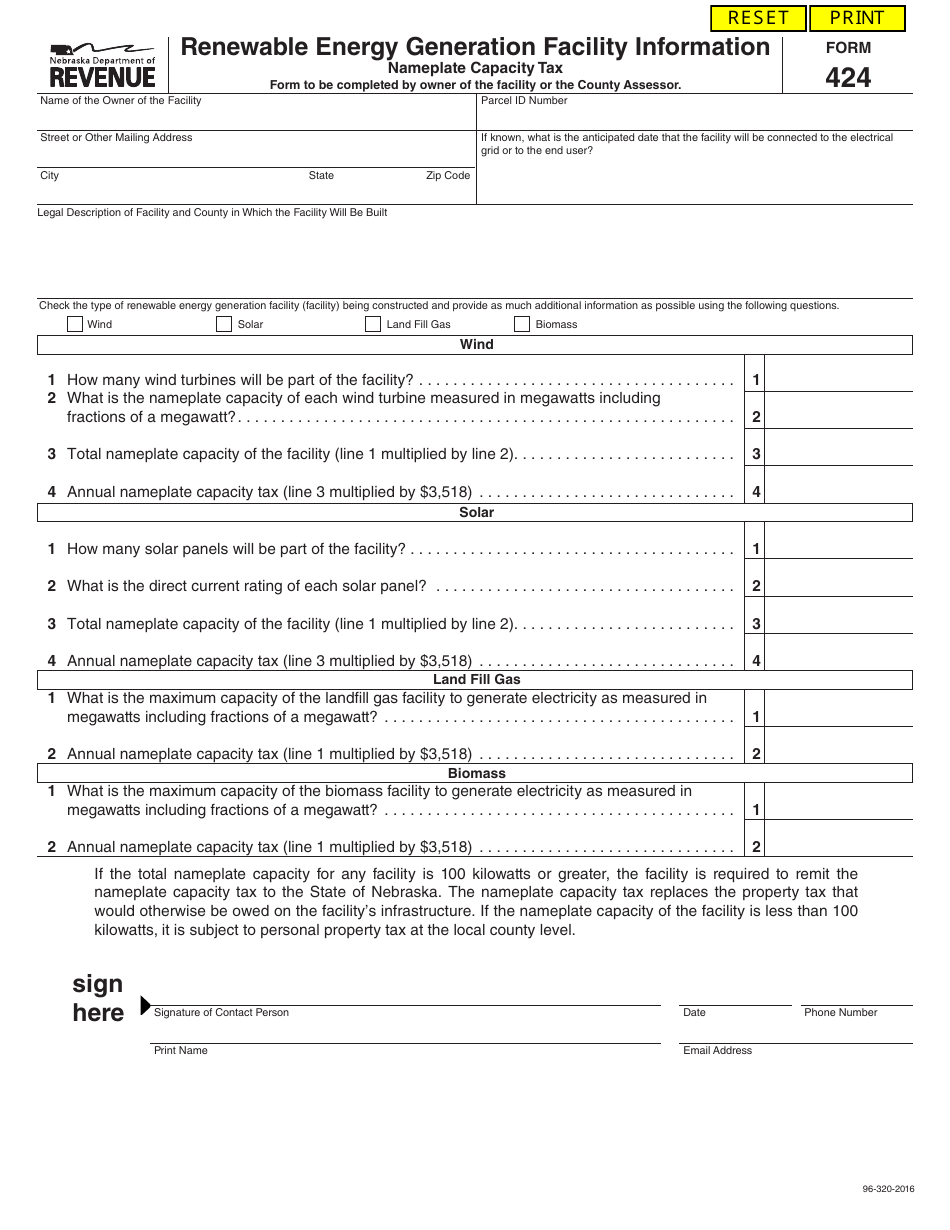

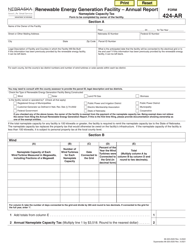

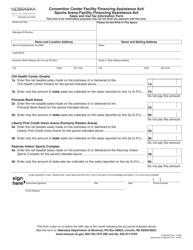

Form 424 Renewable Energy Generation Facility Information - Nameplate Capacity Tax - Nebraska

What Is Form 424?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 424?

A: Form 424 is a document used to provide information about a renewable energy generation facility's nameplate capacity tax in Nebraska.

Q: What is a renewable energy generation facility?

A: A renewable energy generation facility is a facility that converts natural resources, such as wind or solar energy, into usable energy.

Q: What is nameplate capacity tax?

A: Nameplate capacity tax is a tax imposed on the installed capacity, or maximum amount of energy that a facility can produce, of a renewable energy generation facility.

Q: What is the purpose of Form 424?

A: The purpose of Form 424 is to provide information about the nameplate capacity tax for a renewable energy generation facility in Nebraska.

Q: Who needs to fill out Form 424?

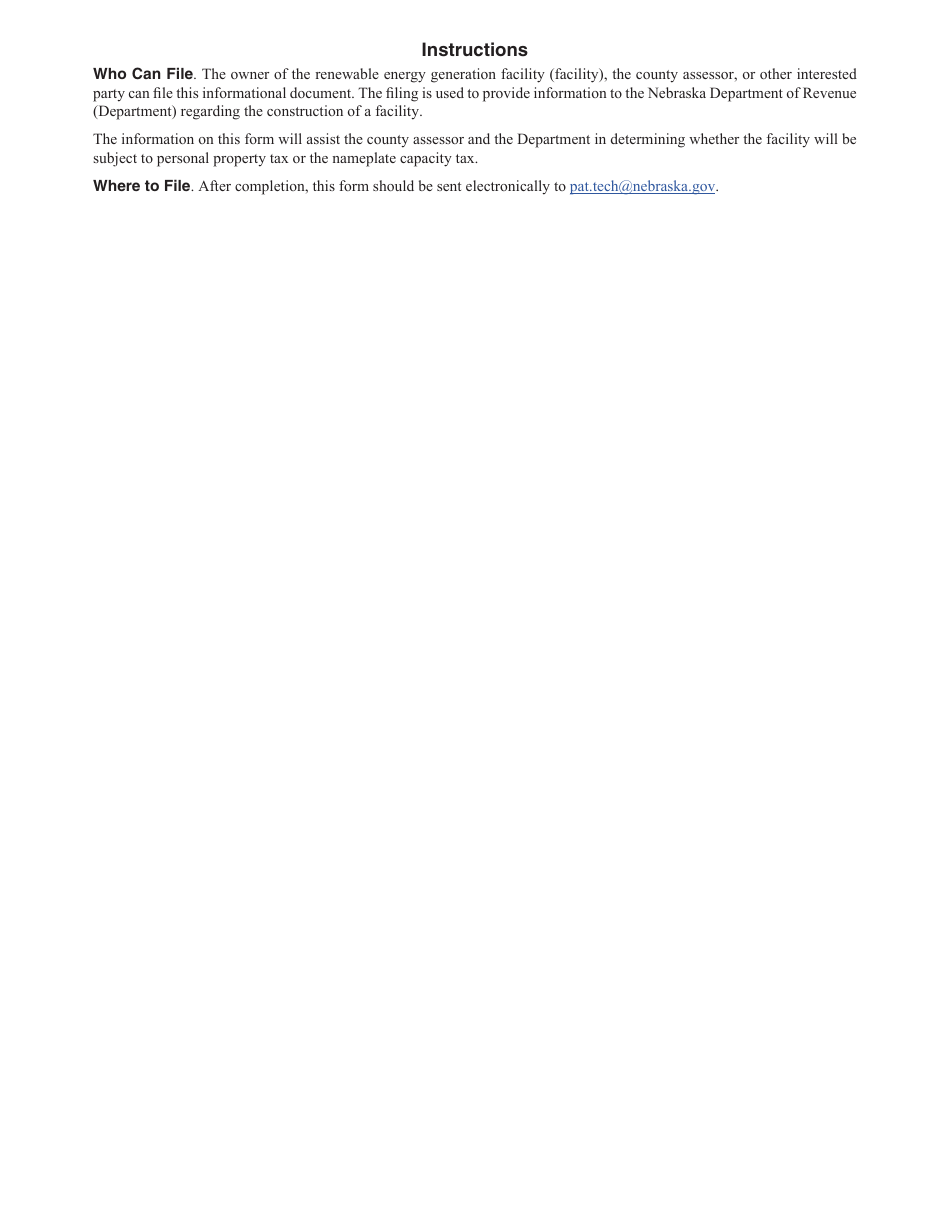

A: Owners or operators of renewable energy generation facilities in Nebraska need to fill out Form 424.

Q: What information is required on Form 424?

A: Form 424 requires information about the facility, such as its name, location, and nameplate capacity, as well as information about the owner or operator.

Q: When is Form 424 due?

A: Form 424 is due on or before March 1st of each year.

Q: Are there any penalties for late filing of Form 424?

A: Yes, there may be penalties for late filing of Form 424.

Q: Who should I contact for more information about Form 424?

A: For more information about Form 424, you should contact the Nebraska Department of Revenue.

Form Details:

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 424 by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.