This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

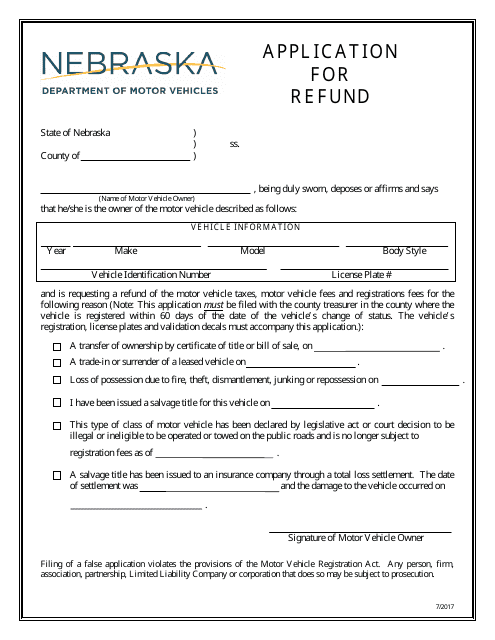

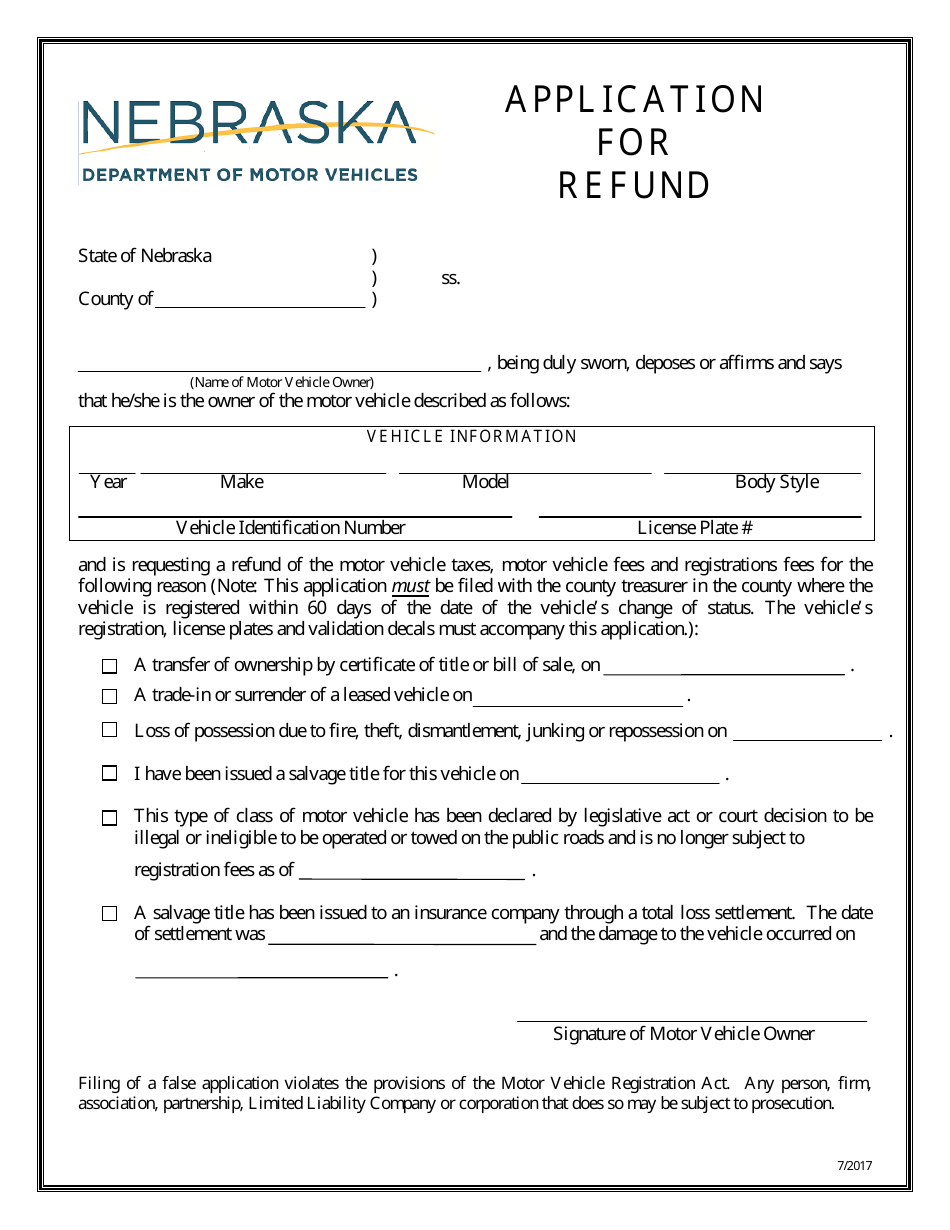

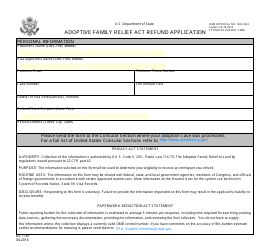

Application for Refund - Nebraska

Application for Refund is a legal document that was released by the Nebraska Department of Motor Vehicles - a government authority operating within Nebraska.

FAQ

Q: How do I apply for a refund in Nebraska?

A: You can apply for a refund in Nebraska by completing the appropriate form and submitting it to the relevant department.

Q: What types of refunds can I apply for in Nebraska?

A: You can apply for various types of refunds in Nebraska, including income tax refunds, sales tax refunds, and refund of overpayment of fees.

Q: Is there a deadline to apply for a refund in Nebraska?

A: Yes, there is a deadline to apply for a refund in Nebraska. The specific deadline may vary depending on the type of refund you are applying for.

Q: How long does it take to process a refund in Nebraska?

A: The processing time for a refund in Nebraska may vary. It is best to contact the relevant department for specific information.

Q: What supporting documents do I need to submit with my refund application in Nebraska?

A: The supporting documents required for a refund application in Nebraska may vary depending on the type of refund you are applying for. Check the instructions provided with the application form for details.

Q: What should I do if I haven't received my refund in Nebraska?

A: If you haven't received your refund in Nebraska, you should contact the relevant department to inquire about the status of your refund.

Q: Can I appeal a denied refund in Nebraska?

A: Yes, you can appeal a denied refund in Nebraska. The specific process for appeals may vary depending on the type of refund and the department involved. Contact the relevant department for more information.

Form Details:

- Released on July 1, 2017;

- The latest edition currently provided by the Nebraska Department of Motor Vehicles;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Motor Vehicles.