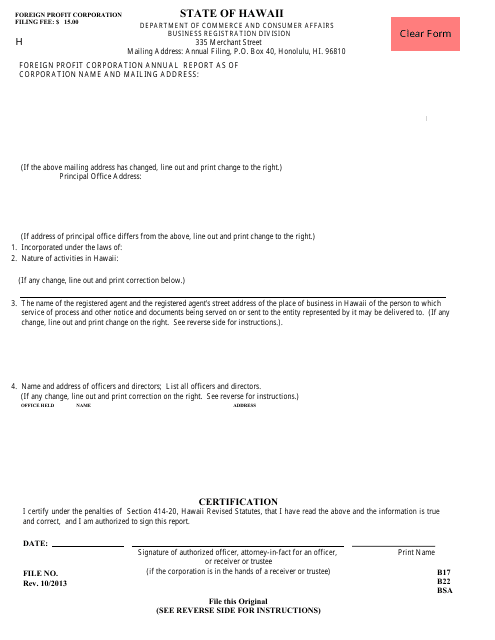

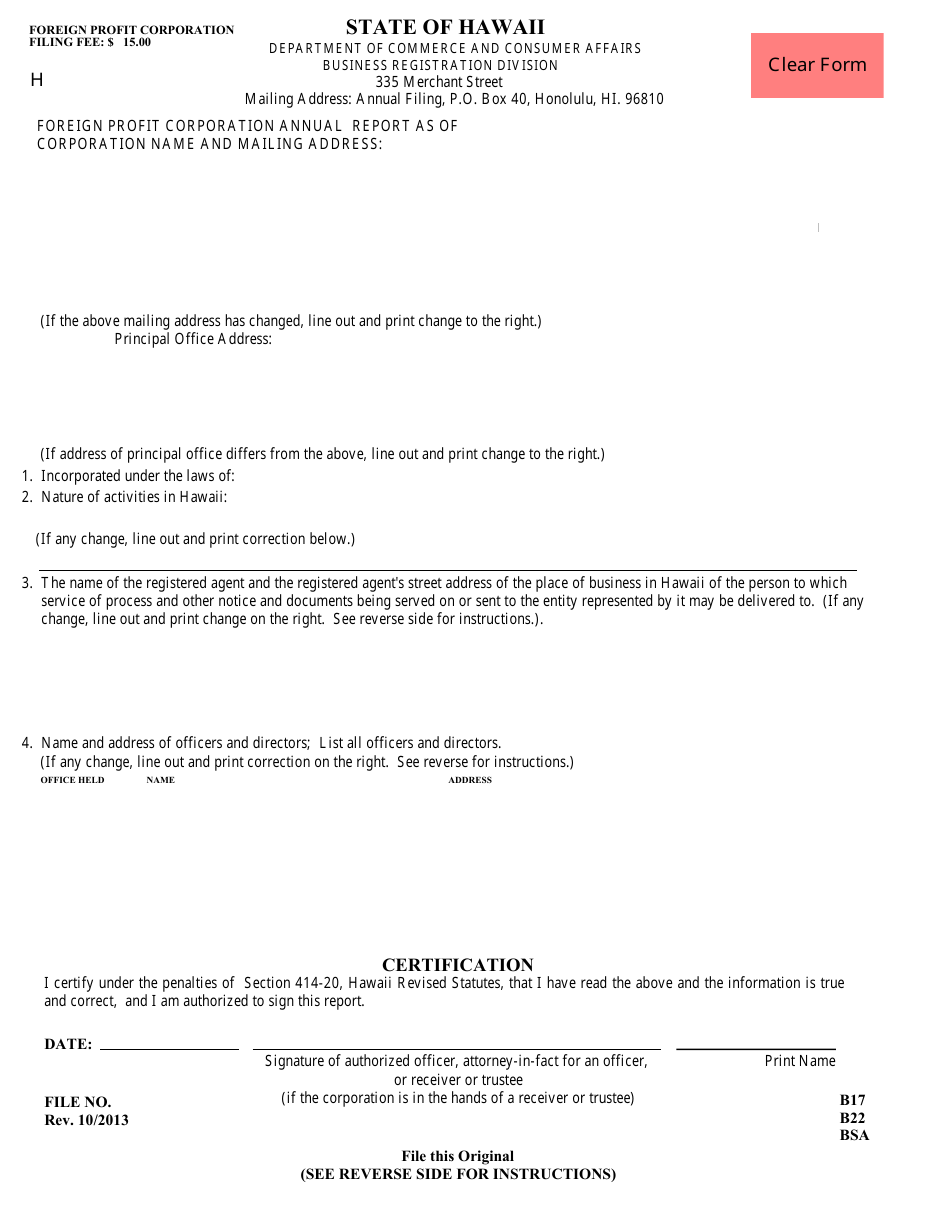

Foreign Profit Corporation Annual Report Form - Hawaii

Foreign Profit Corporation Annual Report Form is a legal document that was released by the Hawaii Department of Commerce & Consumer Affairs - a government authority operating within Hawaii.

FAQ

Q: What is the Foreign Profit Corporation Annual Report Form?

A: The Foreign Profit Corporation Annual Report Form is a document that certain out-of-state corporations must file in Hawaii.

Q: Who is required to file the Foreign Profit Corporation Annual Report Form?

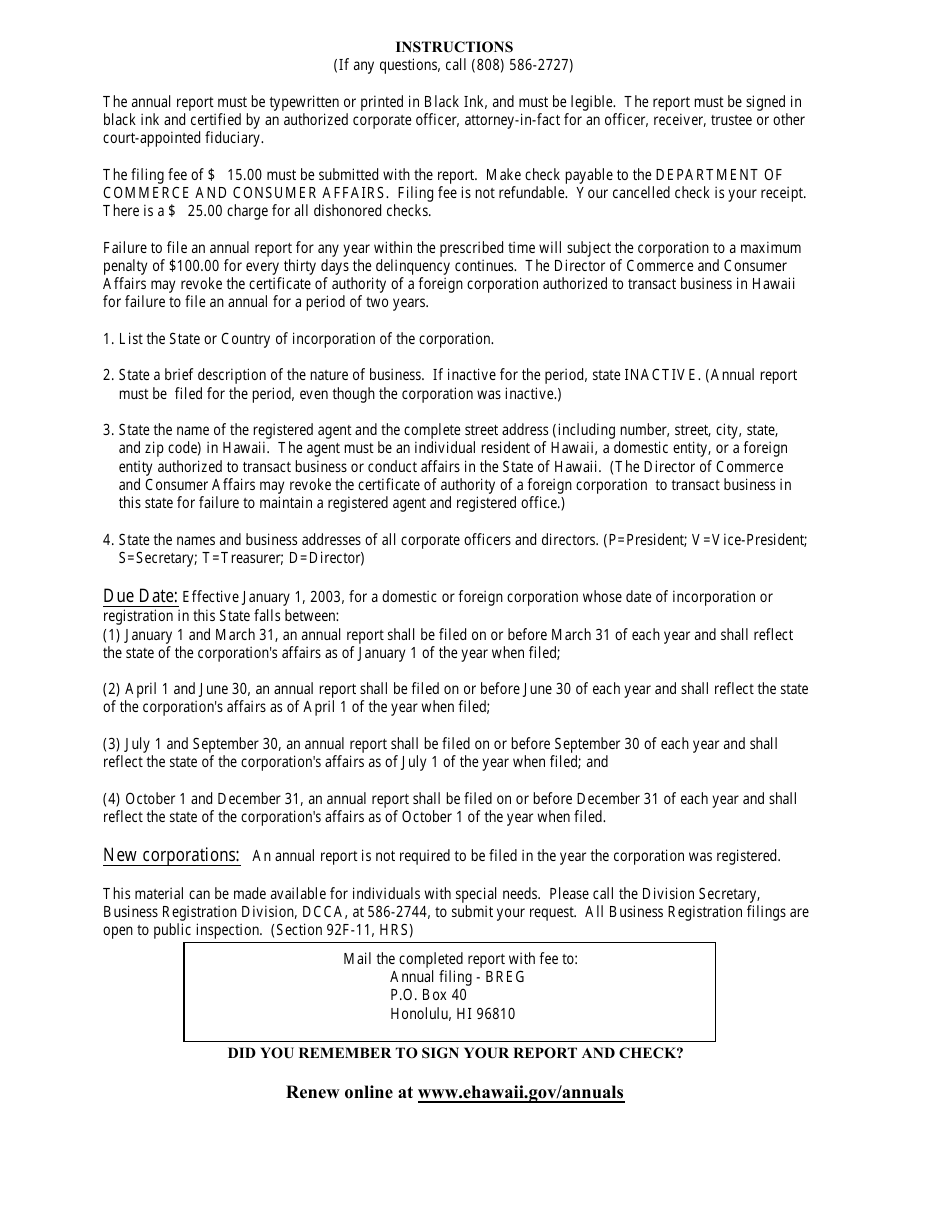

A: Out-of-state corporations that are doing business in Hawaii and seeking to maintain their legal status in the state are required to file the form.

Q: What information is required in the Foreign Profit Corporation Annual Report Form?

A: The form requires information about the corporation's name, principal office address, registered agent, officers, and directors.

Q: When is the deadline for filing the Foreign Profit Corporation Annual Report Form?

A: The deadline for filing the form is the last day of the anniversary month of the corporation's original Hawaii qualification.

Q: What happens if a corporation fails to file the Foreign Profit Corporation Annual Report Form?

A: If a corporation fails to file the form, it may be subject to penalties and possible dissolution or revocation of its Hawaii qualification.

Form Details:

- Released on October 1, 2013;

- The latest edition currently provided by the Hawaii Department of Commerce & Consumer Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Hawaii Department of Commerce & Consumer Affairs.