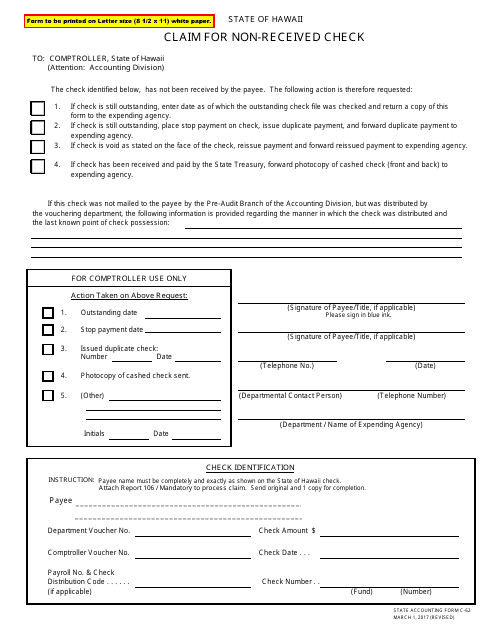

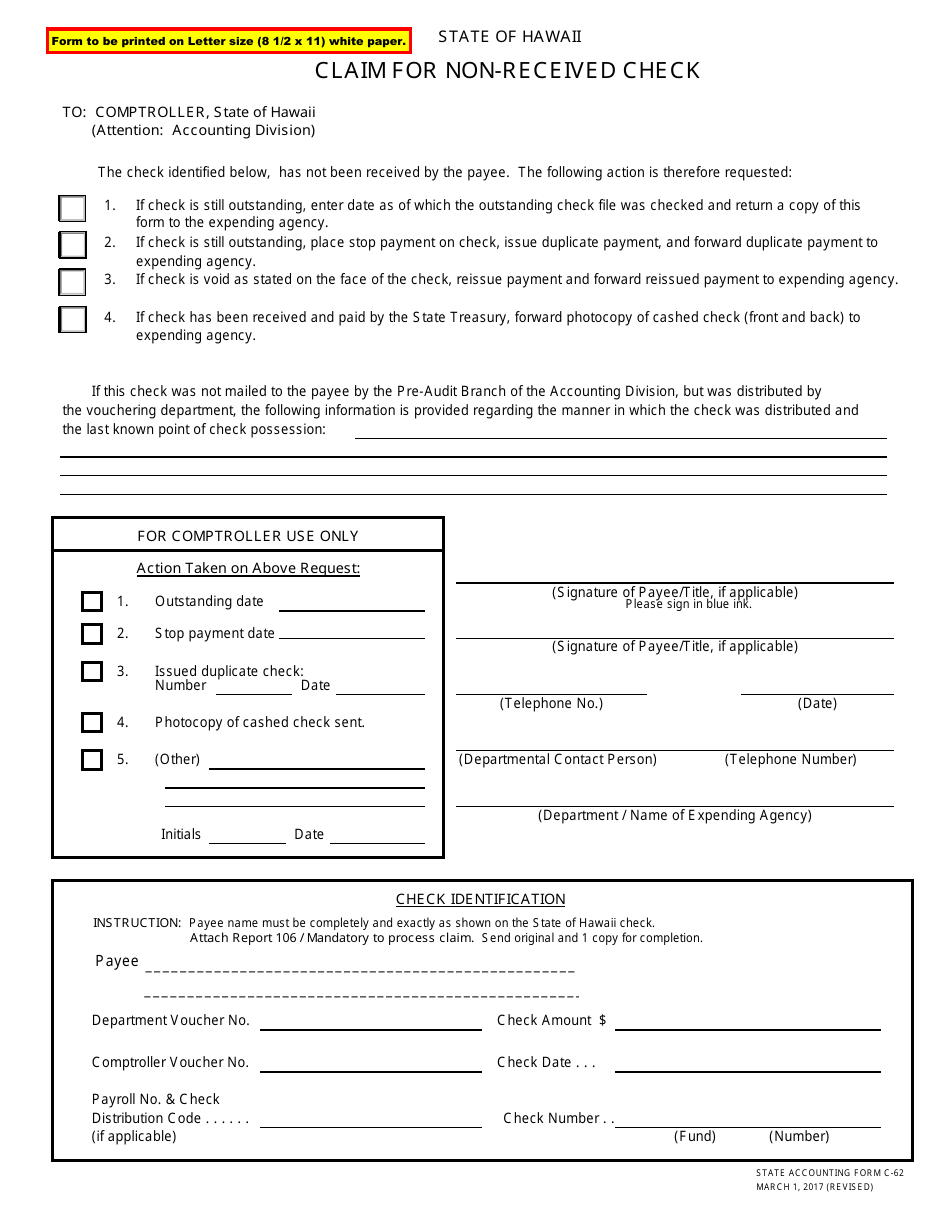

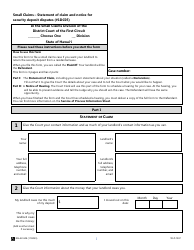

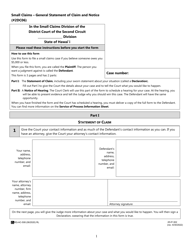

Form C-62 Claim for Non-received Check - Hawaii

What Is Form C-62?

This is a legal form that was released by the Hawaii Department of Accounting & General Services - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form C-62?

A: Form C-62 is a claim form used in Hawaii to report non-received checks.

Q: What is a non-received check?

A: A non-received check refers to a check that was supposed to be sent or received but has not been.

Q: When should I use Form C-62?

A: You should use Form C-62 if you were supposed to receive a check but have not received it.

Q: Who can use Form C-62?

A: Anyone who is expecting a check but has not received it can use Form C-62.

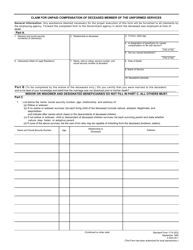

Q: What information do I need to provide on Form C-62?

A: You will need to provide your personal information, details of the non-received check, and any supporting documentation.

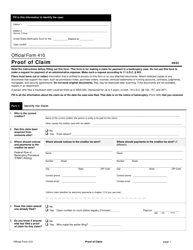

Q: Is there a deadline to submit Form C-62?

A: Yes, you must submit Form C-62 within 180 days of the date the check was expected to be received.

Q: What happens after I submit Form C-62?

A: After you submit Form C-62, the Hawaii Department of Labor and Industrial Relations will review your claim and take appropriate action to investigate the non-received check.

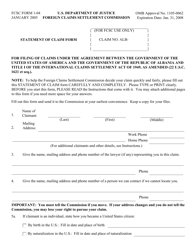

Q: Can I track the progress of my claim?

A: Yes, you can contact the Hawaii Department of Labor and Industrial Relations to inquire about the status of your claim.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Hawaii Department of Accounting & General Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form C-62 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Accounting & General Services.