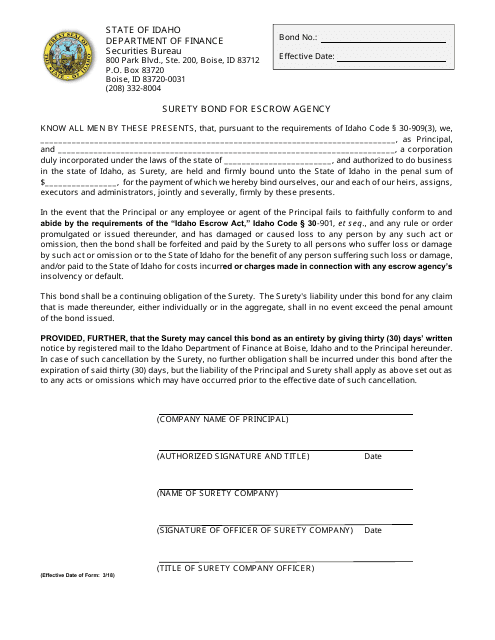

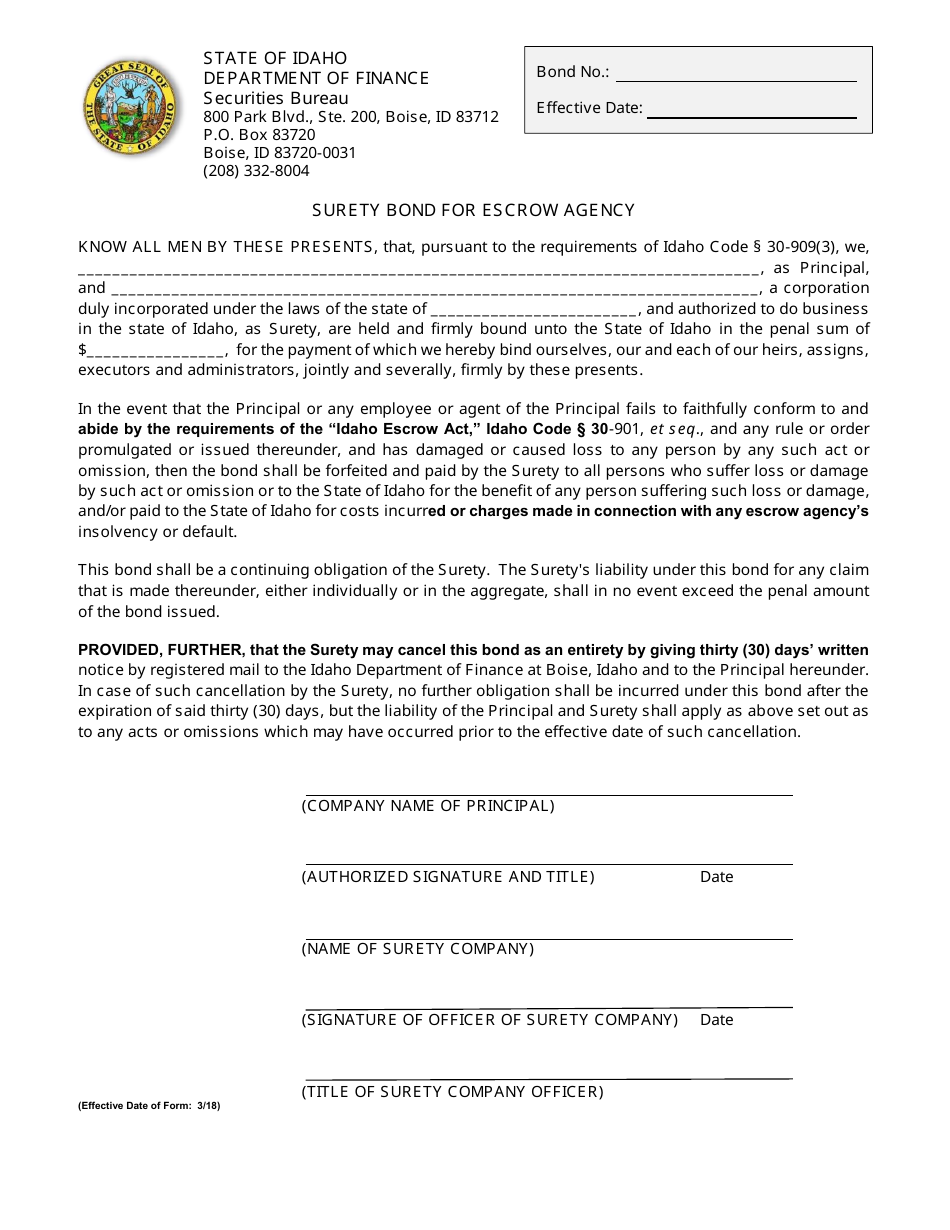

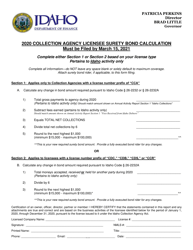

Surety Bond for Escrow Agency - Idaho

Surety Bond for Escrow Agency is a legal document that was released by the Idaho Department of Finance - a government authority operating within Idaho.

FAQ

Q: What is a surety bond for an escrow agency in Idaho?

A: A surety bond is a type of financial guarantee that an escrow agency in Idaho must obtain to protect customers and ensure that funds are properly handled.

Q: Why is a surety bond required for an escrow agency in Idaho?

A: A surety bond is required to provide financial protection to the customers of an escrow agency in Idaho in case the agency fails to fulfill its obligations or commits any fraudulent acts.

Q: How does a surety bond for an escrow agency in Idaho work?

A: When an escrow agency obtains a surety bond, the bond serves as a guarantee that the agency will comply with all regulations and protect the funds entrusted to them. If the agency fails to do so, customers can file a claim against the bond to recover their losses.

Q: Who needs to obtain a surety bond for an escrow agency in Idaho?

A: Any escrow agency operating in Idaho is required to obtain a surety bond as a condition for obtaining or renewing their license.

Q: How much does a surety bond for an escrow agency in Idaho cost?

A: The cost of a surety bond for an escrow agency in Idaho can vary based on factors such as the agency's financial stability, credit history, and the bond amount required. It is best to contact a surety bond provider for an accurate quote.

Form Details:

- Released on March 1, 2018;

- The latest edition currently provided by the Idaho Department of Finance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Idaho Department of Finance.