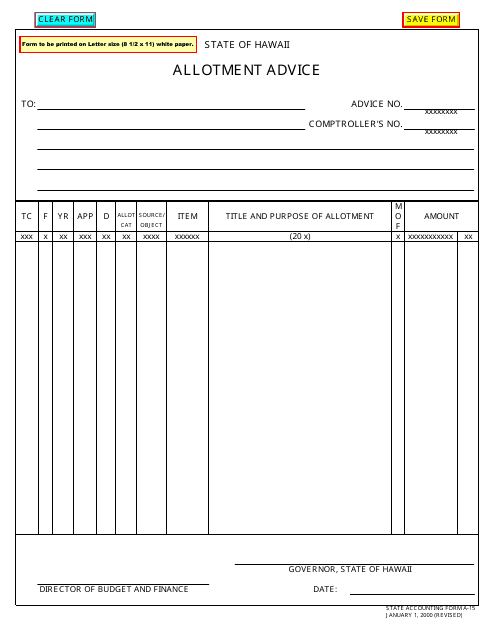

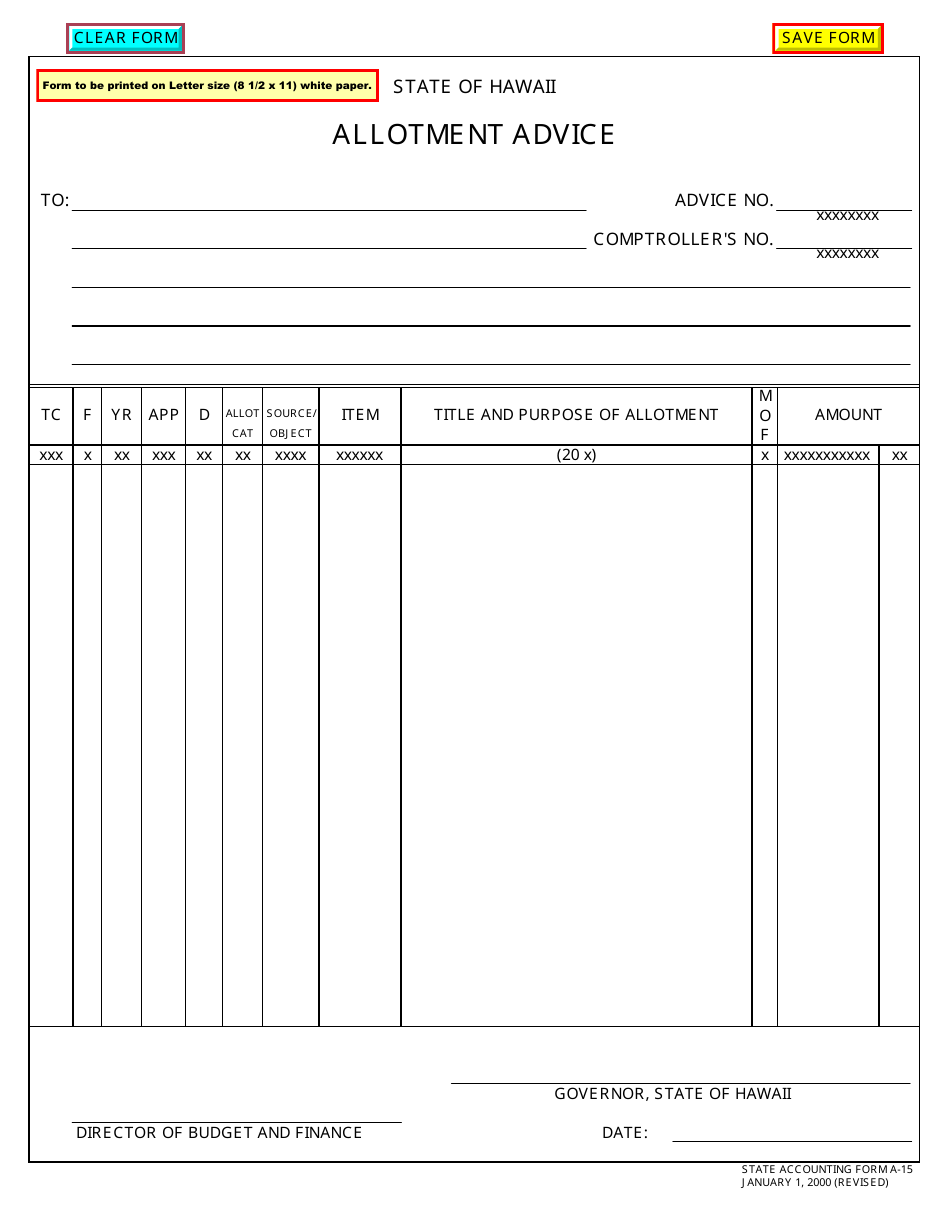

Form A-15 Allotment Advice - Hawaii

What Is Form A-15?

This is a legal form that was released by the Hawaii Department of Accounting & General Services - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form A-15?

A: Form A-15 is an allotment advice form used in Hawaii.

Q: What is an allotment advice?

A: An allotment advice is a document that provides information about deductions from an employee's salary.

Q: Who uses Form A-15?

A: Employers in Hawaii use Form A-15 to report employee salary deductions.

Q: What is the purpose of Form A-15?

A: The purpose of Form A-15 is to track and report employee salary deductions in Hawaii.

Q: Do I need to fill out Form A-15?

A: No, as an employee, you do not need to fill out Form A-15. It is the responsibility of your employer.

Q: What information is required on Form A-15?

A: Form A-15 requires information such as the employee's name, social security number, and details of the salary deductions.

Q: Can I use Form A-15 in other states?

A: No, Form A-15 is specific to Hawaii and is not used in other states.

Q: What should I do if I have questions about Form A-15?

A: If you have questions about Form A-15, you should contact your employer or the Hawaii state government.

Form Details:

- Released on January 1, 2000;

- The latest edition provided by the Hawaii Department of Accounting & General Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A-15 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Accounting & General Services.