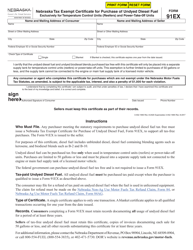

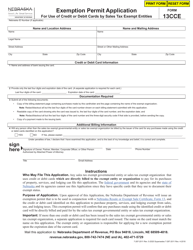

Form 13E Nebraska Energy Source Exempt Sale Certificate - Nebraska

What Is Form 13E?

This is a legal form that was released by the Nebraska Department of Revenue - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

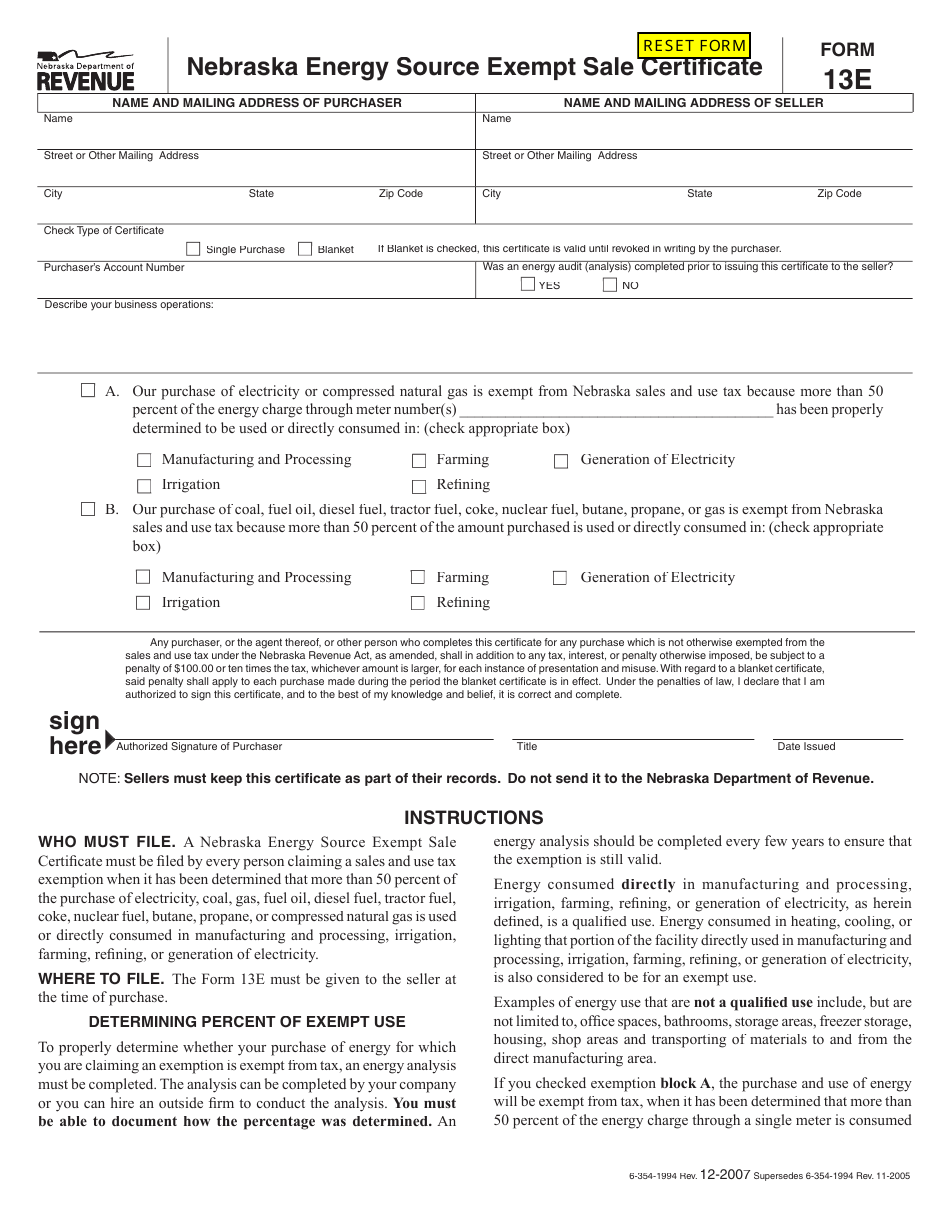

Q: What is Form 13E?

A: Form 13E is the Nebraska Energy Source Exempt Sale Certificate.

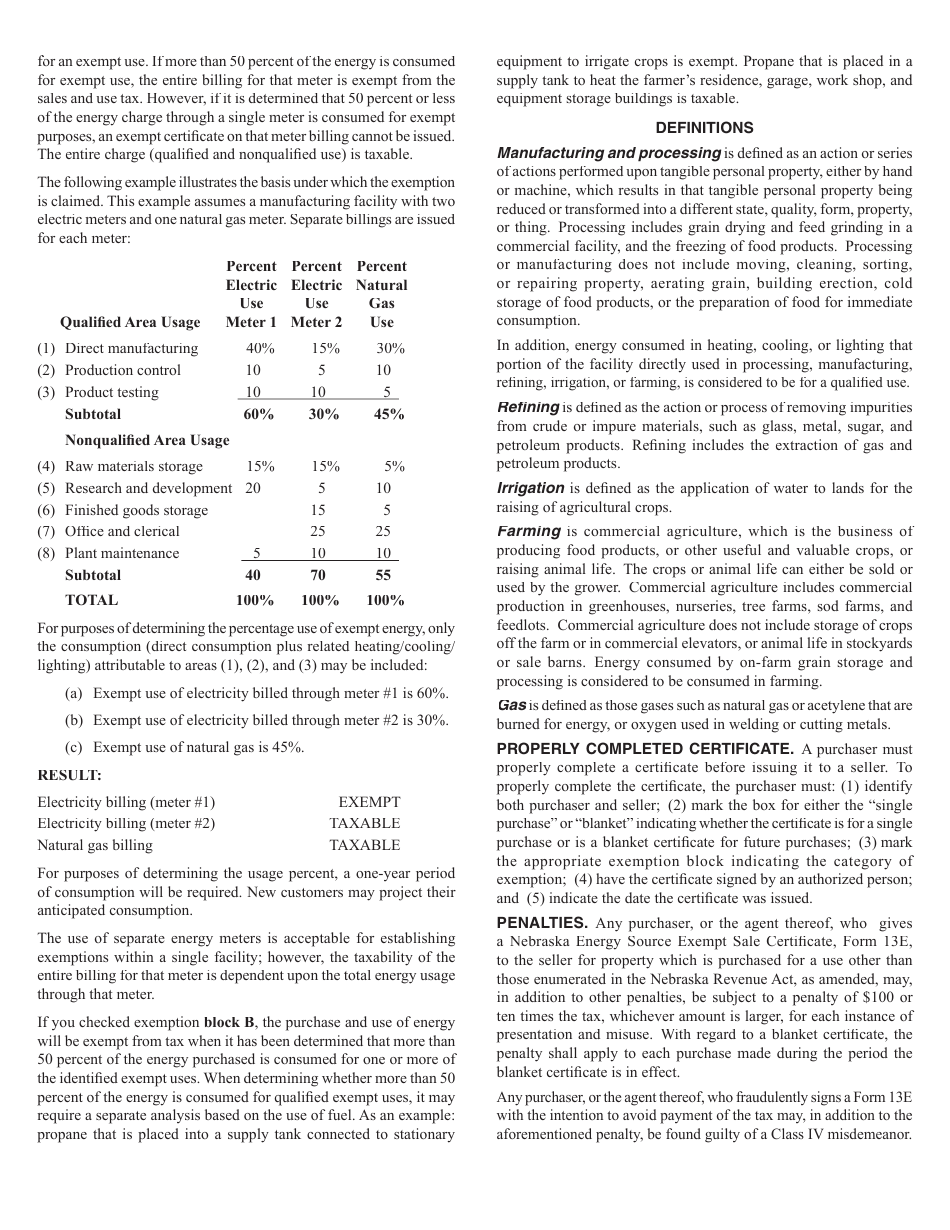

Q: What is the purpose of Form 13E?

A: The purpose of Form 13E is to certify that a sale or delivery of an energy source in Nebraska is exempt from sales tax.

Q: Who needs to fill out Form 13E?

A: The seller or any person making a delivery of an energy source in Nebraska needs to fill out Form 13E.

Q: What is considered an energy source in Nebraska?

A: Energy sources in Nebraska include electricity, natural gas, coal, oil, or any other substance, material, or fuel used to produce energy.

Q: What information is required on Form 13E?

A: Form 13E requires information such as the seller's name and address, the buyer's name and address, the type and quantity of the energy source, and the reason for the exemption.

Q: Is there a deadline to submit Form 13E?

A: There is no specific deadline to submit Form 13E, but it should be completed and kept on file for at least three years.

Q: Is there a fee to file Form 13E?

A: No, there is no fee to file Form 13E.

Q: Can Form 13E be used for multiple sales or deliveries?

A: Yes, Form 13E can be used to certify multiple sales or deliveries of energy sources.

Q: Are there any penalties for not filing Form 13E?

A: Failure to file or maintain records of Form 13E may result in penalties imposed by the Nebraska Department of Revenue.

Form Details:

- Released on December 1, 2007;

- The latest edition provided by the Nebraska Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 13E by clicking the link below or browse more documents and templates provided by the Nebraska Department of Revenue.