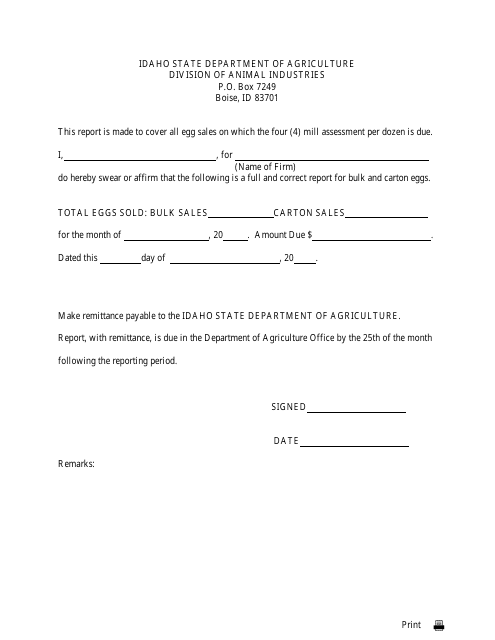

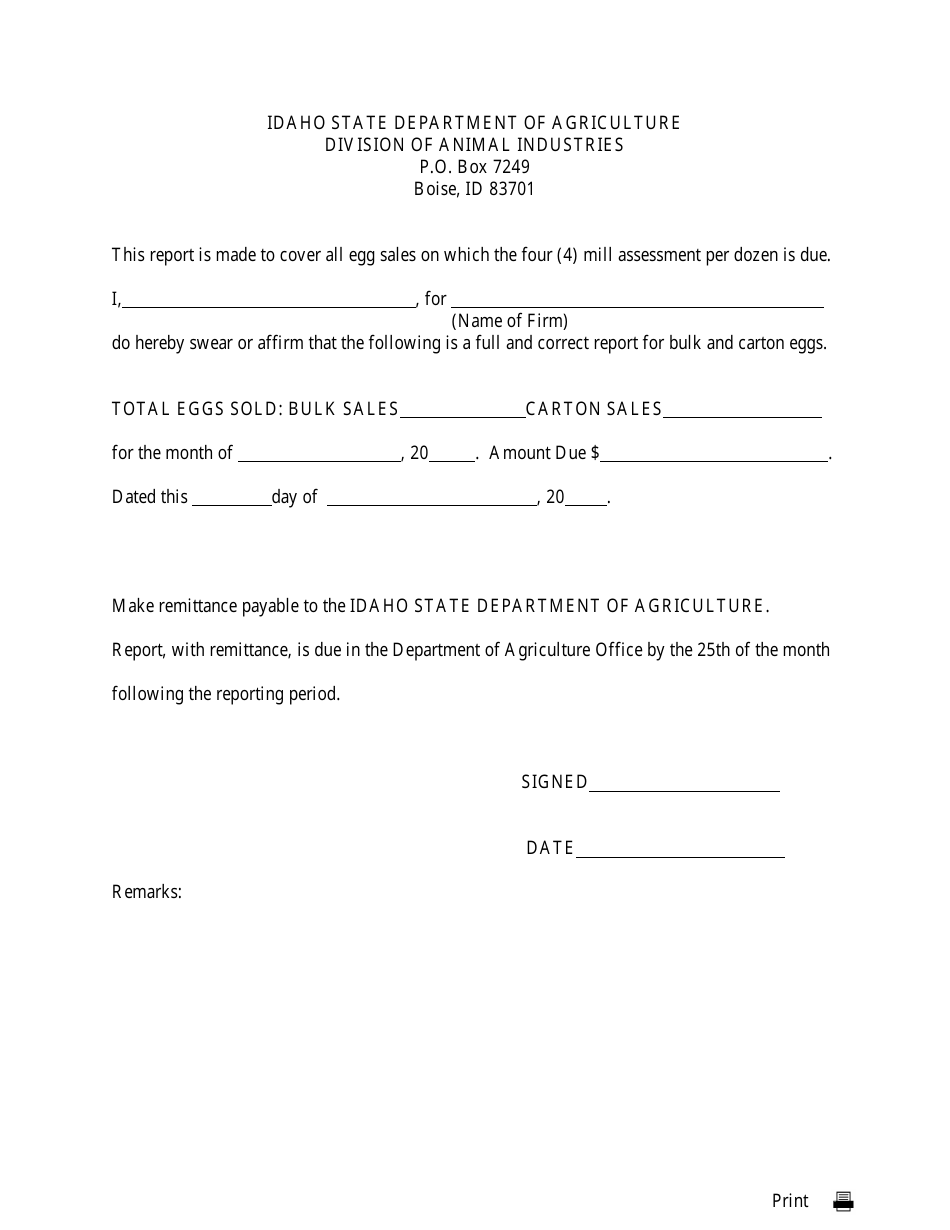

Monthly Mill Levy Assessment - Idaho

Monthly Mill Levy Assessment is a legal document that was released by the Idaho Department of Agriculture - a government authority operating within Idaho.

FAQ

Q: What is a monthly mill levy assessment?

A: A monthly mill levy assessment is a fee imposed on property owners to fund specific services or projects in Idaho.

Q: Who is responsible for imposing the monthly mill levy assessment?

A: The local government or the county government is responsible for imposing the monthly mill levy assessment.

Q: What are some examples of projects or services funded by the monthly mill levy assessment?

A: Some examples include funding for schools, libraries, parks, or public safety services.

Q: How is the amount of the monthly mill levy assessment determined?

A: The amount of the monthly mill levy assessment is determined based on the assessed value of the property.

Q: Do all property owners in Idaho have to pay the monthly mill levy assessment?

A: Not all property owners have to pay the monthly mill levy assessment. It depends on the specific assessment imposed by the local government.

Q: Are there any exemptions or discounts available for the monthly mill levy assessment?

A: Exemptions or discounts for the monthly mill levy assessment may be available for certain categories of property owners, such as senior citizens or veterans.

Q: How often is the monthly mill levy assessment charged?

A: The monthly mill levy assessment is typically charged on a regular basis, such as monthly, quarterly, or annually.

Q: Can the monthly mill levy assessment amount change over time?

A: Yes, the monthly mill levy assessment amount can change over time, depending on the needs of the community and the decisions made by the local government.

Q: What happens if a property owner fails to pay the monthly mill levy assessment?

A: If a property owner fails to pay the monthly mill levy assessment, they may face penalties, such as late fees or legal action.

Q: Is there a way to dispute or challenge the amount of the monthly mill levy assessment?

A: Yes, property owners have the right to dispute or challenge the amount of the monthly mill levy assessment if they believe it is incorrect or unfair.

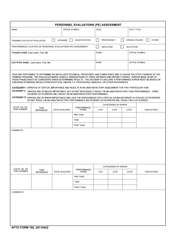

Form Details:

- The latest edition currently provided by the Idaho Department of Agriculture;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Idaho Department of Agriculture.