This version of the form is not currently in use and is provided for reference only. Download this version of

Form M-68

for the current year.

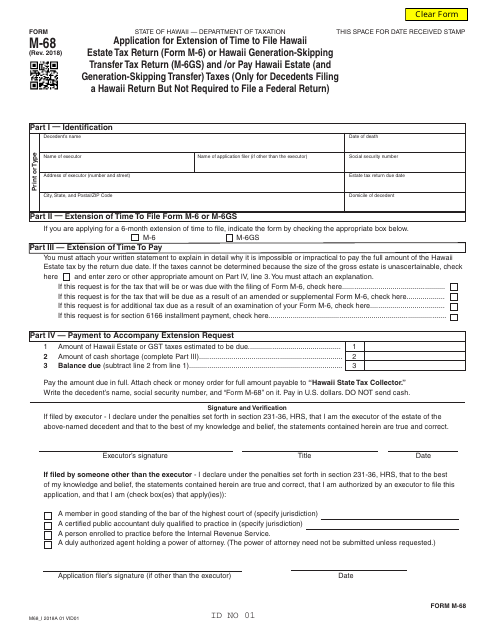

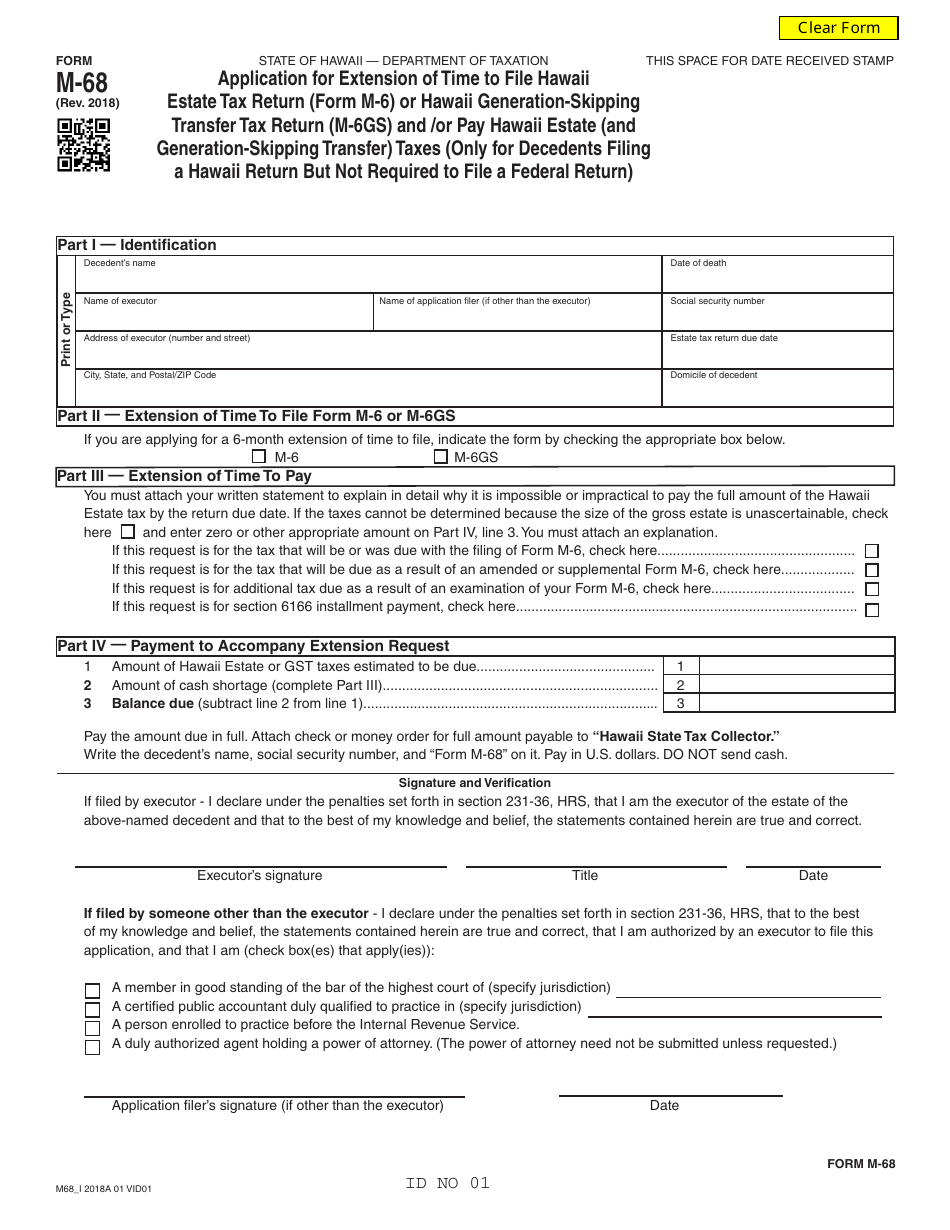

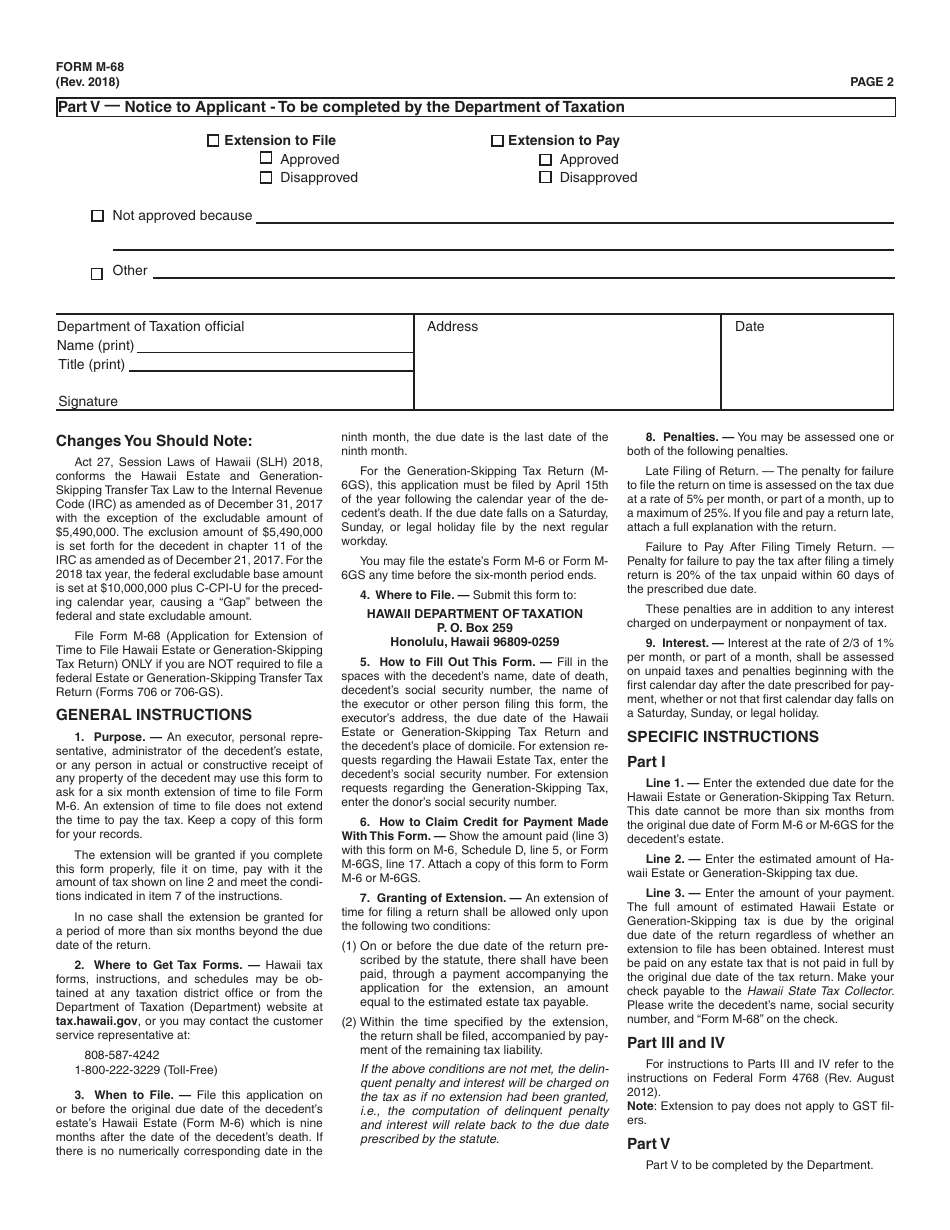

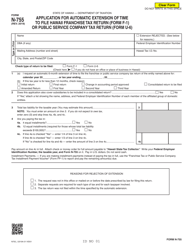

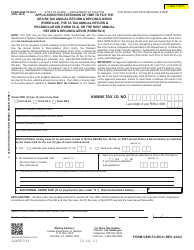

Form M-68 Application for Extension of Time to File Hawaii Estate Tax Return (Form M-6) or Hawaii Generation-Skipping Transfer Tax Return (M-6gs) and / Or Pay Hawaii Estate (And Generation-Skipping Transfer) Taxes (Only for Decedents Filing a Hawaii Return but Not Required to File a Federal Return) - Hawaii

What Is Form M-68?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-68?

A: Form M-68 is an application for extension of time to file the Hawaii Estate Tax Return (Form M-6) or the Hawaii Generation-Skipping Transfer Tax Return (M-6gs) and/or pay Hawaii Estate (and Generation-Skipping Transfer) Taxes.

Q: Who is required to file Form M-68?

A: Form M-68 is only required for decedents who are filing a Hawaii return but are not required to file a federal return.

Q: What does Form M-68 allow you to do?

A: Form M-68 allows you to request an extension of time to file the Hawaii Estate Tax Return or the Hawaii Generation-Skipping Transfer Tax Return and/or to pay Hawaii Estate (and Generation-Skipping Transfer) Taxes.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M-68 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.