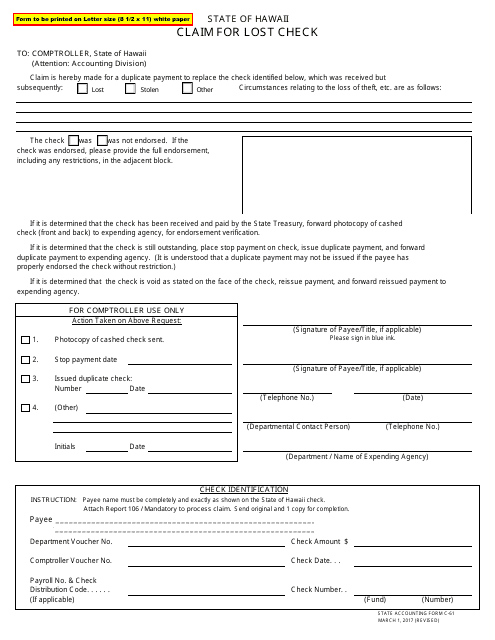

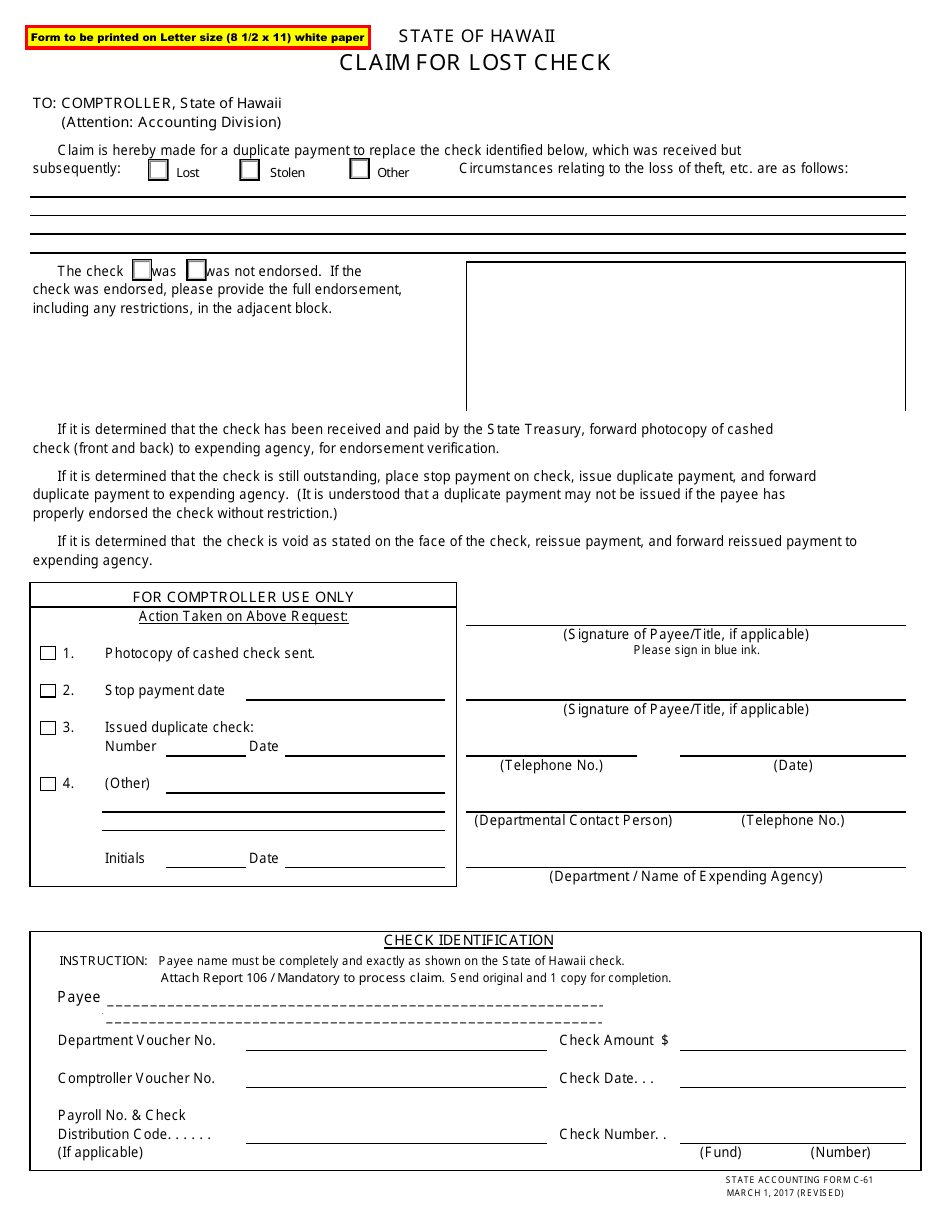

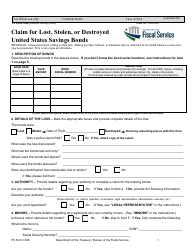

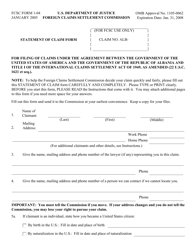

Form C-61 Claim for Lost Check - Hawaii

What Is Form C-61?

This is a legal form that was released by the Hawaii Department of Accounting & General Services - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form C-61?

A: Form C-61 is a claim form used in Hawaii to report a lost or missing check.

Q: Who can use Form C-61?

A: Anyone in Hawaii who has lost a check can use Form C-61 to report the loss.

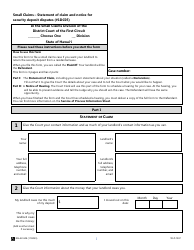

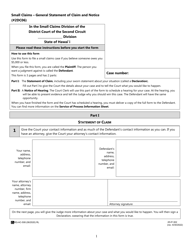

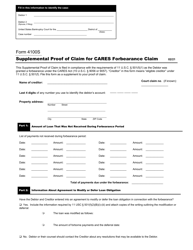

Q: What information is required on Form C-61?

A: Form C-61 requires the claimant to provide details about the lost check, including check number, amount, date issued, and the reason for the loss.

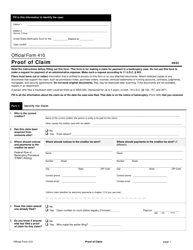

Q: What should I do if I have lost a check in Hawaii?

A: If you have lost a check in Hawaii, you should fill out Form C-61 and submit it to the appropriate department to report the loss and request a replacement.

Q: Is there a deadline for filing Form C-61?

A: Yes, there is a deadline for filing Form C-61. It must be filed within 180 days from the date the check was issued.

Q: Will I receive a replacement check after filing Form C-61?

A: If your claim is approved, you may receive a replacement check for the lost amount.

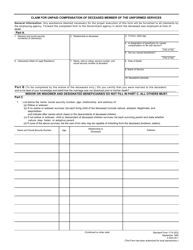

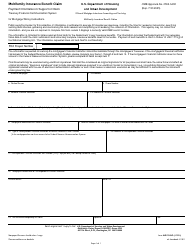

Q: What if someone else cashes the lost check before I can report it?

A: If someone else cashes your lost check before you can report it, you may have to provide additional documentation to support your claim and prove that you did not receive the funds.

Q: Can I track the status of my claim after submitting Form C-61?

A: Yes, you can track the status of your claim by contacting the department where you submitted the form.

Q: Are there any fees associated with filing Form C-61?

A: There are no fees associated with filing Form C-61 to report a lost check in Hawaii.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the Hawaii Department of Accounting & General Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form C-61 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Accounting & General Services.