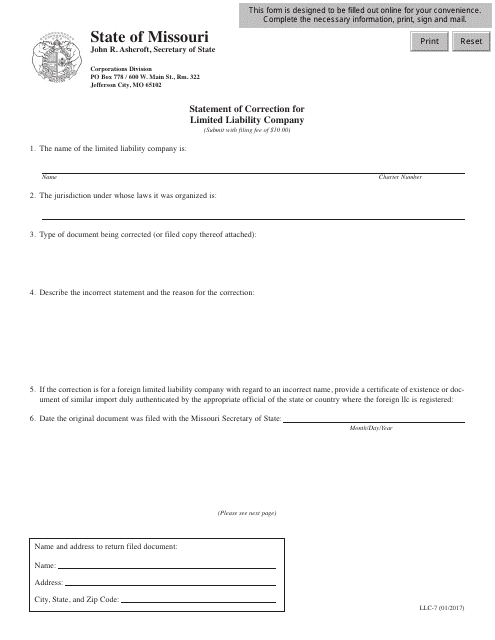

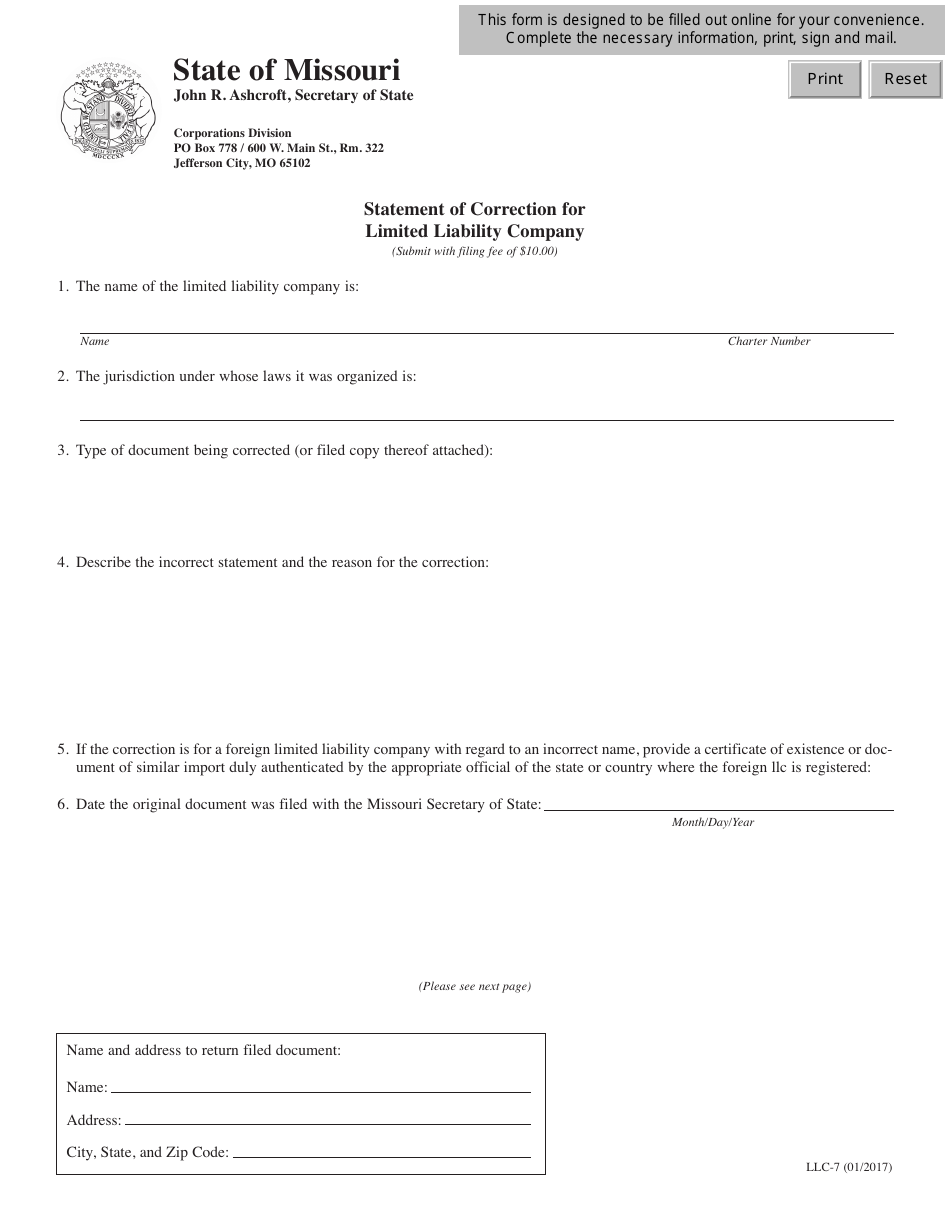

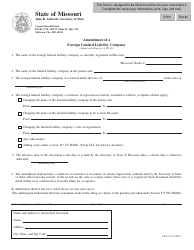

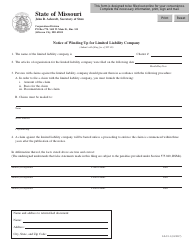

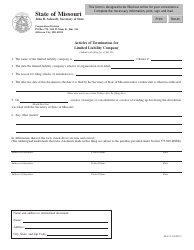

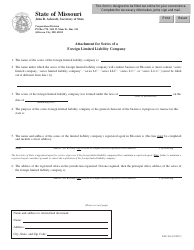

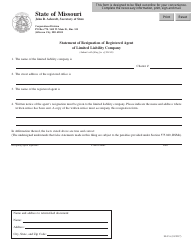

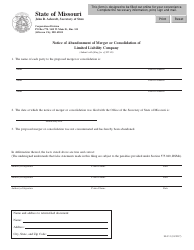

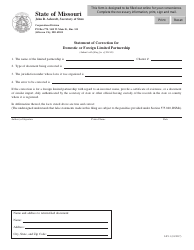

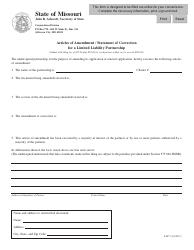

Form LLC-7 Statement of Correction for Limited Liability Company - Missouri

What Is Form LLC-7?

This is a legal form that was released by the Missouri Secretary of State - a government authority operating within Missouri. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

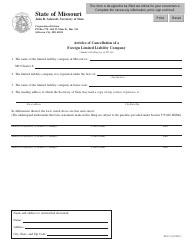

Q: What is an LLC-7 Statement of Correction?

A: An LLC-7 Statement of Correction is a form used to correct errors or omissions in the documents filed for a Limited Liability Company (LLC) in Missouri.

Q: When should I use an LLC-7 Statement of Correction?

A: You should use an LLC-7 Statement of Correction when you need to correct mistakes in previously filed LLC documents in Missouri.

Q: What errors can be corrected with an LLC-7 Statement of Correction?

A: An LLC-7 Statement of Correction can be used to correct typographical errors, inaccurate information, or missing information in LLC documents.

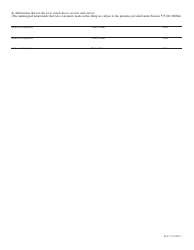

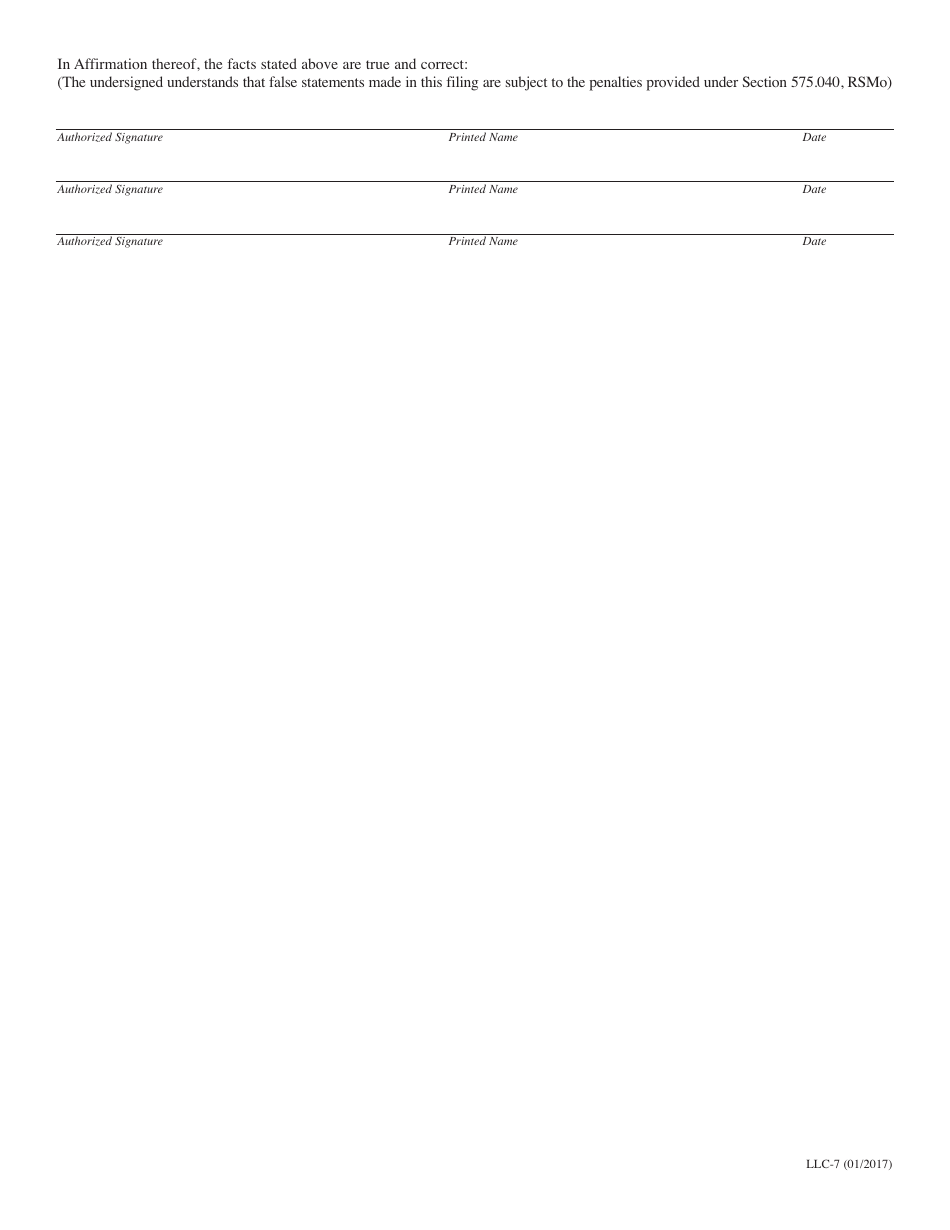

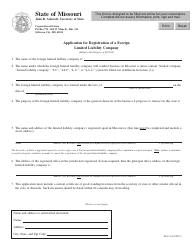

Q: How do I fill out an LLC-7 Statement of Correction?

A: You need to provide the name of the LLC, the date of the original document, the type of document being corrected, a detailed explanation of the correction, and the signature of an authorized person.

Q: Is an LLC-7 Statement of Correction required for all LLCs in Missouri?

A: No, an LLC-7 Statement of Correction is only required if there are errors or omissions in previously filed LLC documents.

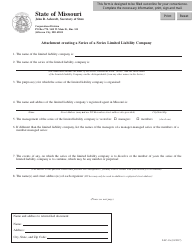

Q: What is the deadline for filing an LLC-7 Statement of Correction?

A: There is no specific deadline for filing an LLC-7 Statement of Correction in Missouri. It should be filed as soon as the errors or omissions are discovered.

Q: Can I hire someone to help me with filing an LLC-7 Statement of Correction?

A: Yes, you can hire an attorney or a professional business filing service to help you with filing an LLC-7 Statement of Correction in Missouri.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the Missouri Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form LLC-7 by clicking the link below or browse more documents and templates provided by the Missouri Secretary of State.