by clicking the link below or browse more documents and templates provided by the Illinois Department of Revenue.