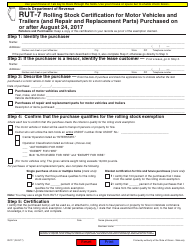

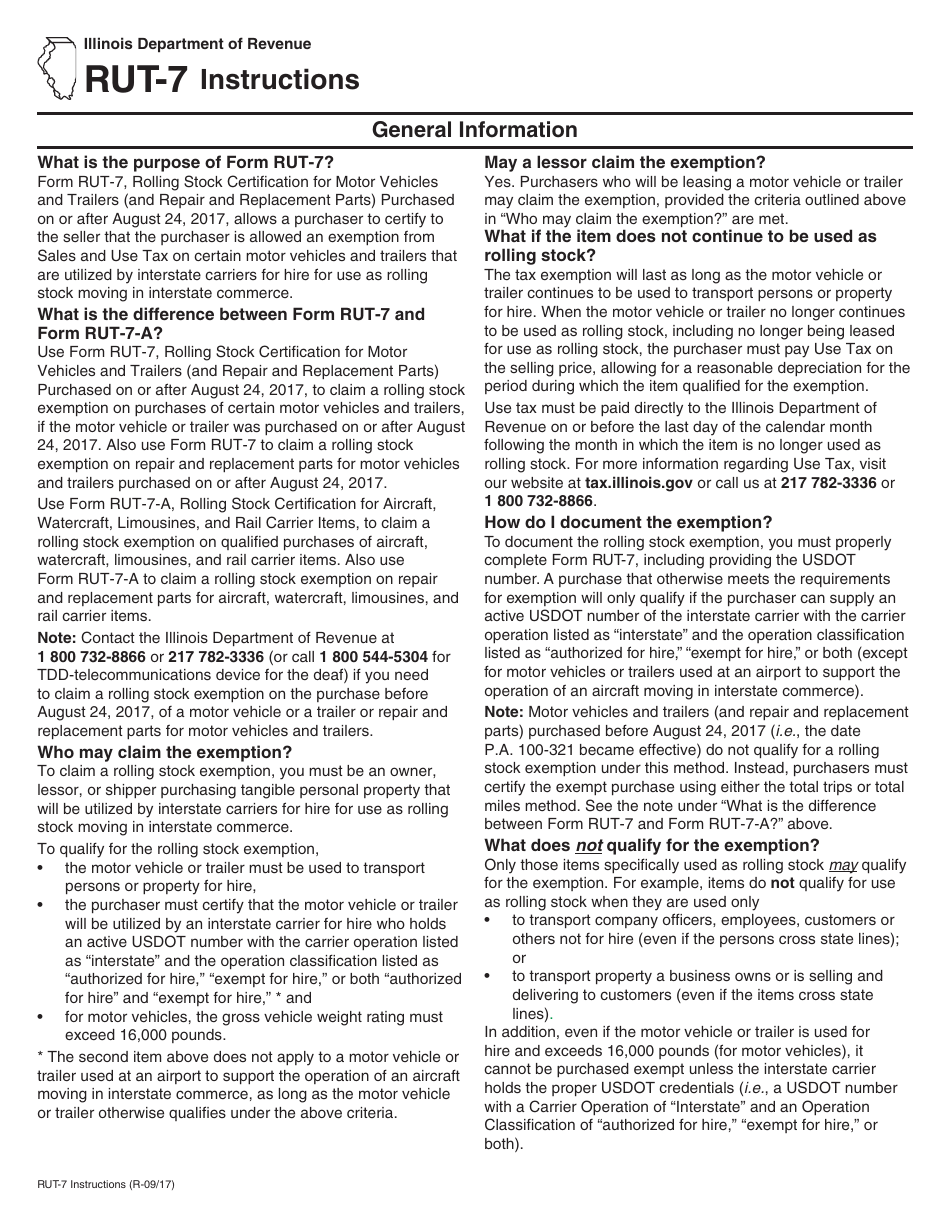

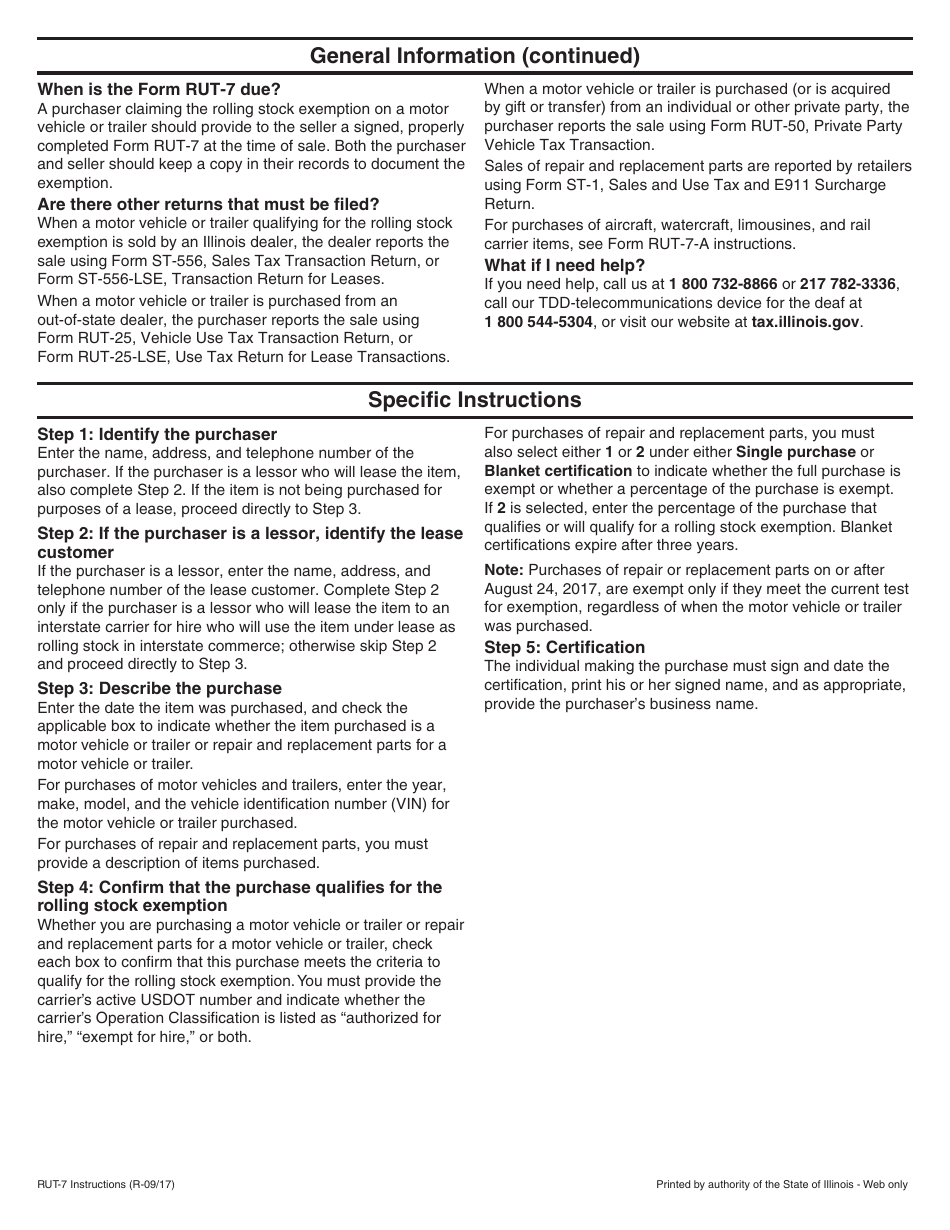

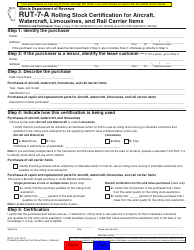

Instructions for Form RUT-7 Rolling Stock Certification for Motor Vehicles and Trailers (And Repair and Replacement Parts) Purchased on or After August 24, 2017 - Illinois

This document contains official instructions for Form RUT-7 , Rolling Stock Certification for Motor Vehicles and Trailers (And Repair and Replacement Parts) Purchased on or After August 24, 2017 - a form released and collected by the Illinois Department of Revenue. An up-to-date fillable Form RUT-7 is available for download through this link.

FAQ

Q: What is Form RUT-7?

A: Form RUT-7 is a certification form used in Illinois for motor vehicles and trailers purchased on or after August 24, 2017.

Q: What does Form RUT-7 certify?

A: Form RUT-7 certifies that a motor vehicle, trailer, or repair/replacement parts were purchased for use as rolling stock.

Q: When should I use Form RUT-7?

A: You should use Form RUT-7 when purchasing rolling stock, including motor vehicles, trailers, and repair/replacement parts, in Illinois on or after August 24, 2017.

Q: Do I need to submit Form RUT-7 with my purchase?

A: Yes, you need to submit Form RUT-7 to the seller or lessor at the time of purchase.

Q: Can I use Form RUT-7 for purchases made before August 24, 2017?

A: No, Form RUT-7 is only applicable for purchases made on or after August 24, 2017.

Q: What information is needed on Form RUT-7?

A: Form RUT-7 requires information such as the buyer's name, address, and tax identification number, as well as details of the purchased rolling stock.

Q: Are there any exemptions to using Form RUT-7?

A: Yes, there are exemptions for certain types of rolling stock, such as off-road vehicles and vehicles purchased for leasing.

Q: What happens if I don't submit Form RUT-7?

A: Failure to submit Form RUT-7 may result in penalties or additional taxes.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Illinois Department of Revenue.