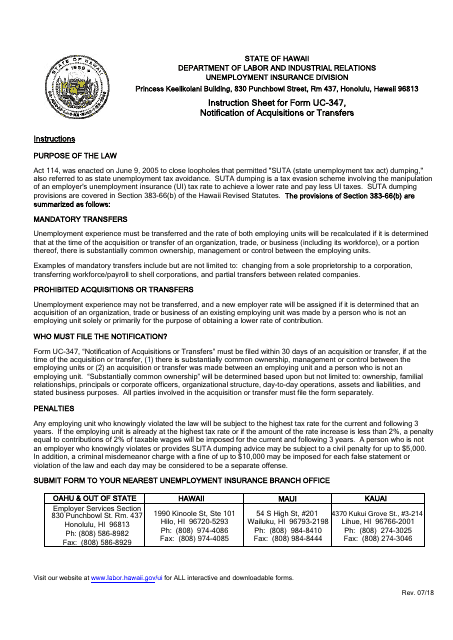

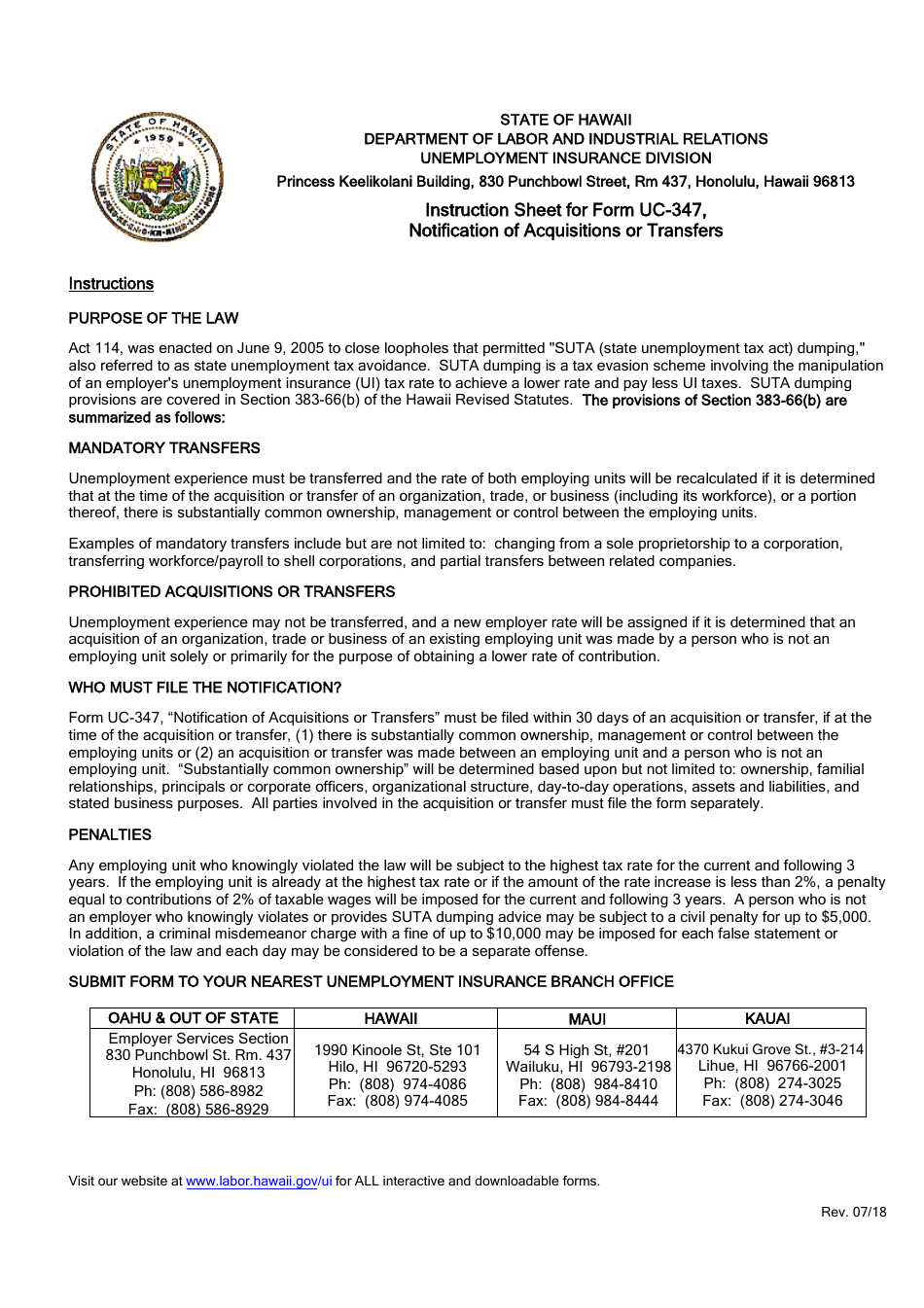

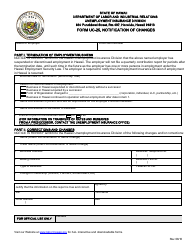

Form UC-347 Notification of Acquisitions or Transfers - Hawaii

What Is Form UC-347?

This is a legal form that was released by the Hawaii Department of Labor & Industrial Relations - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form UC-347?

A: Form UC-347 is the Notification of Acquisitions or Transfers - Hawaii.

Q: What is the purpose of Form UC-347?

A: The purpose of Form UC-347 is to notify the state of Hawaii about any acquisitions or transfers of businesses.

Q: Who needs to file Form UC-347?

A: Any business that has undergone an acquisition or transfer in Hawaii needs to file Form UC-347.

Q: When should Form UC-347 be filed?

A: Form UC-347 should be filed within 30 days of the acquisition or transfer.

Q: Is there a fee for filing Form UC-347?

A: No, there is no fee for filing Form UC-347.

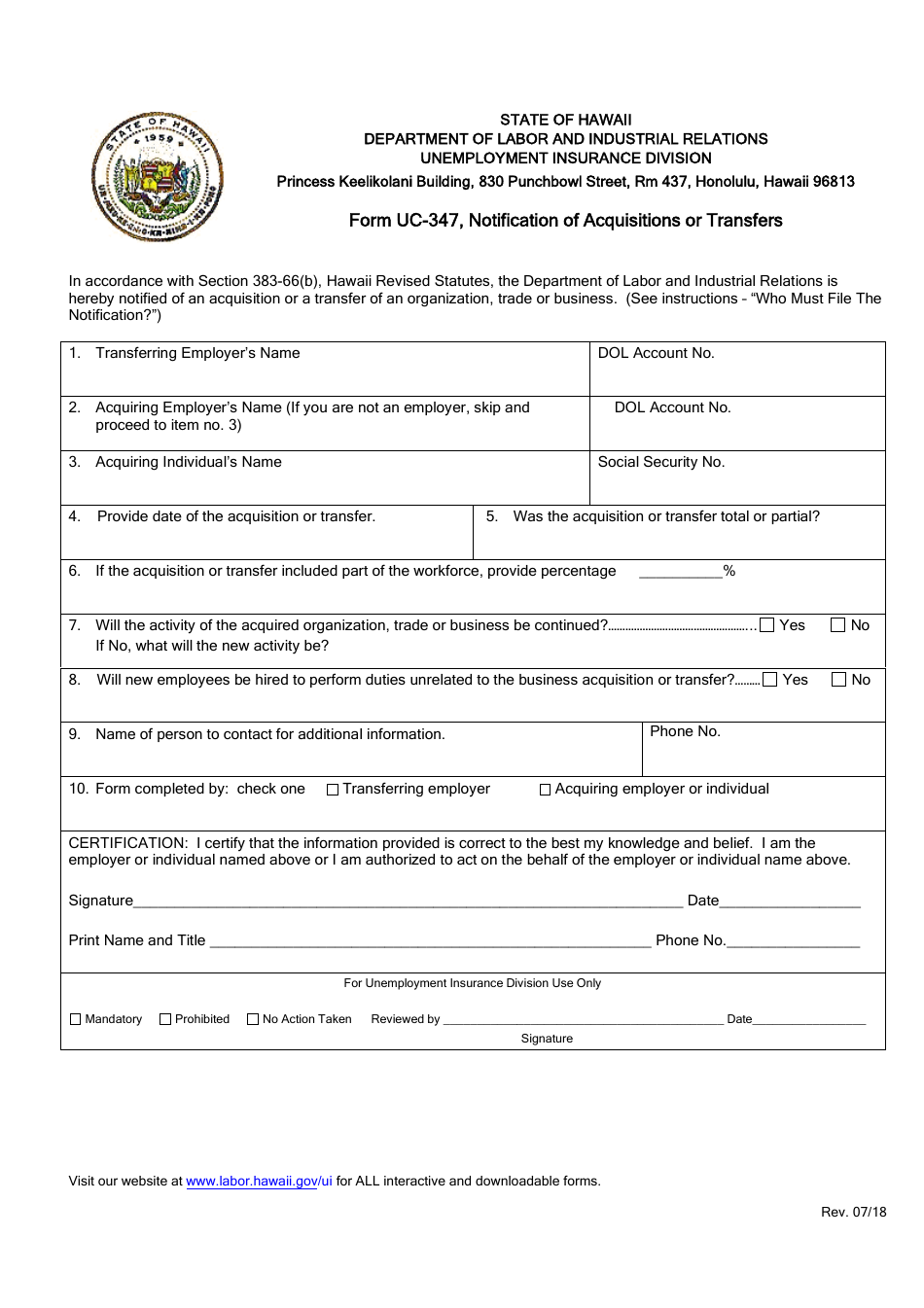

Q: What information is required on Form UC-347?

A: Form UC-347 requires information about the acquiring or transferring entity, the selling entity, and the details of the acquisition or transfer.

Q: What happens after filing Form UC-347?

A: After filing Form UC-347, the state of Hawaii will process the notification and update their records accordingly.

Q: Are there any consequences for not filing Form UC-347?

A: Failure to file Form UC-347 can result in penalties and other legal consequences.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the Hawaii Department of Labor & Industrial Relations;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form UC-347 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Labor & Industrial Relations.