This version of the form is not currently in use and is provided for reference only. Download this version of

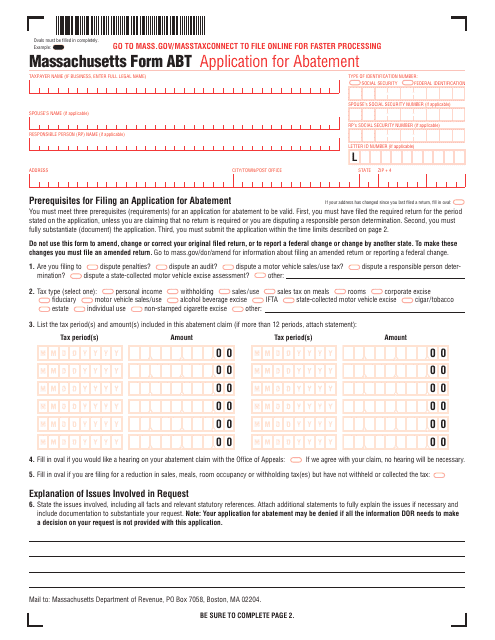

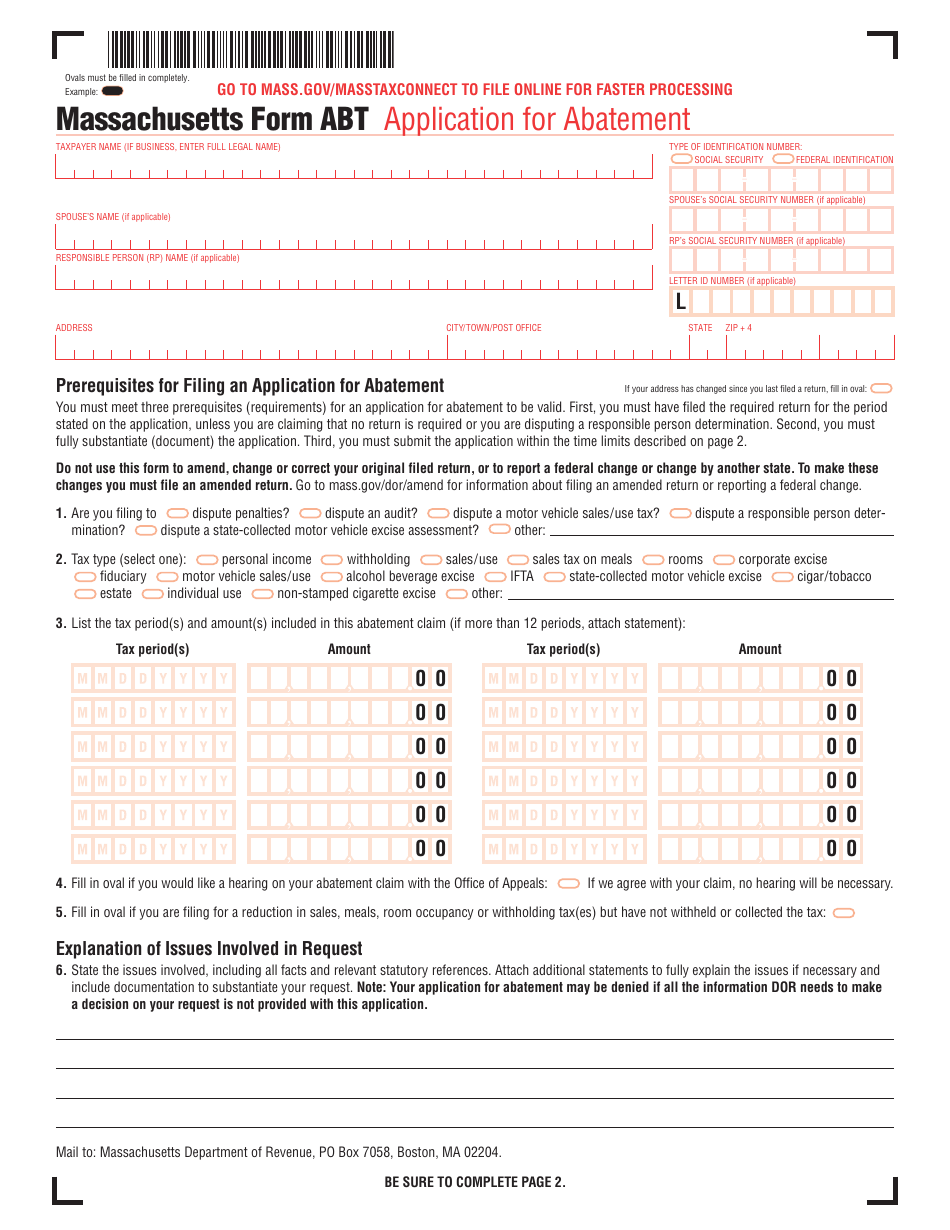

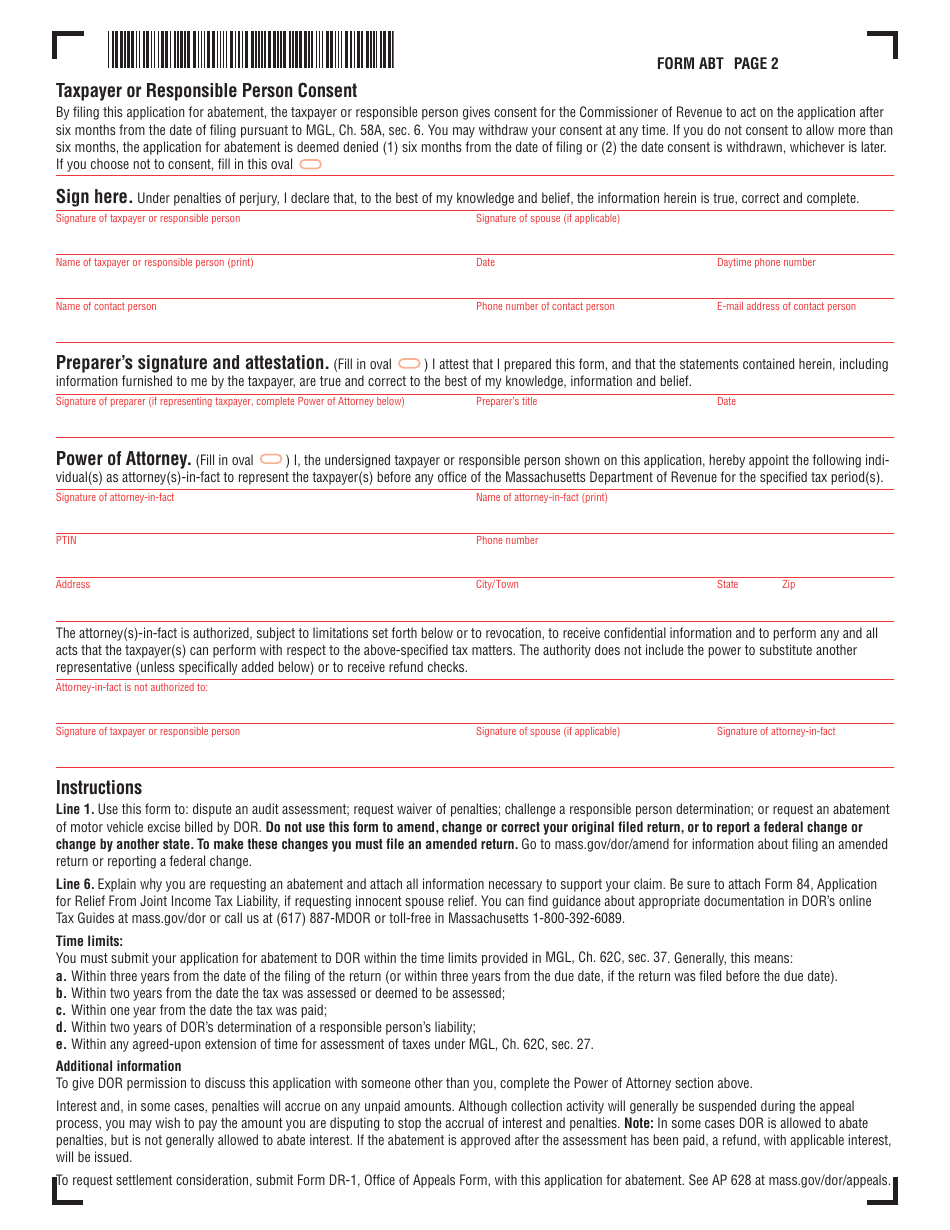

Form ABT

for the current year.

Form ABT Application for Abatement - Massachusetts

What Is Form ABT?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is an ABT Application for Abatement?

A: The ABT Application for Abatement is a form used in Massachusetts to request a reduction or elimination of certain taxes or penalties.

Q: What taxes or penalties can be abated through the ABT Application?

A: The ABT Application can be used to request an abatement of various taxes, such as property tax, sales tax, and income tax, as well as penalties related to these taxes.

Q: Who can file an ABT Application for Abatement?

A: Any individual or business that believes they have been overcharged or penalized unfairly for taxes can file an ABT Application for Abatement.

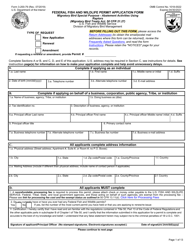

Q: How do I fill out the ABT Application for Abatement?

A: You will need to provide your personal or business information, the specific taxes or penalties you are requesting an abatement for, supporting documentation, and a detailed explanation of your reasons for the request.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ABT by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.