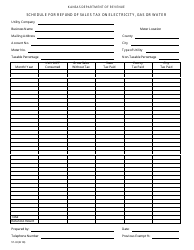

This version of the form is not currently in use and is provided for reference only. Download this version of

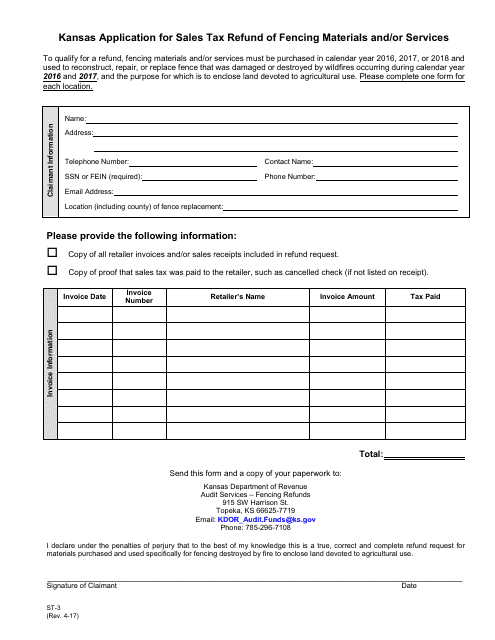

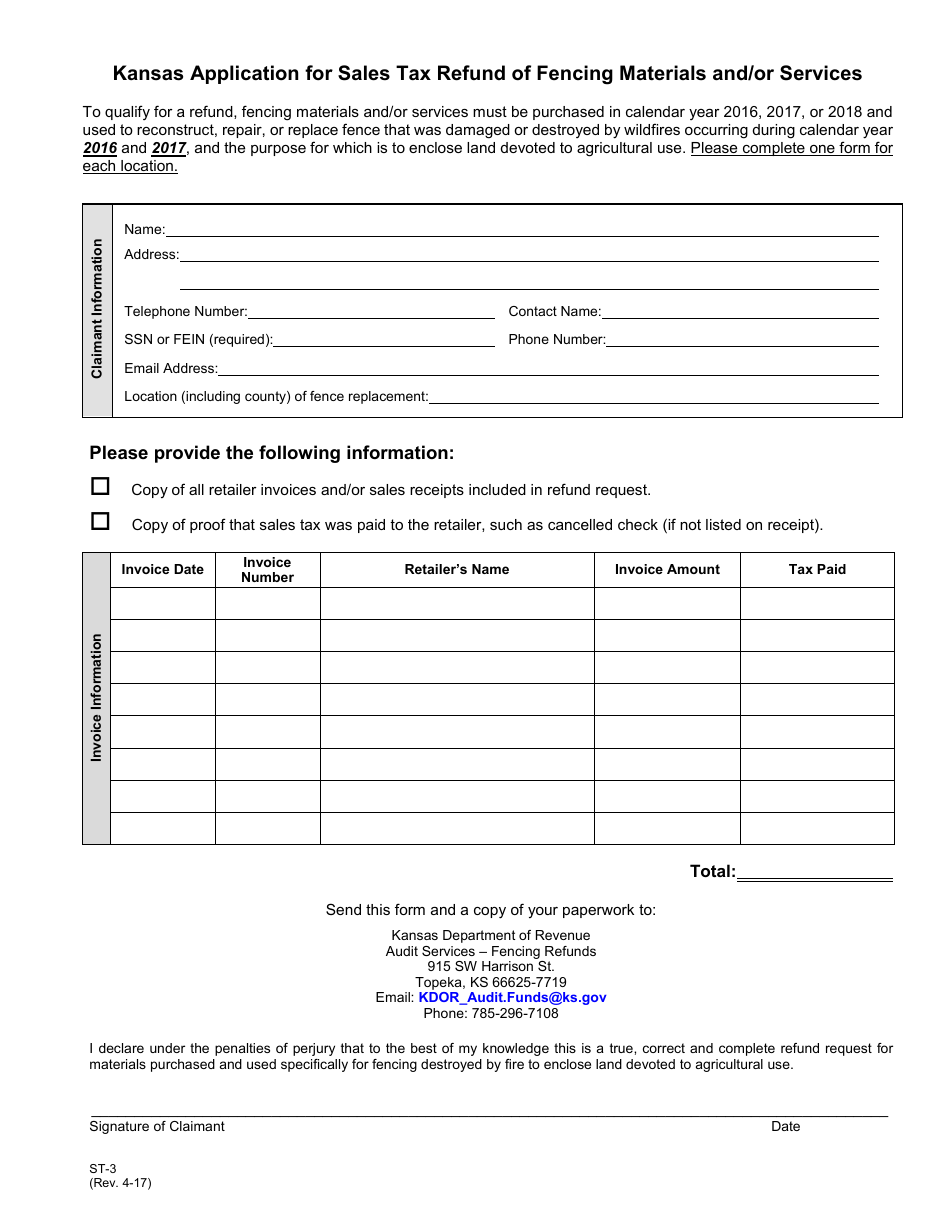

Form ST-3

for the current year.

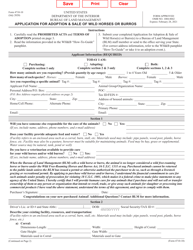

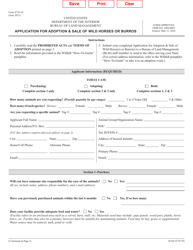

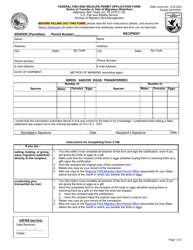

Form ST-3 Kansas Application for Sales Tax Refund of Fencing Materials and / or Services - Kansas

What Is Form ST-3?

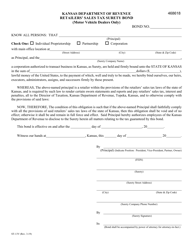

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-3?

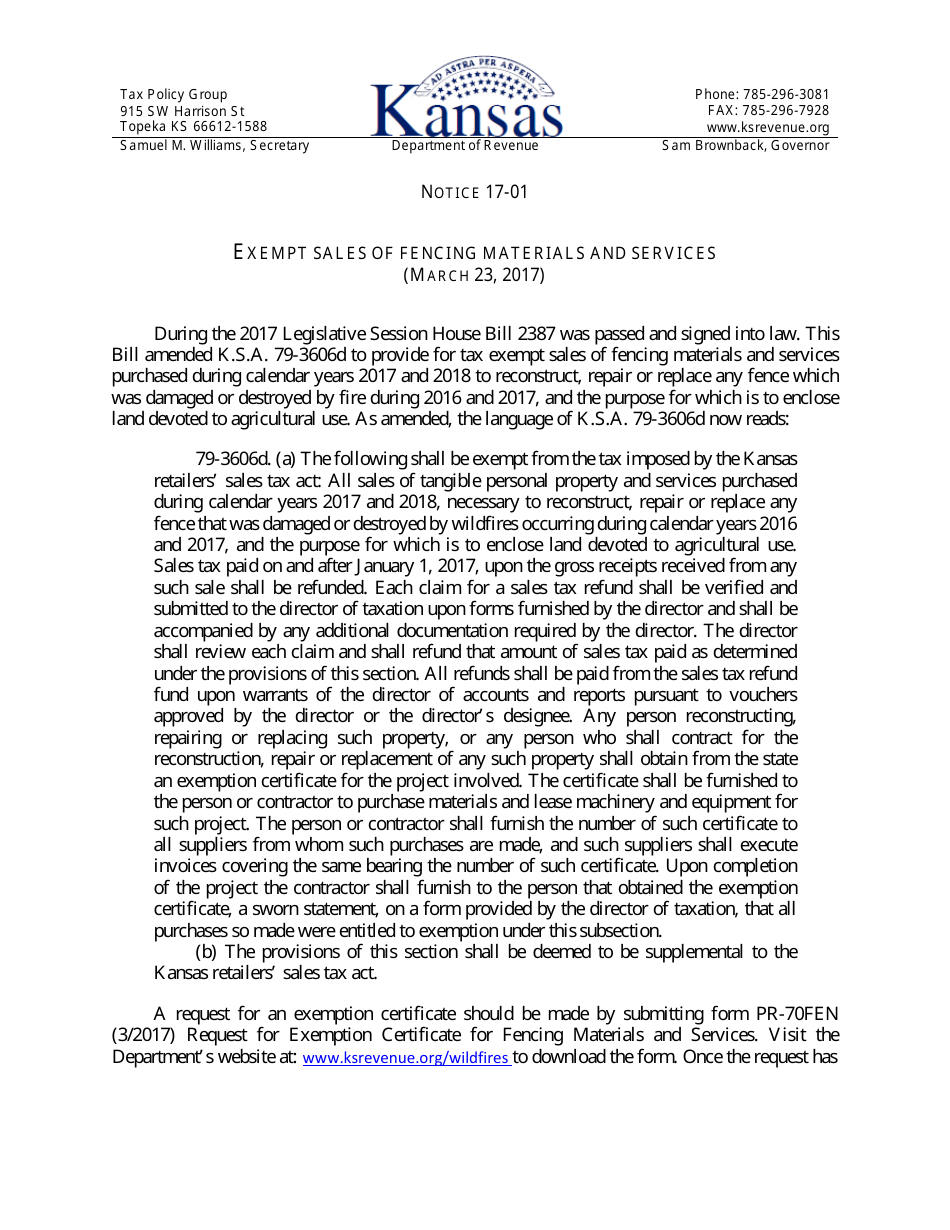

A: Form ST-3 is an application for sales tax refund of fencing materials and/or services in the state of Kansas.

Q: Who can use Form ST-3?

A: Any individual or business that has purchased fencing materials and/or services in Kansas and wishes to apply for a sales tax refund.

Q: What is the purpose of Form ST-3?

A: The purpose of Form ST-3 is to request a refund of sales tax paid on fencing materials and/or services purchased in Kansas.

Q: What information is required on Form ST-3?

A: Form ST-3 requires information such as the purchaser's name, address, and taxpayer ID number, as well as details of the fencing materials and/or services purchased and the amount of sales tax paid.

Q: Is there a deadline for submitting Form ST-3?

A: Yes, Form ST-3 must be filed within 6 months from the date of purchase.

Q: How long does it take to receive a refund?

A: The processing time for a sales tax refund application can vary, but it typically takes 8-12 weeks to receive a refund.

Q: Can I apply for a sales tax refund for previous years?

A: No, Form ST-3 can only be used to request a refund for sales tax paid within the past 6 months.

Q: What should I do if my application is denied?

A: If your application is denied, you have the right to appeal the decision and provide additional supporting documentation.

Q: Are there any fees associated with filing Form ST-3?

A: There are no fees to file Form ST-3, but you may be required to pay a processing fee if you choose to receive your refund via direct deposit.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-3 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.