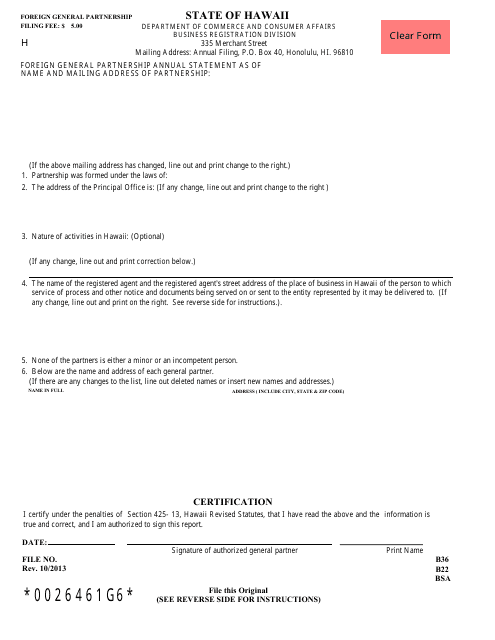

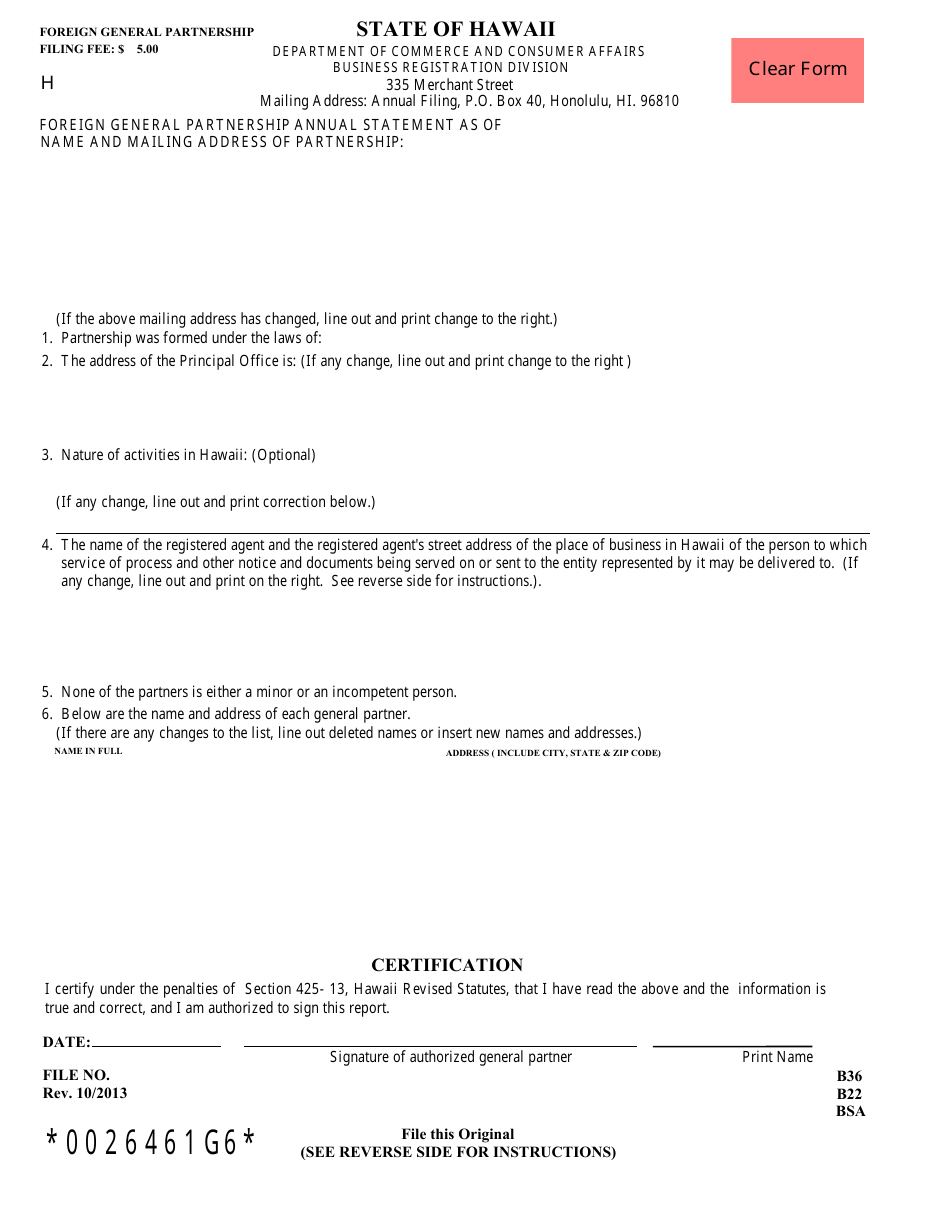

Form G6 Foreign General Partnership Annual Statement - Hawaii

What Is Form G6?

This is a legal form that was released by the Hawaii Department of Commerce & Consumer Affairs - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form G6?

A: Form G6 is the Foreign General Partnership Annual Statement in Hawaii.

Q: Who needs to file Form G6?

A: Foreign general partnerships that are registered in Hawaii must file Form G6.

Q: What is the purpose of Form G6?

A: The purpose of Form G6 is to provide annual information on foreign general partnerships operating in Hawaii.

Q: When is Form G6 due?

A: Form G6 is due on the last day of the anniversary month in which the foreign general partnership was initially registered.

Q: What information is required on Form G6?

A: Form G6 requires details such as the name and address of the foreign general partnership, the names and addresses of the partners, and information about the partnership's activities in Hawaii.

Q: What happens if I don't file Form G6?

A: Failure to file Form G6 may result in penalties or the revocation of the foreign general partnership's authority to do business in Hawaii.

Form Details:

- Released on October 1, 2013;

- The latest edition provided by the Hawaii Department of Commerce & Consumer Affairs;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G6 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Commerce & Consumer Affairs.