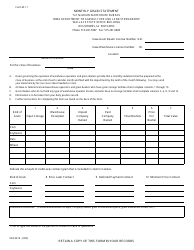

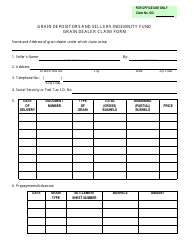

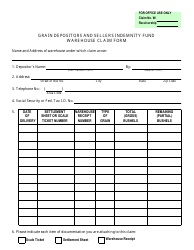

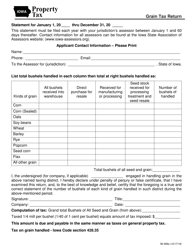

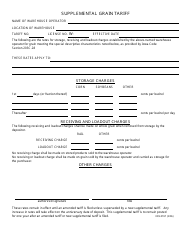

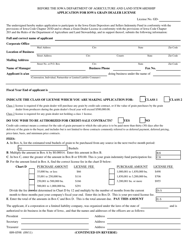

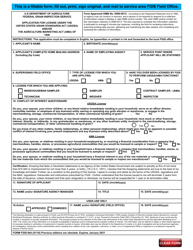

Form W-11 Monthly Grain Statement - Iowa

What Is Form W-11?

This is a legal form that was released by the Iowa Department of Agriculture and Land Stewardship - a government authority operating within Iowa. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form W-11?

A: Form W-11 is the Monthly Grain Statement.

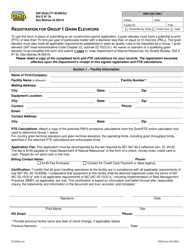

Q: Who needs to file Form W-11?

A: Farmers in Iowa who produce and sell grain need to file Form W-11.

Q: What is the purpose of Form W-11?

A: Form W-11 is used to report the grain sales and production for a specific month.

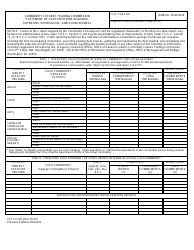

Q: How often do I need to file Form W-11?

A: Form W-11 should be filed monthly.

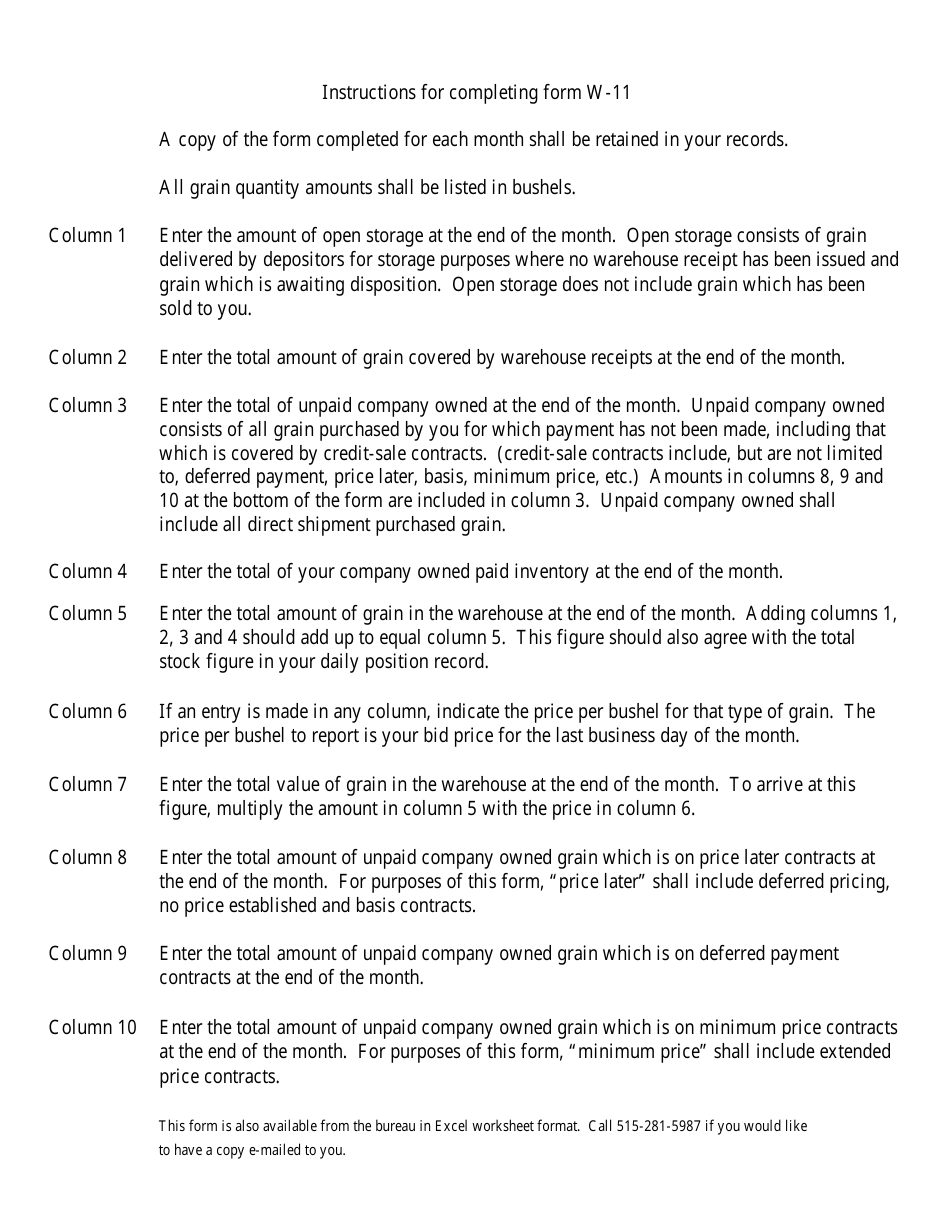

Q: What information do I need to provide on Form W-11?

A: You need to provide details about the grain sales and production, such as the quantity sold and the price.

Q: When is Form W-11 due?

A: Form W-11 is due on the 20th day of the month following the reporting month.

Q: Do I need to keep a copy of Form W-11 for my records?

A: Yes, it is recommended to keep a copy of Form W-11 for your records.

Q: Are there any penalties for late filing of Form W-11?

A: Yes, there may be penalties for late filing of Form W-11.

Q: Do I need to include Form W-11 with my federal tax return?

A: No, Form W-11 is for state reporting purposes only and should not be included with your federal tax return.

Form Details:

- Released on February 1, 2009;

- The latest edition provided by the Iowa Department of Agriculture and Land Stewardship;

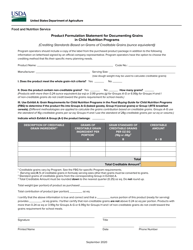

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form W-11 by clicking the link below or browse more documents and templates provided by the Iowa Department of Agriculture and Land Stewardship.