This version of the form is not currently in use and is provided for reference only. Download this version of

Form PC577

for the current year.

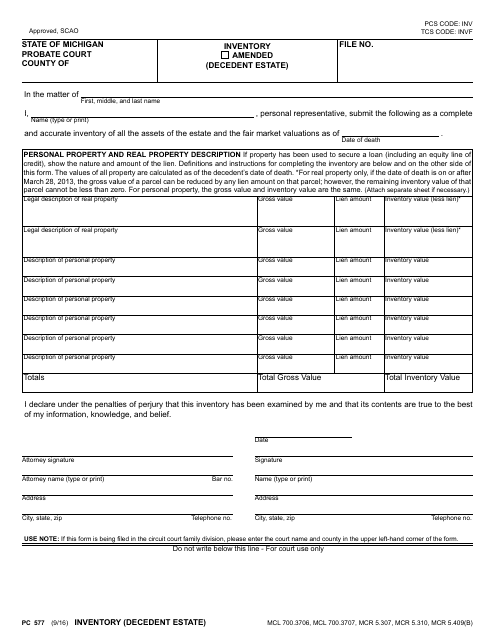

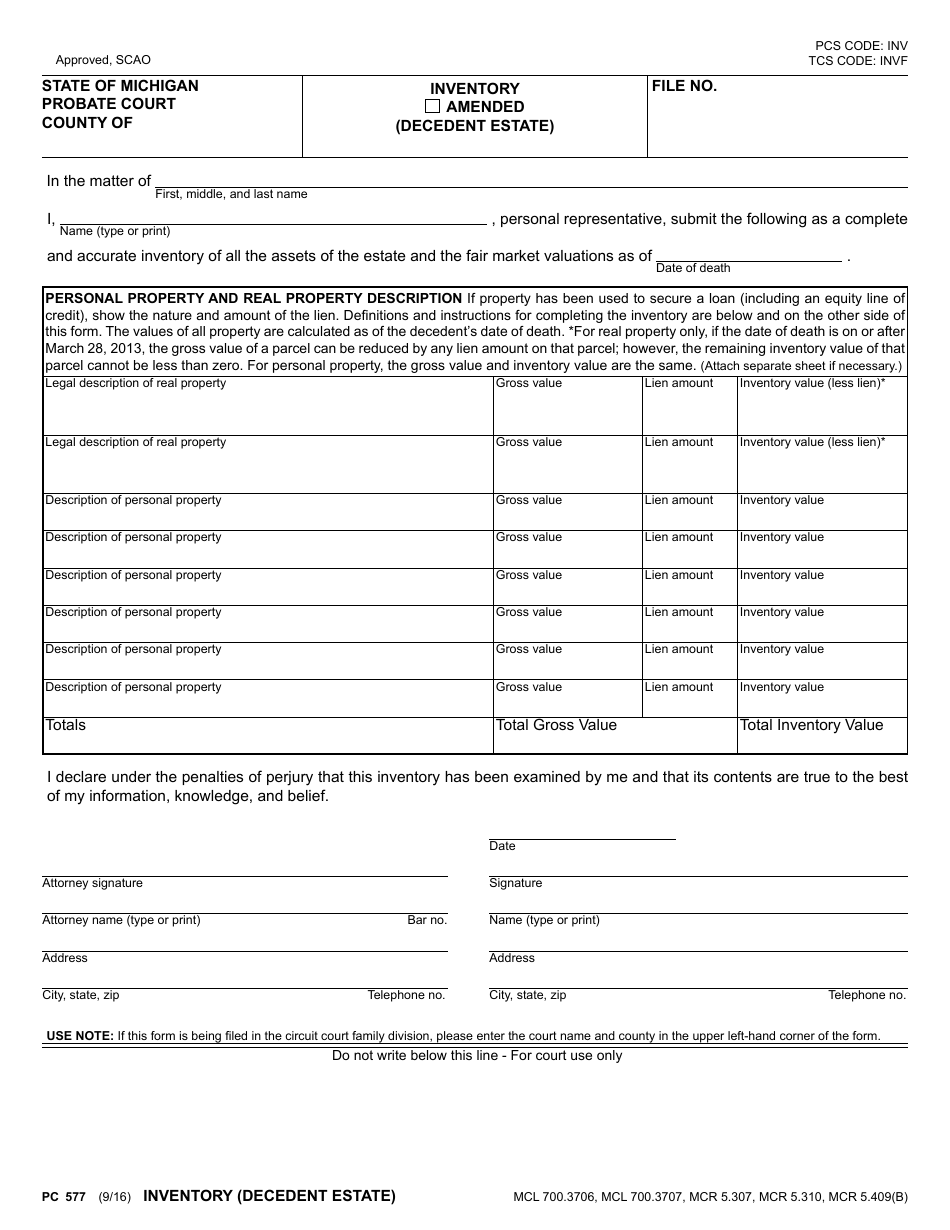

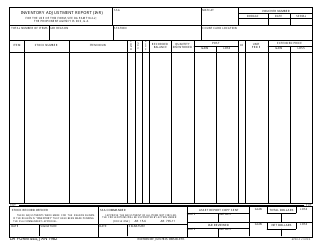

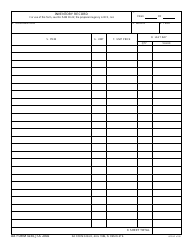

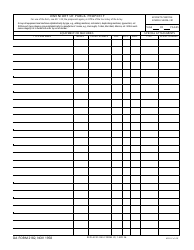

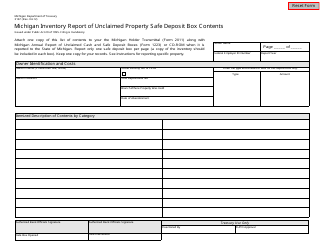

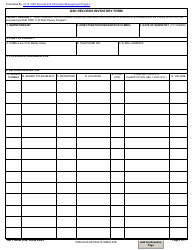

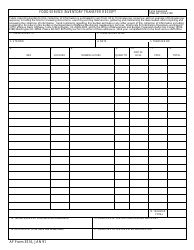

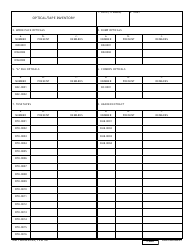

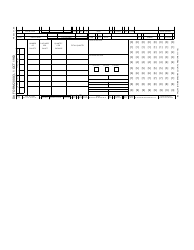

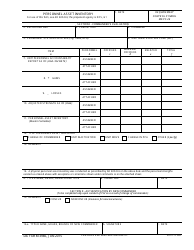

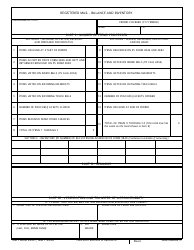

Form PC577 Inventory (Decedent Estate) - Michigan

What Is Form PC577?

This is a legal form that was released by the Michigan Probate Court - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PC577 Inventory?

A: Form PC577 Inventory is a document used in Michigan for the inventory of a decedent's estate.

Q: Who uses Form PC577 Inventory?

A: Form PC577 Inventory is used by the personal representative of a decedent's estate in Michigan.

Q: What is the purpose of Form PC577 Inventory?

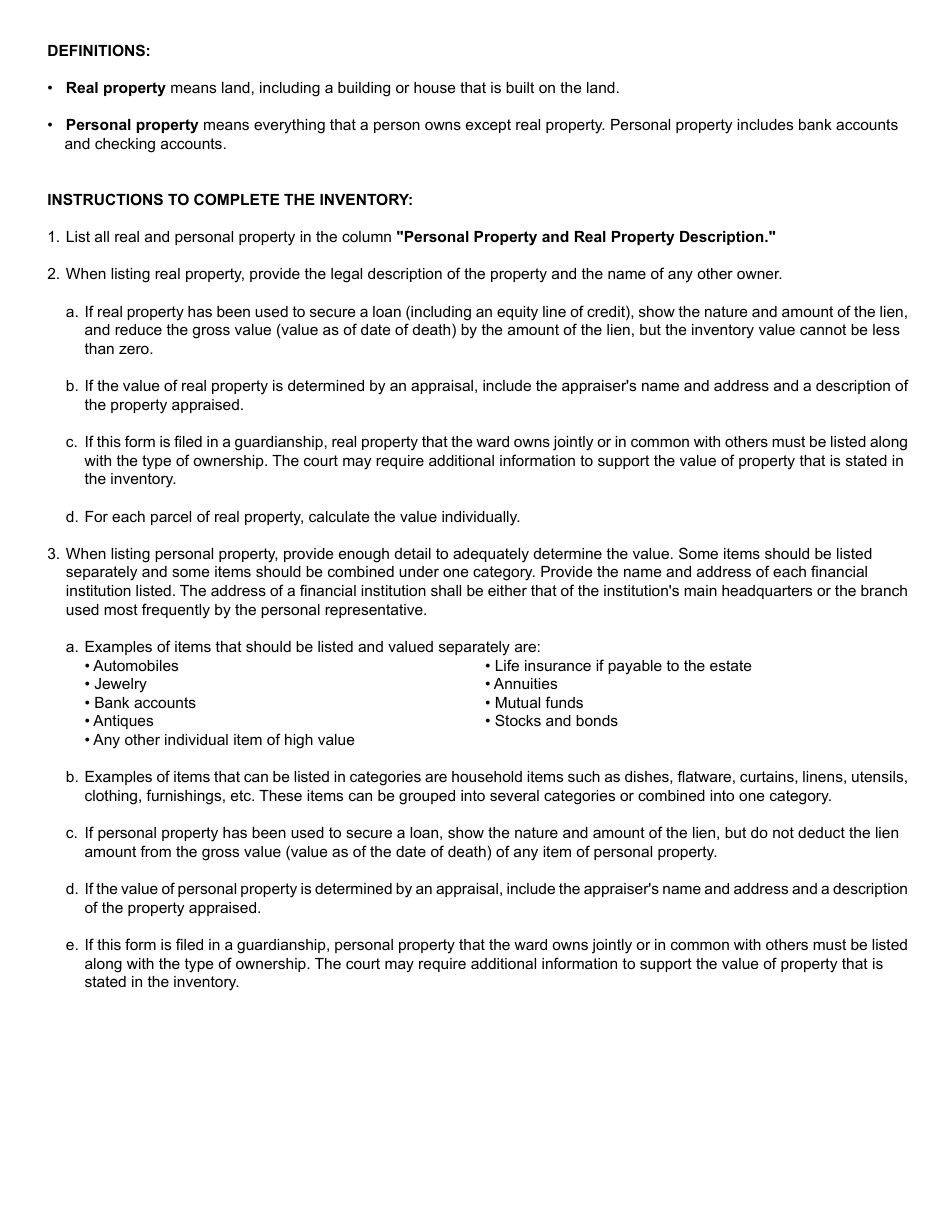

A: The purpose of Form PC577 Inventory is to provide a detailed list of the assets and liabilities of the decedent's estate.

Q: What information is required on Form PC577 Inventory?

A: Form PC577 Inventory requires information such as the decedent's name, date of death, and a detailed description of each asset and liability.

Q: When should Form PC577 Inventory be filed?

A: Form PC577 Inventory should be filed with the court within 91 days after the appointment of the personal representative.

Q: Are there any filing fees for Form PC577 Inventory?

A: The filing fee for Form PC577 Inventory may vary depending on the county in Michigan.

Q: Can Form PC577 Inventory be amended?

A: Yes, Form PC577 Inventory can be amended if there are any changes or updates to the inventory of the decedent's estate.

Q: What happens after filing Form PC577 Inventory?

A: After filing Form PC577 Inventory, the court will review the inventory and may require additional documentation or information.

Q: Are there any penalties for not filing Form PC577 Inventory?

A: Failure to file Form PC577 Inventory may result in penalties or adverse consequences, and may delay the administration of the decedent's estate.

Form Details:

- Released on September 1, 2016;

- The latest edition provided by the Michigan Probate Court;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PC577 by clicking the link below or browse more documents and templates provided by the Michigan Probate Court.