This version of the form is not currently in use and is provided for reference only. Download this version of

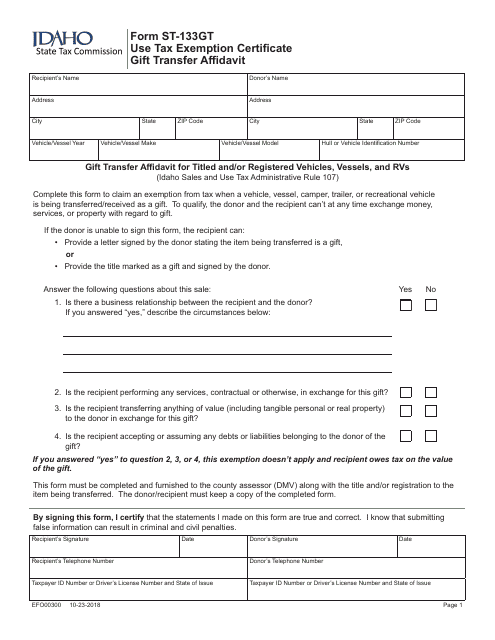

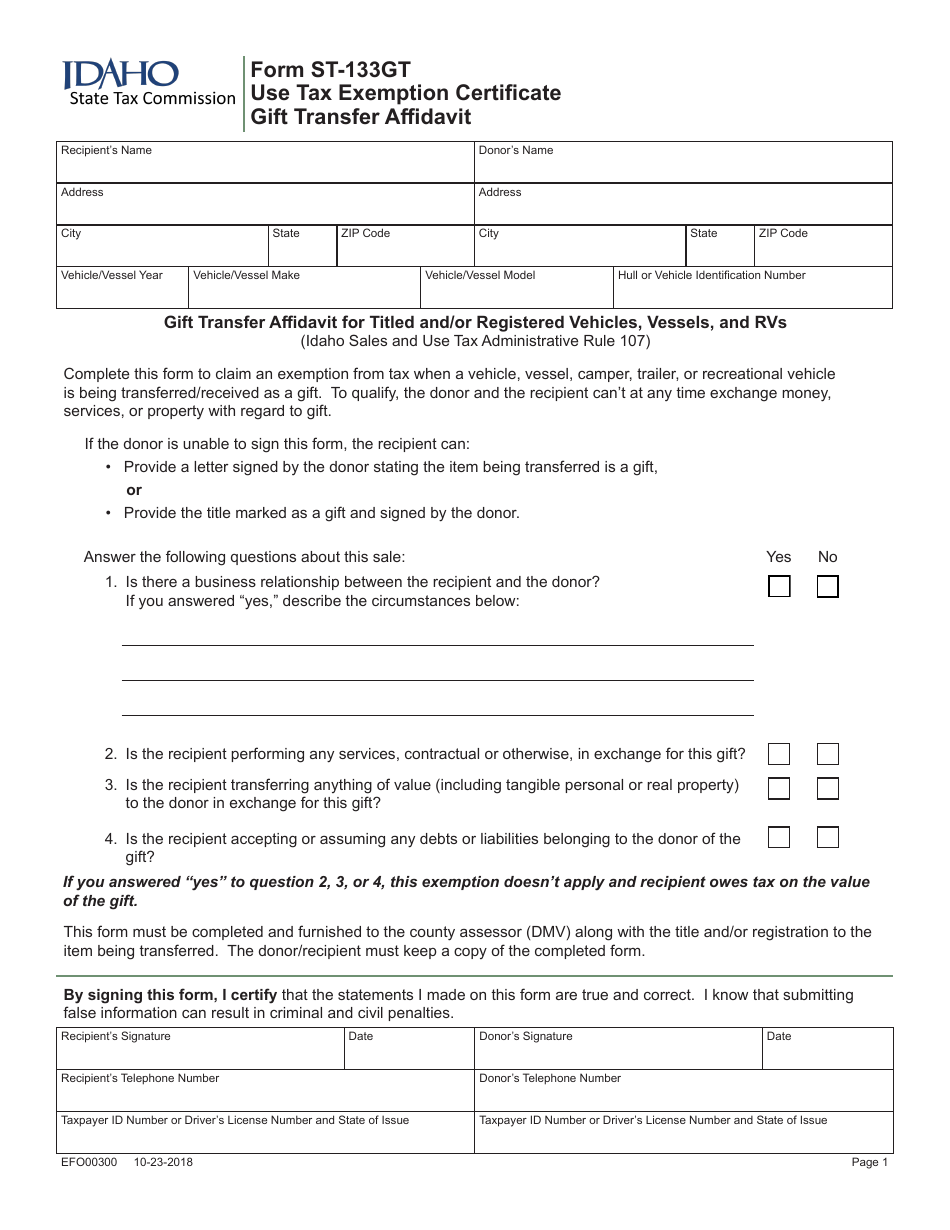

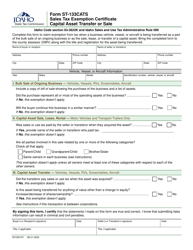

Form ST-133GT (EFO00300)

for the current year.

Form ST-133GT (EFO00300) Use Tax Exemption Certificate - Gift Transfer Affidavit - Idaho

What Is Form ST-133GT (EFO00300)?

This is a legal form that was released by the Idaho State Tax Commission - a government authority operating within Idaho. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-133GT?

A: Form ST-133GT is the Use Tax Exemption Certificate - Gift Transfer Affidavit specific to Idaho.

Q: What is the purpose of Form ST-133GT?

A: The purpose of Form ST-133GT is to claim exemption from use tax when transferring a gift.

Q: What is use tax?

A: Use tax is a tax on the use, consumption, or storage of goods purchased without paying sales tax.

Q: Who should use Form ST-133GT?

A: Form ST-133GT should be used by individuals in Idaho who are transferring a gift and want to claim an exemption from use tax.

Q: Does Form ST-133GT apply to all types of transfers?

A: No, Form ST-133GT specifically applies to gift transfers.

Q: Is Form ST-133GT only applicable in Idaho?

A: Yes, Form ST-133GT is specific to the state of Idaho.

Q: Are there any filing fees for Form ST-133GT?

A: No, there are no filing fees associated with filing Form ST-133GT.

Form Details:

- Released on October 23, 2018;

- The latest edition provided by the Idaho State Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-133GT (EFO00300) by clicking the link below or browse more documents and templates provided by the Idaho State Tax Commission.