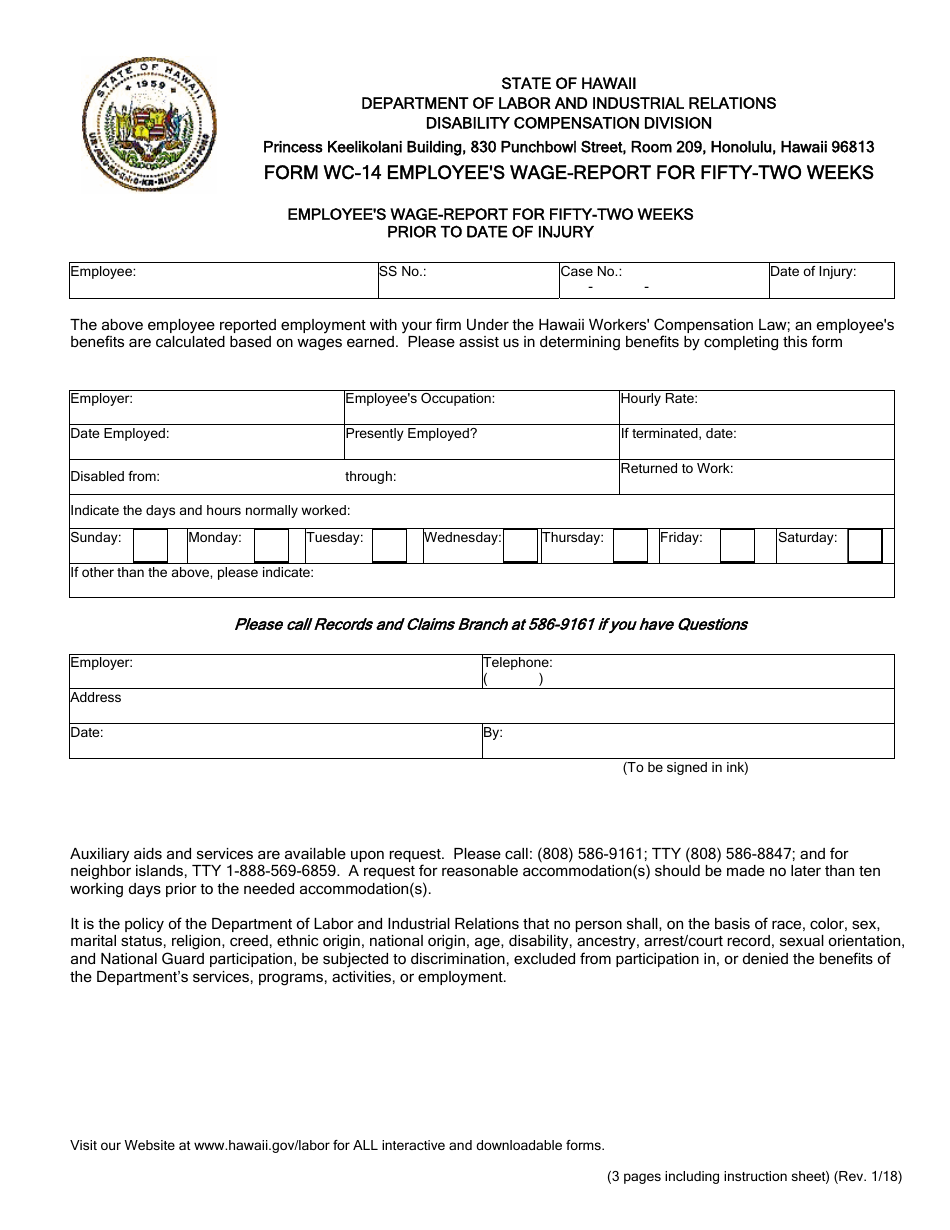

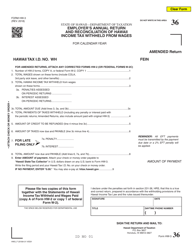

Form WC-14 Employee's Wage-Report for Fifty-Two Weeks - Hawaii

What Is Form WC-14?

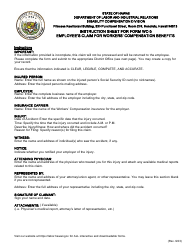

This is a legal form that was released by the Hawaii Department of Labor & Industrial Relations - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form WC-14?

A: Form WC-14 is the Employee's Wage Report for Fifty-Two Weeks in Hawaii.

Q: What is the purpose of Form WC-14?

A: The purpose of Form WC-14 is to report an employee's wages for fifty-two weeks in Hawaii.

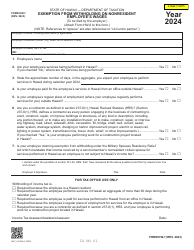

Q: Who needs to file Form WC-14?

A: Employers in Hawaii need to file Form WC-14 for each employee.

Q: Is there a deadline for filing Form WC-14?

A: Yes, Form WC-14 must be filed within a certain time frame as specified by the Hawaii Department of Labor and Industrial Relations.

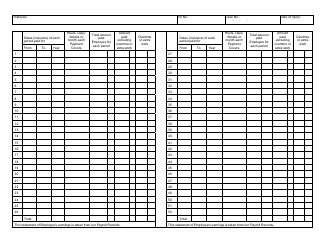

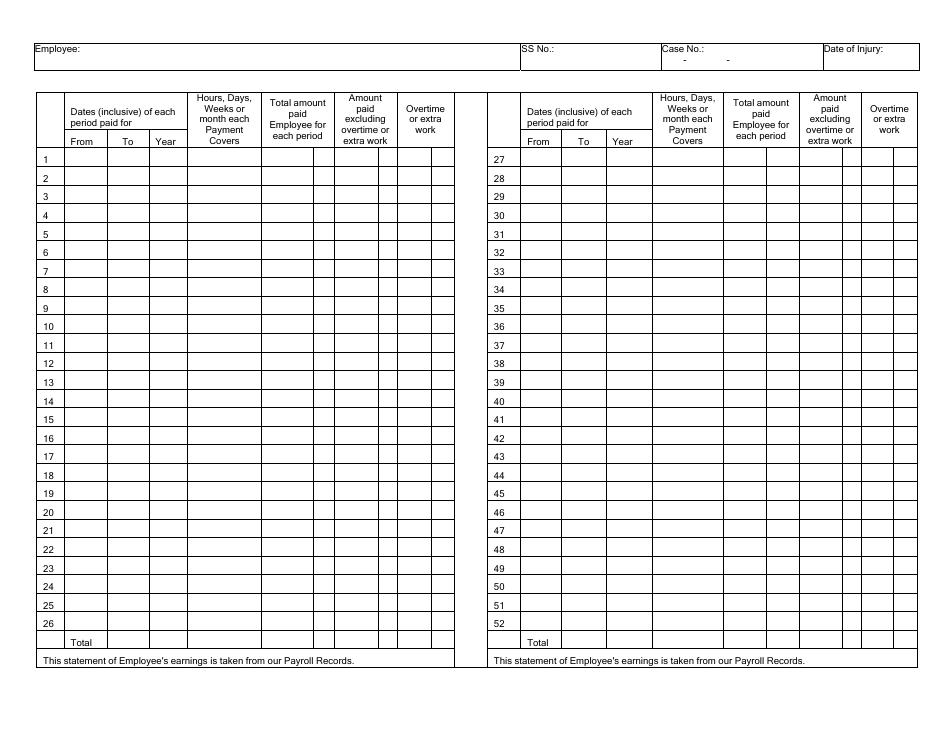

Q: What information is required on Form WC-14?

A: Form WC-14 requires information such as the employee's name, social security number, wages earned each week, and the total wages for the fifty-two week period.

Q: Can Form WC-14 be filed electronically?

A: Yes, employers have the option to file Form WC-14 electronically.

Q: What happens if I don't file Form WC-14?

A: Failure to file Form WC-14 may result in penalties or legal consequences.

Q: Are there any exemptions for filing Form WC-14?

A: There may be exemptions or special circumstances that exempt certain employers from filing Form WC-14. It is best to consult the Hawaii Department of Labor and Industrial Relations for more information.

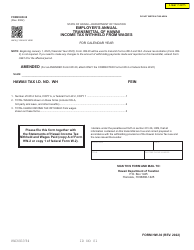

Q: Can I amend Form WC-14 after submitting it?

A: Yes, you can amend Form WC-14 if there are errors or changes to the reported information. You should follow the instructions provided by the Hawaii Department of Labor and Industrial Relations for making amendments.

Form Details:

- Released on January 1, 2018;

- The latest edition provided by the Hawaii Department of Labor & Industrial Relations;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WC-14 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Labor & Industrial Relations.