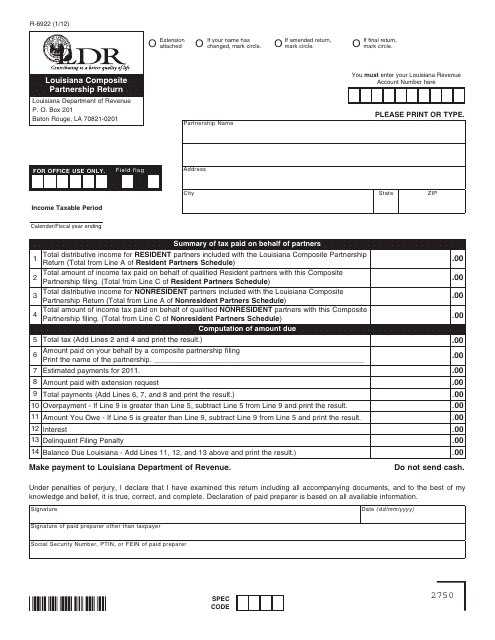

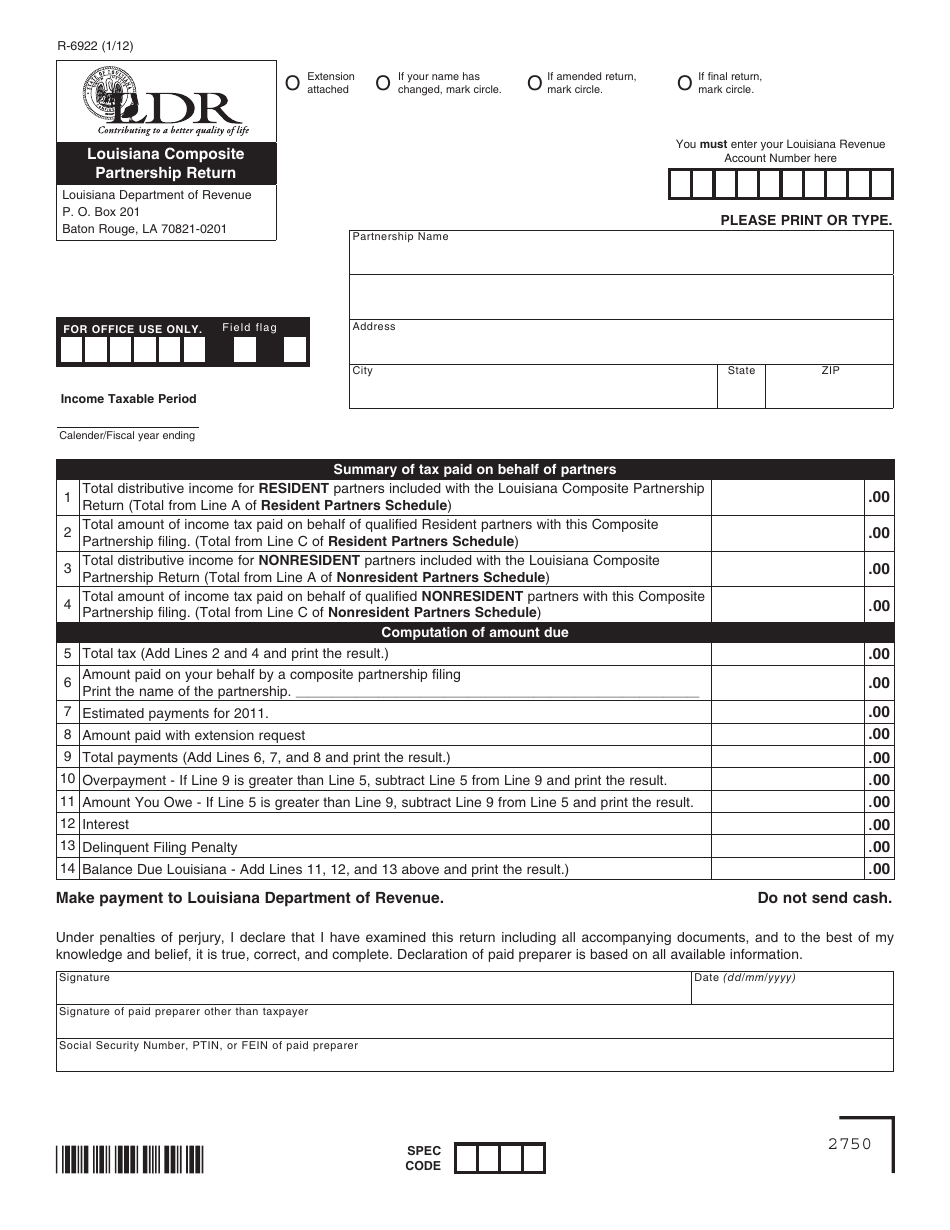

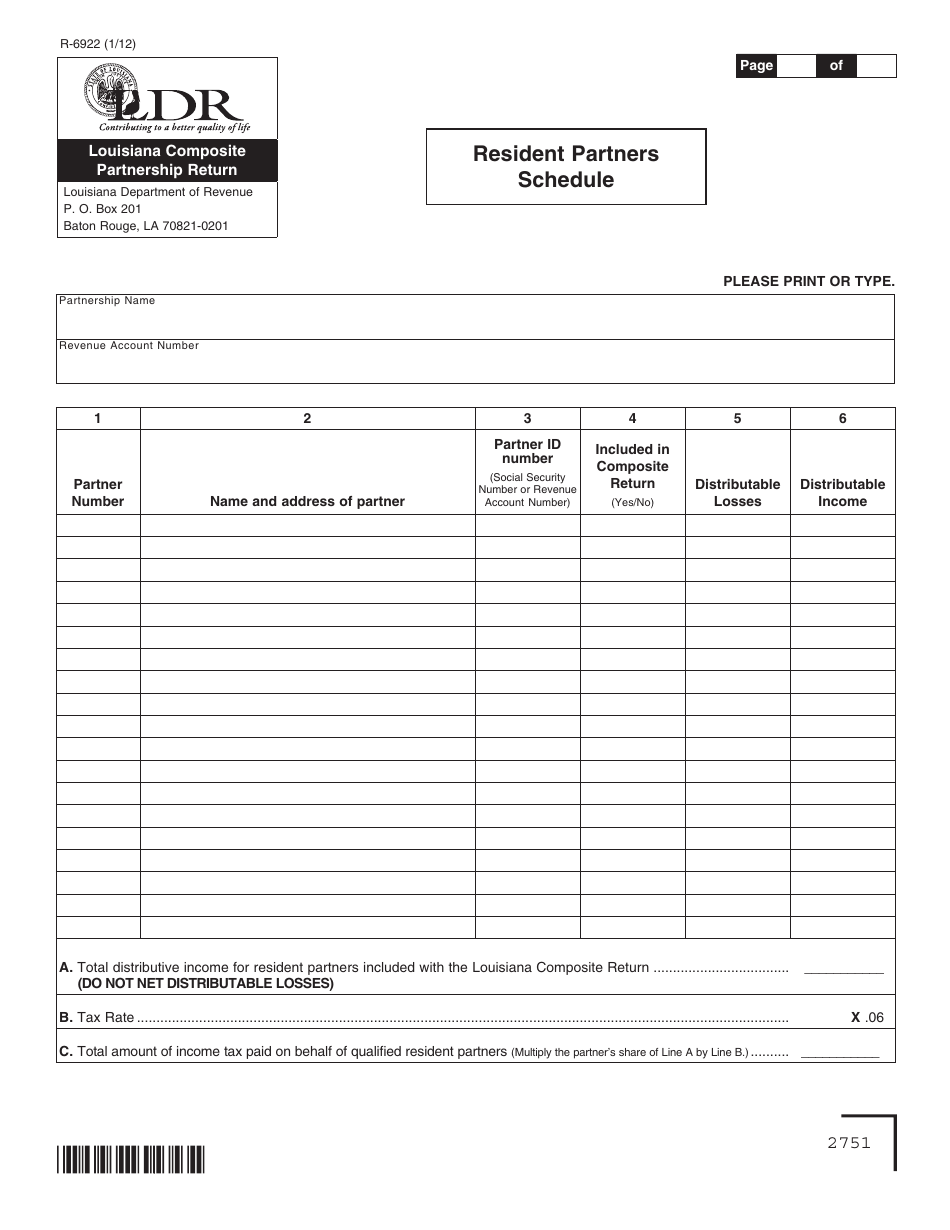

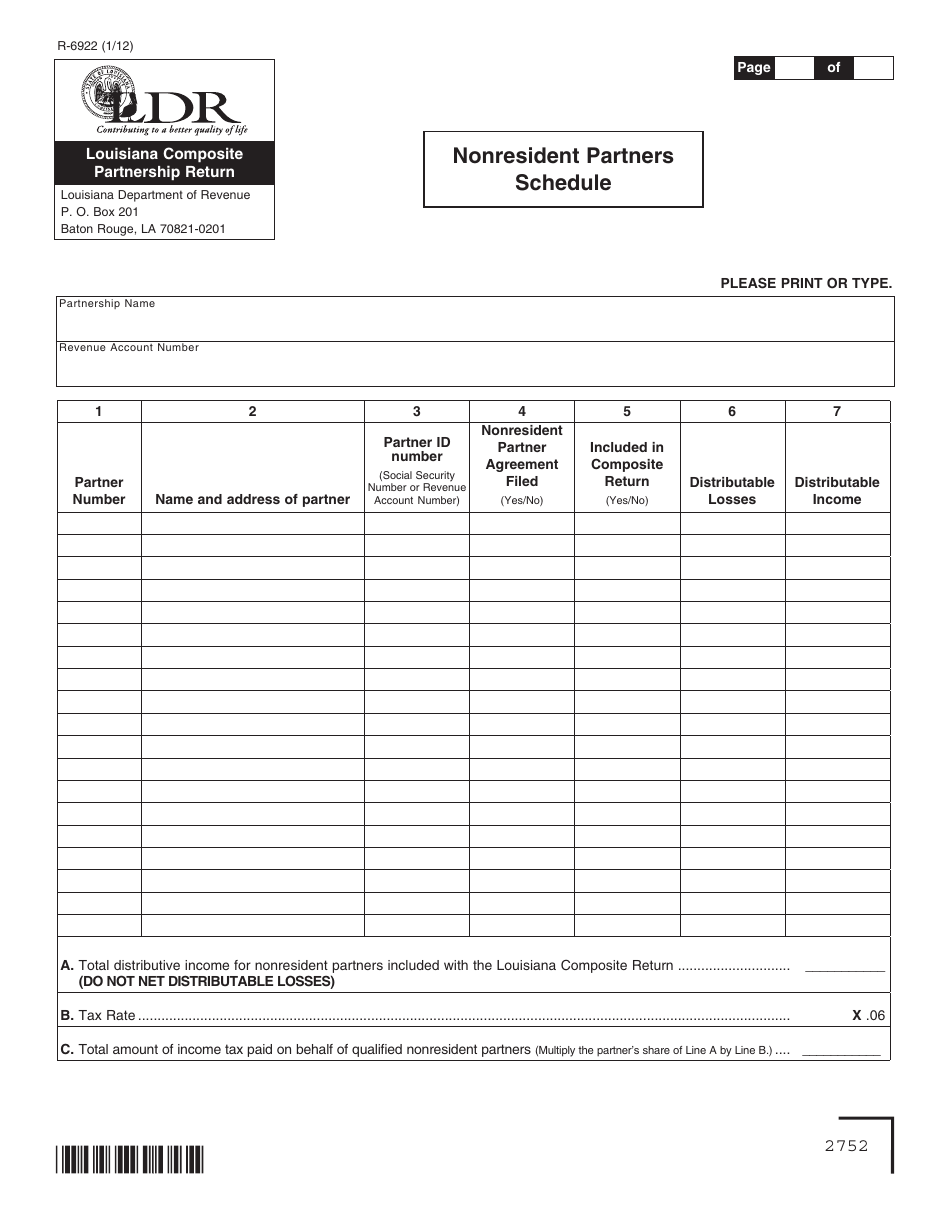

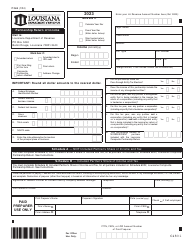

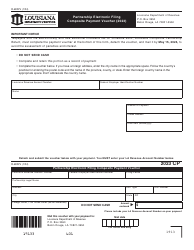

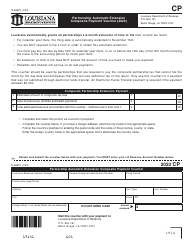

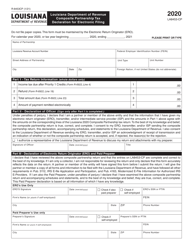

Form R-6922 Louisiana Composite Partnership Return - Louisiana

What Is Form R-6922?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form R-6922?

A: Form R-6922 is the Louisiana Composite Partnership Return.

Q: Who needs to file Form R-6922?

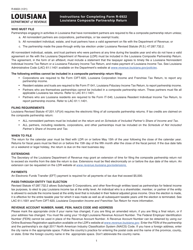

A: Any partnership that has nonresident partners and conducts business in Louisiana needs to file Form R-6922.

Q: What is the purpose of Form R-6922?

A: Form R-6922 is used to report the Louisiana income and tax liability of nonresident partners in a partnership.

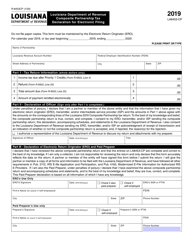

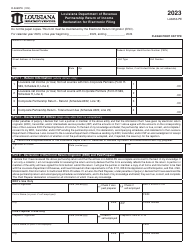

Q: What information is required on Form R-6922?

A: Form R-6922 requires information about the partnership, its partners, and the income allocated to nonresident partners.

Q: When is Form R-6922 due?

A: Form R-6922 is due on or before the 15th day of the fourth month following the close of the partnership's tax year.

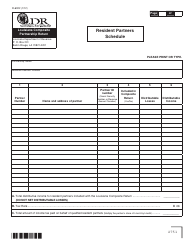

Q: Are there any additional forms or schedules that need to be filed with Form R-6922?

A: Yes, Form R-6922 requires the attachment of Schedule COF, which provides information on the partners' share of Louisiana income.

Q: What happens if Form R-6922 is not filed or filed late?

A: Failure to file Form R-6922 or filing it late may result in penalties and interest.

Q: Can I request an extension to file Form R-6922?

A: Yes, you can request an extension to file Form R-6922 by filing Form R-6462, Louisiana Extension Request.

Q: What should I do if I have questions about Form R-6922?

A: If you have questions about Form R-6922, you should contact the Louisiana Department of Revenue for assistance.

Form Details:

- Released on January 1, 2012;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-6922 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.